Rising Demand for Efficiency

The pharmacy automation market in Germany is experiencing a notable surge in demand for efficiency within pharmacy operations. As healthcare providers strive to optimize workflows, the integration of automated systems appears to be a viable solution. According to recent data, pharmacies that have adopted automation report a reduction in medication dispensing errors by up to 50%. This efficiency not only enhances patient safety but also allows pharmacists to allocate more time to patient care. The increasing complexity of medication regimens further necessitates the need for automation, as it streamlines processes and minimizes human error. Consequently, the pharmacy automation market is likely to expand as more pharmacies recognize the potential benefits of automation in improving operational efficiency.

Growing Demand for Cost Reduction

Cost reduction is a critical driver influencing the pharmacy automation market in Germany. As pharmacies face increasing pressure to manage operational costs, automation presents a compelling solution. Automated systems can significantly reduce labor costs by streamlining workflows and minimizing the need for manual intervention. Additionally, pharmacies that have adopted automation report savings of up to 20% in operational expenses. This financial incentive is likely to encourage more pharmacies to invest in automation technologies, as they seek to enhance profitability while maintaining high standards of patient care. Consequently, the pharmacy automation market is expected to expand as cost-conscious pharmacies recognize the long-term benefits of automation.

Increasing Focus on Patient Safety

Patient safety remains a paramount concern within the healthcare sector, significantly influencing the pharmacy automation market in Germany. The implementation of automated systems is seen as a critical measure to enhance safety protocols. Automated dispensing systems can minimize the risk of medication errors, which are a leading cause of adverse drug events. Reports indicate that pharmacies utilizing automation have experienced a 30% decrease in medication errors. This focus on patient safety is likely to drive further investments in automation technologies, as healthcare providers seek to improve outcomes and reduce liability. As a result, the pharmacy automation market is expected to witness sustained growth, fueled by the ongoing commitment to enhancing patient safety.

Regulatory Changes Favoring Automation

Regulatory changes in Germany are increasingly favoring the adoption of automation within the pharmacy sector. Recent policies have been introduced to encourage the use of automated systems, aiming to improve efficiency and safety in medication dispensing. These regulations are designed to streamline the approval process for new technologies, making it easier for pharmacies to implement automation solutions. As a result, the pharmacy automation market is likely to benefit from a more favorable regulatory environment, which could lead to increased investment in automation technologies. The alignment of regulatory frameworks with technological advancements suggests a promising future for the pharmacy automation market, as pharmacies seek to comply with new standards while enhancing operational efficiency.

Technological Advancements in Automation

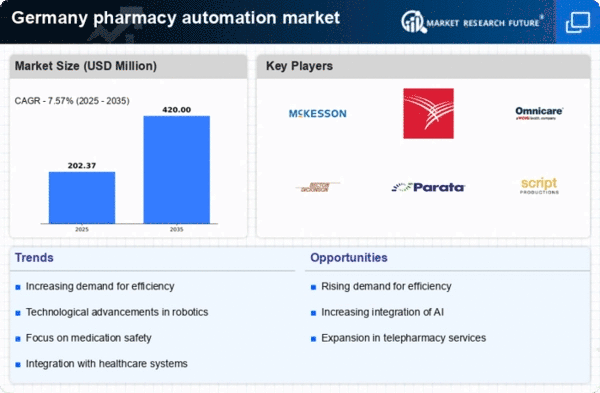

Technological advancements are playing a pivotal role in shaping the pharmacy automation market in Germany. Innovations such as artificial intelligence and machine learning are being integrated into pharmacy systems, enhancing their capabilities. For instance, automated dispensing systems equipped with AI can analyze prescription patterns and optimize inventory management. This not only reduces waste but also ensures that pharmacies maintain adequate stock levels. Furthermore, the market is projected to grow at a CAGR of approximately 8% over the next five years, driven by these technological innovations. As pharmacies increasingly adopt these advanced solutions, the overall efficiency and accuracy of medication dispensing are expected to improve significantly, thereby bolstering the pharmacy automation market.