Adoption of Cloud-Based Solutions

the sales performance-management market in Germany is projected to witness a significant shift towards cloud-based solutions. Businesses are increasingly adopting cloud technologies to streamline their sales processes and improve collaboration among teams. By 2025, it is anticipated that over 60% of organizations will utilize cloud-based platforms for sales performance management. This transition offers several advantages, including scalability, cost-effectiveness, and enhanced accessibility to data. Cloud solutions enable real-time updates and facilitate remote work, which is becoming increasingly important in today's business environment. As a result, the sales performance-management market is likely to see accelerated growth as companies embrace these innovative technologies to enhance their operational efficiency.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into the sales performance-management market is emerging as a transformative driver in Germany. AI technologies are being utilized to automate routine tasks, analyze customer data, and provide predictive insights that can enhance sales strategies. By 2025, it is projected that AI-driven solutions will account for approximately 25% of the sales performance-management market. This integration allows organizations to identify trends and patterns in customer behavior, enabling more personalized sales approaches. Furthermore, AI can assist in forecasting sales performance, thereby improving resource allocation and strategic planning. The growing reliance on AI indicates a shift towards more sophisticated sales management practices.

Regulatory Compliance and Data Security

In the context of the sales performance-management market, regulatory compliance and data security are becoming increasingly critical for organizations in Germany. As data protection regulations tighten, companies are compelled to invest in secure sales management systems that ensure compliance with legal standards. By 2025, it is expected that around 20% of sales budgets will be directed towards enhancing data security measures. This focus on compliance not only protects sensitive customer information but also builds trust with clients. Organizations that prioritize data security are likely to gain a competitive advantage, as they can assure customers of their commitment to safeguarding personal data. Consequently, the sales performance-management market is projected to grow as businesses seek solutions that align with regulatory requirements.

Rising Demand for Performance Analytics

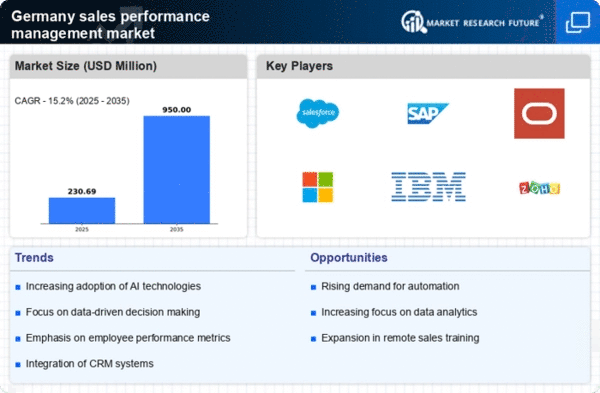

the sales performance-management market in Germany is expected to experience a notable increase in demand for performance analytics tools. Companies are increasingly recognizing the value of data-driven insights to enhance sales strategies and optimize team performance. In 2025, the market is projected to grow by approximately 15%, driven by the need for real-time analytics that can inform decision-making processes. Organizations are investing in advanced analytics solutions to track key performance indicators (KPIs) and assess sales effectiveness. This trend indicates a shift towards a more analytical approach in sales management, where data is leveraged to identify strengths and weaknesses within sales teams. Consequently, the sales performance-management market is likely to expand as businesses seek to implement these analytics tools to gain a competitive edge.

Increased Focus on Sales Training Programs

In Germany, there is a growing emphasis on the development of comprehensive sales training programs within the sales performance-management market. Organizations are recognizing that well-trained sales personnel are crucial for achieving sales targets and enhancing customer satisfaction. As of 2025, it is estimated that companies will allocate around 10% of their sales budgets to training initiatives. This investment reflects a commitment to equipping sales teams with the necessary skills and knowledge to navigate complex market dynamics. Enhanced training programs not only improve individual performance but also foster a culture of continuous learning, which is essential for long-term success in the competitive landscape of sales.