Increased Focus on Cost Efficiency

Cost efficiency is becoming a critical driver in the virtual networking market, particularly as organizations in the GCC seek to optimize their operational expenditures. The shift towards virtual networking solutions allows companies to reduce costs associated with traditional networking infrastructure. By leveraging cloud-based services, businesses can minimize hardware investments and maintenance expenses. Reports suggest that organizations can save up to 30% on networking costs by transitioning to virtual solutions. This financial incentive is prompting a broader adoption of virtual networking technologies, as companies recognize the potential for significant savings while maintaining high levels of connectivity and collaboration.

Growing Importance of Data Security

As the virtual networking market expands, the emphasis on data security is becoming increasingly pronounced. Organizations in the GCC are prioritizing secure networking solutions to protect sensitive information from cyber threats. The rise in data breaches and cyberattacks has led to a heightened awareness of the need for robust security measures. Consequently, the virtual networking market is witnessing a surge in demand for solutions that incorporate advanced encryption and authentication protocols. It is estimated that investments in cybersecurity within the virtual networking market could reach $5 billion by 2027, reflecting the critical need for secure communication channels in an increasingly digital landscape.

Rising Demand for Remote Work Solutions

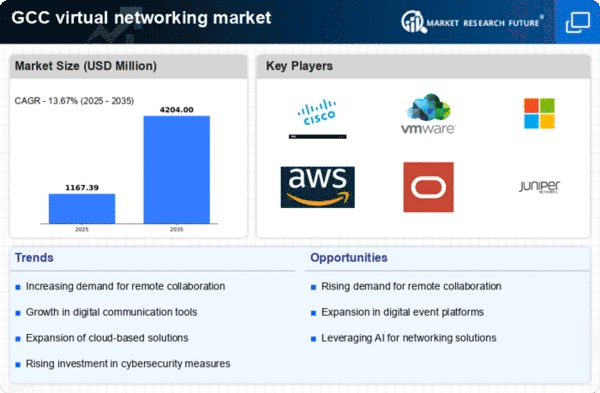

The virtual networking market is experiencing a notable surge in demand for remote work solutions across the GCC region. As organizations increasingly adopt flexible work arrangements, the need for robust virtual networking tools has become paramount. This shift is reflected in the market's growth trajectory, with projections indicating a compound annual growth rate (CAGR) of approximately 15% over the next five years. Companies are seeking platforms that facilitate seamless communication and collaboration among remote teams, thereby driving innovation in the virtual networking market. Furthermore, the integration of advanced features such as video conferencing and real-time document sharing is enhancing user experience, making these solutions indispensable for modern businesses.

Emergence of Innovative Networking Technologies

The virtual networking market is being propelled by the emergence of innovative networking technologies that enhance connectivity and user experience. Developments in software-defined networking (SDN) and network function virtualization (NFV) are transforming how organizations approach their networking needs. These technologies enable greater flexibility and scalability, allowing businesses to adapt to changing demands swiftly. The virtual networking market is projected to grow by 25% over the next few years, driven by the adoption of these cutting-edge solutions. As companies in the GCC seek to leverage the latest advancements, the integration of innovative technologies is likely to redefine the landscape of virtual networking.

Government Initiatives Supporting Digital Transformation

Government initiatives aimed at fostering digital transformation in the GCC are significantly influencing the virtual networking market. Various national strategies are being implemented to enhance digital infrastructure, which is expected to bolster the adoption of virtual networking solutions. For instance, investments in 5G technology and smart city projects are creating a conducive environment for the growth of this market. The virtual networking market is projected to benefit from these initiatives, with an anticipated increase in market size by 20% over the next few years. Such government support not only encourages businesses to adopt innovative networking solutions but also enhances overall economic competitiveness in the region.