The enterprise software market in Germany is characterized by a dynamic competitive landscape, driven by rapid technological advancements and increasing demand for digital transformation. Major players such as SAP (DE), Microsoft (US), and Oracle (US) are at the forefront, each adopting distinct strategies to enhance their market presence. SAP (DE) focuses on integrating advanced analytics and AI capabilities into its offerings, thereby positioning itself as a leader in enterprise resource planning (ERP) solutions. Meanwhile, Microsoft (US) emphasizes cloud-based services, leveraging its Azure platform to provide scalable solutions that cater to diverse business needs. Oracle (US) continues to innovate in database management and cloud applications, aiming to streamline operations for enterprises across various sectors. Collectively, these strategies foster a competitive environment that encourages innovation and responsiveness to market demands.

Key business tactics within this market include localized service offerings and supply chain optimization, which are essential for meeting the specific needs of German enterprises. The competitive structure appears moderately fragmented, with a mix of established giants and emerging players. This fragmentation allows for a diverse range of solutions, although the influence of key players remains substantial, shaping industry standards and customer expectations.

In October 2025, SAP (DE) announced a strategic partnership with a leading AI firm to enhance its cloud solutions, aiming to integrate machine learning capabilities into its software suite. This move is likely to bolster SAP's competitive edge by providing clients with advanced tools for data analysis and decision-making, thereby reinforcing its position in the market. The partnership underscores SAP's commitment to innovation and its focus on meeting the evolving needs of its customer base.

In September 2025, Microsoft (US) launched a new initiative aimed at expanding its Azure cloud services in Germany, which includes localized data centers to comply with stringent data protection regulations. This initiative not only enhances service delivery but also addresses growing concerns regarding data sovereignty among German enterprises. By investing in local infrastructure, Microsoft (US) demonstrates its dedication to supporting the digital transformation of businesses in the region.

In August 2025, Oracle (US) unveiled a new suite of cloud applications tailored for the manufacturing sector, designed to optimize production processes and supply chain management. This strategic move reflects Oracle's intent to penetrate niche markets and cater to specific industry needs, potentially increasing its market share in Germany. The introduction of these applications may also signal a shift towards more specialized solutions that address the unique challenges faced by different sectors.

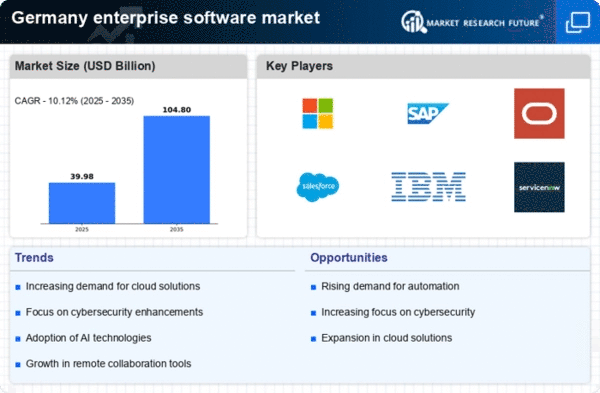

As of November 2025, current trends in the enterprise software market include a pronounced focus on digitalization, sustainability, and the integration of AI technologies. Strategic alliances are increasingly shaping the competitive landscape, as companies seek to combine strengths and enhance their offerings. Looking ahead, competitive differentiation is likely to evolve, with a shift from price-based competition towards innovation, technological advancement, and supply chain reliability. This transition suggests that companies will need to invest in R&D and forge strategic partnerships to maintain a competitive edge in an ever-evolving market.