Cost Efficiency and Operational Savings

Cost efficiency remains a critical driver for the virtual customer-premises-equipment market in the GCC. Organizations are increasingly recognizing the financial advantages of deploying virtualized solutions over traditional hardware. By leveraging virtual customer-premises-equipment, companies can reduce capital expenditures associated with physical equipment and minimize ongoing maintenance costs. Reports indicate that businesses can achieve savings of up to 30% in operational costs by transitioning to virtual solutions. This financial incentive is particularly appealing in a competitive market where cost management is paramount. As a result, the virtual customer-premises-equipment market is poised for growth as more enterprises seek to optimize their budgets while maintaining high-quality service delivery.

Growing Focus on Enhanced Customer Experience

In the competitive landscape of the GCC, businesses are increasingly prioritizing enhanced customer experience as a key differentiator. The virtual customer-premises-equipment market plays a pivotal role in enabling organizations to deliver superior service quality and responsiveness. By adopting virtual solutions, companies can streamline their operations, reduce latency, and improve service reliability. This focus on customer satisfaction is reflected in the growing investments in technologies that support seamless communication and service delivery. As organizations strive to meet evolving customer expectations, the virtual customer-premises-equipment market is likely to see sustained growth driven by this emphasis on customer-centric strategies.

Regulatory Support for Digital Transformation

The virtual customer-premises-equipment market is benefiting from increasing regulatory support for digital transformation initiatives within the GCC. Governments in the region are actively promoting the adoption of advanced technologies to enhance economic diversification and improve service delivery. Initiatives aimed at fostering innovation and digital infrastructure development are creating a conducive environment for the growth of virtual customer-premises-equipment. For instance, the GCC countries have set ambitious targets for digital economy contributions, which are expected to reach 20% of GDP by 2030. This regulatory landscape encourages businesses to invest in virtual solutions, thereby propelling the virtual customer-premises-equipment market forward.

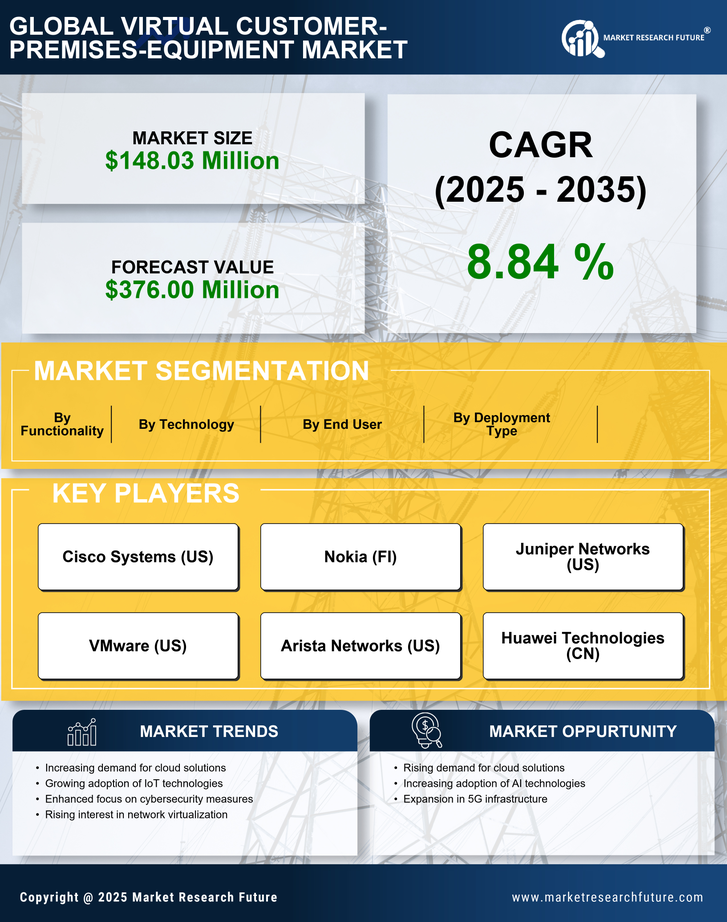

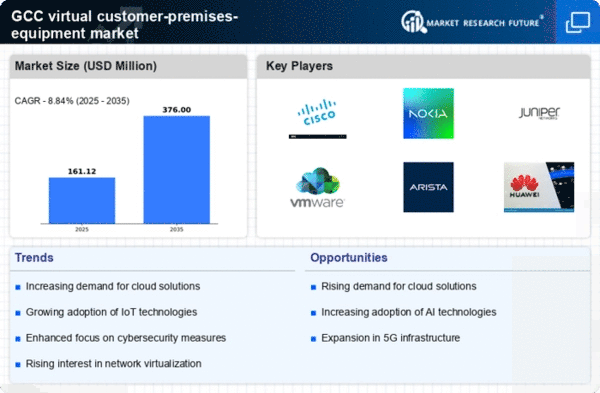

Rising Demand for Flexible Networking Solutions

The virtual customer-premises-equipment market is experiencing a notable surge in demand for flexible networking solutions across the GCC region. Businesses are increasingly seeking to enhance their operational efficiency and reduce costs, which has led to a shift from traditional hardware-based systems to virtualized solutions. This transition allows for greater scalability and adaptability, enabling organizations to respond swiftly to changing market conditions. According to recent data, the GCC's telecommunications sector is projected to grow at a CAGR of approximately 8% over the next five years, further driving the adoption of virtual customer-premises-equipment. As companies prioritize agility in their network infrastructure, the virtual customer-premises-equipment market is likely to benefit significantly from this trend.

Technological Advancements in Network Virtualization

Technological advancements in network virtualization are significantly influencing the virtual customer-premises-equipment market in the GCC. Innovations in software-defined networking (SDN) and network functions virtualization (NFV) are enabling organizations to deploy more efficient and flexible network architectures. These advancements facilitate the integration of various services onto a single platform, reducing complexity and enhancing performance. As the demand for high-speed connectivity and reliable services continues to rise, the virtual customer-premises-equipment market is expected to thrive. The ongoing evolution of virtualization technologies suggests a promising future for businesses looking to optimize their network infrastructure.