Shift Towards Customization

The modern manufacturing-execution-system market in Germany is witnessing a shift towards greater product customization. As consumer preferences evolve, manufacturers are increasingly required to offer tailored solutions. This trend is pushing companies to adopt flexible manufacturing systems that can accommodate varying production demands. Data indicates that nearly 50% of German manufacturers are exploring customization capabilities within their production processes. This shift not only enhances customer satisfaction but also drives the need for sophisticated manufacturing-execution-systems that can efficiently manage diverse product lines. Consequently, the market is likely to expand as manufacturers seek systems that support agile production methodologies.

Increased Demand for Automation

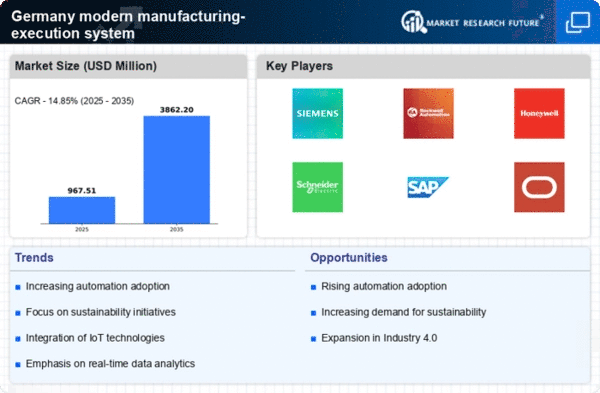

The modern manufacturing-execution-system market in Germany is experiencing a notable surge in demand for automation solutions. This trend is driven by the need for enhanced operational efficiency and reduced labor costs. As manufacturers seek to streamline their processes, the integration of automated systems becomes essential. According to recent data, approximately 60% of German manufacturers are investing in automation technologies to improve productivity. This shift not only optimizes production lines but also minimizes human error, thereby increasing overall output quality. The modern manufacturing-execution-system market is thus positioned to benefit significantly from this growing inclination towards automation, as companies strive to remain competitive in an increasingly digital landscape.

Focus on Supply Chain Resilience

The modern manufacturing-execution-system market in Germany is increasingly shaped by the need for supply chain resilience. Recent disruptions have highlighted vulnerabilities within supply chains, prompting manufacturers to seek systems that enhance visibility and responsiveness. Approximately 55% of companies are prioritizing investments in technologies that improve supply chain management. This focus on resilience is driving the adoption of modern manufacturing-execution-systems that facilitate real-time data sharing and collaboration among stakeholders. As manufacturers aim to mitigate risks and ensure continuity, the demand for robust systems that can adapt to changing market conditions is likely to grow, further propelling the market forward.

Investment in Smart Manufacturing

Germany's modern manufacturing-execution-system market is significantly influenced by the ongoing investment in smart manufacturing initiatives. The adoption of Industry 4.0 principles is prompting manufacturers to integrate advanced technologies such as AI and machine learning into their operations. This investment is projected to grow, with estimates suggesting that the smart manufacturing sector could reach €200 billion by 2025. As companies strive to enhance their operational capabilities, the demand for modern manufacturing-execution-systems that can support these technologies is expected to rise. This driver highlights the potential for innovation and efficiency gains within the manufacturing sector, positioning the market for substantial growth.

Regulatory Compliance and Standards

In Germany, stringent regulatory frameworks and industry standards are compelling manufacturers to adopt modern manufacturing-execution-systems. Compliance with regulations such as the Machinery Directive and ISO standards necessitates the implementation of advanced systems that ensure quality control and traceability. The modern manufacturing-execution-system market is likely to see growth as companies invest in solutions that facilitate adherence to these regulations. It is estimated that around 45% of manufacturers are prioritizing compliance-related investments, which directly influences their choice of manufacturing-execution systems. This driver underscores the importance of integrating compliance features into modern manufacturing-execution-systems to meet both legal requirements and customer expectations.