Evolving Consumer Preferences

The sales performance-management market. is increasingly influenced by evolving consumer preferences. As consumers become more discerning, businesses are compelled to adapt their sales strategies to meet these changing demands. This shift necessitates a more agile approach to sales performance management, where data analytics plays a crucial role. Companies that leverage insights from consumer behavior can enhance their sales strategies, leading to improved performance metrics. In 2025, it is estimated that 70% of Japanese consumers prioritize personalized experiences, which directly impacts sales performance. Consequently, organizations are investing in tools that enable them to analyze customer data effectively, thereby optimizing their sales processes and enhancing overall market competitiveness.

Shift Towards Remote Sales Models

The shift towards remote sales models is significantly impacting the sales performance-management market.. As organizations adapt to new working environments, remote sales strategies are becoming essential. This transition requires robust performance management systems that can effectively monitor and evaluate remote sales teams. In 2025, it is expected that 40% of sales teams in Japan will operate remotely, necessitating the implementation of digital tools that facilitate communication and performance tracking. Companies that embrace this shift can enhance their sales effectiveness, as they are better equipped to respond to market changes and customer needs in real-time. The sales performance-management market is thus evolving to support these new operational paradigms.

Regulatory Compliance and Standards

Regulatory compliance is a critical driver in the sales performance-management market.. As businesses navigate complex regulations, particularly in data protection and consumer rights, they must ensure that their sales practices align with legal standards. This compliance not only mitigates risks but also enhances customer trust, which is vital for sales success. In 2025, it is anticipated that 60% of companies in Japan will prioritize compliance-related investments in their sales strategies. By integrating compliance into their sales performance management frameworks, organizations can foster a culture of accountability and transparency, ultimately leading to improved sales outcomes and customer loyalty.

Technological Advancements in Sales Tools

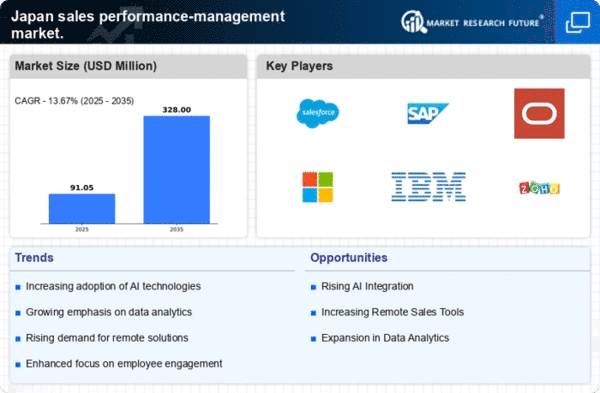

Technological advancements are reshaping the sales performance-management market.. The integration of artificial intelligence (AI) and machine learning (ML) into sales tools is becoming increasingly prevalent. These technologies facilitate predictive analytics, enabling sales teams to forecast trends and customer needs more accurately. In 2025, the market for AI-driven sales tools is projected to grow by 25%, reflecting the demand for innovative solutions that enhance sales efficiency. As organizations adopt these advanced tools, they can streamline their sales processes, improve lead conversion rates, and ultimately drive revenue growth. The sales performance-management market is thus witnessing a significant transformation, as companies seek to harness technology to gain a competitive edge.

Increased Focus on Data-Driven Decision Making

The sales performance-management market. is witnessing an increased focus on data-driven decision making. Organizations are recognizing the value of data analytics in shaping their sales strategies and improving performance outcomes. By leveraging data insights, companies can identify trends, assess sales team effectiveness, and optimize their sales processes. In 2025, it is projected that 75% of Japanese companies will utilize data analytics tools to inform their sales strategies. This trend underscores the importance of integrating data into sales performance management frameworks, as it enables organizations to make informed decisions that drive growth and enhance competitive positioning in the market.