Integration of Advanced Analytics

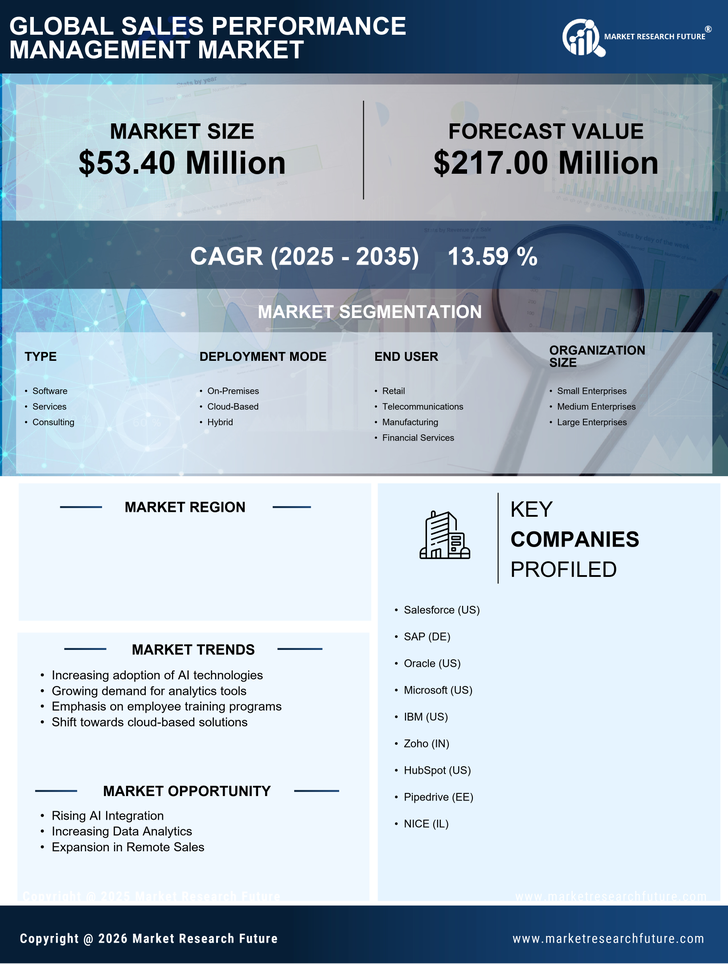

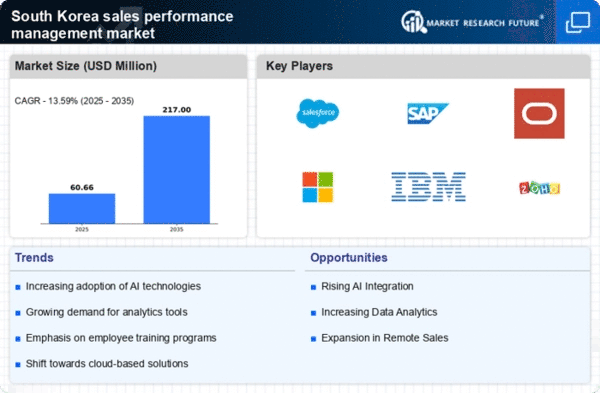

The integration of advanced analytics into the sales performance-management market appears to be a pivotal driver in South Korea. Organizations are increasingly leveraging data analytics to gain insights into sales trends and customer behavior. This trend is evidenced by a reported growth of 15% in the adoption of analytics tools among sales teams in the past year. By utilizing predictive analytics, companies can forecast sales performance more accurately, allowing for better resource allocation and strategic planning. The sales performance-management market is thus evolving to incorporate these technologies, enabling businesses to enhance their decision-making processes and improve overall sales effectiveness. As a result, organizations that embrace advanced analytics are likely to gain a competitive edge in the dynamic South Korean market.

Shift Towards Remote Sales Management

The shift towards remote sales management is significantly influencing the sales performance-management market in South Korea. With the rise of remote work, companies are adapting their sales strategies to accommodate virtual interactions. This transition has led to a 20% increase in the demand for cloud-based sales performance tools, as organizations seek to maintain productivity and collaboration among dispersed teams. Remote sales management solutions facilitate real-time performance tracking and enable managers to provide immediate feedback, which is crucial for maintaining sales momentum. Consequently, the sales performance-management market is witnessing a transformation, as businesses invest in technologies that support remote operations and enhance team engagement, ultimately driving sales growth.

Growing Emphasis on Customer Experience

The growing emphasis on customer experience is reshaping the sales performance-management market in South Korea. Companies are increasingly recognizing that enhancing customer satisfaction directly correlates with improved sales outcomes. Recent studies indicate that organizations focusing on customer-centric strategies have experienced a 25% increase in sales performance. This shift necessitates the integration of customer feedback mechanisms into sales processes, allowing teams to adapt their approaches based on client needs. As a result, the sales performance-management market is evolving to include tools that facilitate customer relationship management and performance tracking, ensuring that sales teams are aligned with customer expectations and preferences.

Regulatory Compliance and Data Security

Regulatory compliance and data security are becoming critical drivers in the sales performance-management market in South Korea. As businesses increasingly rely on digital tools for sales management, the need to comply with data protection regulations has intensified. Companies are investing in secure sales performance-management solutions to safeguard sensitive customer information and ensure compliance with local laws. This focus on security is reflected in a 30% rise in demand for compliance-focused sales tools over the past year. Consequently, the sales performance-management market is adapting to these requirements, with vendors prioritizing security features and compliance capabilities in their offerings, thereby fostering trust among clients and stakeholders.

Increased Investment in Sales Training Technologies

Increased investment in sales training technologies is driving growth in the sales performance-management market in South Korea. Organizations are recognizing the importance of equipping their sales teams with the necessary skills to navigate a competitive landscape. Recent data suggests that companies that invest in training technologies see a 40% improvement in sales performance metrics. This trend has led to a surge in demand for e-learning platforms and virtual training solutions tailored for sales professionals. As a result, the sales performance-management market is witnessing a proliferation of innovative training tools designed to enhance the capabilities of sales teams, ultimately contributing to higher sales effectiveness and productivity.