Integration of AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning into the satellite enabled IoT software market is transforming how data is processed and analyzed. In Japan, companies are increasingly leveraging these technologies to enhance the capabilities of satellite-enabled IoT solutions. AI algorithms can analyze vast amounts of data collected from satellite sensors, providing actionable insights for various applications, including urban planning, environmental monitoring, and disaster management. This technological advancement not only improves the efficiency of data utilization but also enables predictive analytics, which is crucial for proactive decision-making. The market is projected to grow by approximately 10% annually as organizations recognize the value of integrating AI with satellite technologies, thereby enhancing the overall effectiveness of the satellite enabled-iot-software market.

Growing Focus on Environmental Sustainability

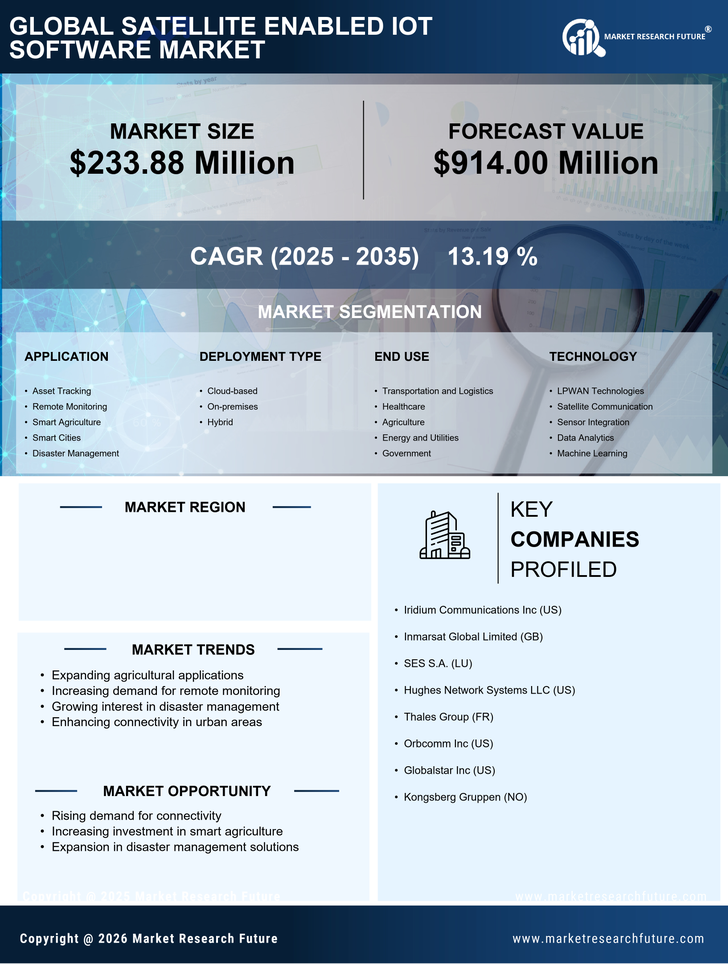

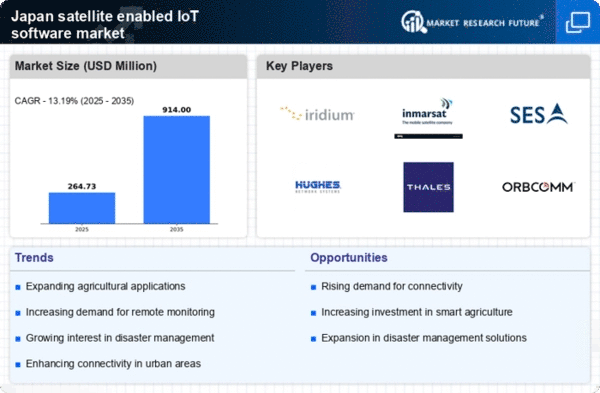

The satellite enabled IoT software market in Japan is increasingly influenced by a growing focus on environmental sustainability. As concerns about climate change and resource depletion intensify, industries are seeking innovative solutions to monitor and manage their environmental impact. Satellite-enabled IoT software provides critical data for tracking emissions, monitoring deforestation, and managing natural resources. This trend is particularly evident in sectors such as forestry and fisheries, where real-time data is essential for sustainable practices. The market is expected to expand at a CAGR of around 14% as organizations prioritize sustainability initiatives, thereby driving demand for satellite technologies that facilitate environmental monitoring and compliance.

Rising Demand for Remote Monitoring Solutions

The satellite enabled IoT software market in Japan experiences a notable surge in demand for remote monitoring solutions across various sectors. Industries such as agriculture, logistics, and environmental monitoring increasingly rely on satellite technology to gather real-time data from remote locations. This trend is driven by the need for enhanced operational efficiency and improved decision-making capabilities. For instance, the agricultural sector utilizes satellite-enabled IoT software to monitor crop health and soil conditions, leading to optimized resource allocation. According to recent estimates, the market for remote monitoring solutions is projected to grow at a CAGR of approximately 15% over the next five years, indicating a robust expansion in the satellite enabled-iot-software market. This growth reflects the increasing reliance on technology to address challenges posed by geographical constraints.

Advancements in Satellite Communication Technologies

Advancements in satellite communication technologies are significantly impacting the satellite enabled IoT software market in Japan. The development of high-throughput satellites and low Earth orbit (LEO) satellite constellations is enhancing connectivity and data transmission capabilities. These advancements enable faster and more reliable communication for IoT devices deployed in remote areas, which is crucial for industries such as agriculture, transportation, and energy. As connectivity improves, the adoption of satellite-enabled IoT solutions is likely to increase, leading to a projected market growth of approximately 11% over the next few years. This growth reflects the ongoing evolution of satellite technologies and their integration into various sectors, thereby strengthening the satellite enabled-iot-software market.

Government Initiatives Supporting Satellite Technologies

In Japan, government initiatives play a pivotal role in fostering the growth of the satellite enabled IoT software market. The Japanese government has been actively investing in satellite infrastructure and promoting policies that encourage the adoption of satellite technologies across various industries. These initiatives aim to enhance national security, improve disaster response capabilities, and support economic growth. For example, the Ministry of Internal Affairs and Communications has allocated substantial funding for satellite communication projects, which directly benefits the satellite enabled-iot-software market. As a result, the market is expected to witness a compound annual growth rate (CAGR) of around 12% over the next few years, driven by increased government support and investment in satellite technologies.