Cost Reduction Initiatives

Cost reduction initiatives are increasingly influencing the pharmacy automation market. As pharmacies face rising operational costs, automation presents a viable solution to enhance profitability. By automating routine tasks, such as inventory management and prescription filling, pharmacies can significantly lower labor costs and minimize waste. Reports suggest that pharmacies implementing automation can achieve cost savings of up to 20% annually. Additionally, the reduction in medication errors leads to fewer costly recalls and legal liabilities. This financial incentive is compelling pharmacies to invest in automation technologies, thereby driving growth in the pharmacy automation market as they seek to optimize their operations and improve their bottom line.

Rising Demand for Efficiency

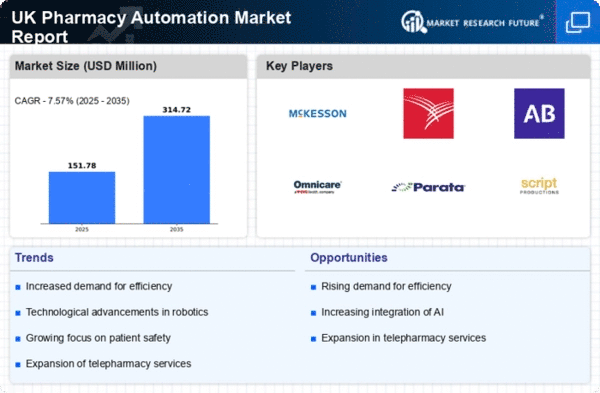

The pharmacy automation market is experiencing a notable surge in demand for efficiency. As the healthcare landscape evolves, pharmacies are increasingly seeking solutions that streamline workflows and reduce operational costs. Automation technologies, such as robotic dispensing systems, are being adopted to enhance accuracy and speed in medication dispensing. According to recent data, pharmacies that implement automation can reduce medication errors by up to 50%, thereby improving patient safety. This drive for efficiency is further supported by the increasing volume of prescriptions, which has risen by approximately 5% annually in the UK. Consequently, the pharmacy automation market is positioned to grow as pharmacies strive to meet these demands while maintaining high standards of service.

Increasing Focus on Patient Safety

The emphasis on patient safety is a critical driver in the pharmacy automation market. With the rise in medication errors and adverse drug events, pharmacies are prioritizing systems that enhance safety protocols. Automation solutions, such as barcode verification and automated dispensing cabinets, are being implemented to ensure accurate medication administration. Data indicates that pharmacies utilizing these technologies can achieve a reduction in medication errors by up to 70%. This focus on safety not only protects patients but also helps pharmacies comply with regulatory standards, thereby fostering trust and reliability in their services. As patient safety remains a top priority, the pharmacy automation market is expected to expand as more pharmacies adopt these essential technologies.

Regulatory Compliance and Standards

Regulatory compliance is a fundamental driver in the pharmacy automation market. The UK healthcare sector is governed by stringent regulations aimed at ensuring patient safety and quality of care. Pharmacies are increasingly required to adhere to these standards, which often necessitate the adoption of automated systems for accurate record-keeping and medication management. Automation technologies facilitate compliance by providing detailed audit trails and real-time reporting capabilities. As regulatory bodies continue to enforce these standards, pharmacies are likely to invest in automation solutions to meet compliance requirements. This trend not only enhances operational efficiency but also positions the pharmacy automation market for sustained growth as pharmacies navigate the complexities of regulatory landscapes.

Technological Advancements in Automation

Technological advancements are playing a pivotal role in shaping the pharmacy automation market. Innovations in robotics, artificial intelligence, and machine learning are enabling pharmacies to adopt more sophisticated automation solutions. For instance, automated medication dispensing systems are now equipped with advanced tracking and inventory management features, which can lead to a reduction in stock discrepancies by as much as 30%. Furthermore, the integration of cloud-based systems allows for real-time data access and analytics, enhancing decision-making processes. As these technologies continue to evolve, they are likely to drive further investment in the pharmacy automation market, as pharmacies seek to leverage these advancements to improve operational efficiency and patient care.