Growing Focus on Preventive Healthcare

The ultrasound gastroscopes market is witnessing a shift towards preventive healthcare in Germany. With an increasing emphasis on early detection and prevention of diseases, healthcare providers are incorporating ultrasound gastroscopes into routine screening protocols. This proactive approach is aimed at identifying gastrointestinal issues before they escalate into more serious conditions. The German healthcare system is increasingly prioritizing preventive measures, which is likely to drive the demand for ultrasound gastroscopes. As a result, hospitals and clinics are expected to allocate more resources towards acquiring these advanced diagnostic tools, thereby fostering growth in the ultrasound gastroscopes market. This trend aligns with broader public health initiatives aimed at improving overall health outcomes.

Rising Demand for Minimally Invasive Procedures

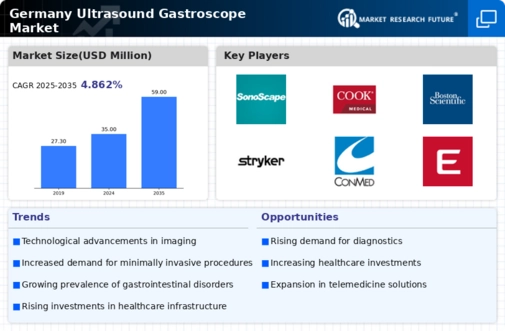

The ultrasound gastroscopes market in Germany is experiencing a notable increase in demand for minimally invasive procedures. This trend is largely driven by the growing awareness among patients and healthcare providers regarding the benefits of such techniques, which include reduced recovery times and lower risk of complications. As a result, hospitals and clinics are increasingly adopting ultrasound gastroscopes to enhance their diagnostic and therapeutic capabilities. According to recent data, the market is projected to grow at a CAGR of approximately 8% over the next five years, reflecting the shift towards less invasive options in gastrointestinal diagnostics. This rising demand is likely to propel the ultrasound gastroscopes market forward, as more healthcare facilities invest in advanced technologies to meet patient expectations.

Technological Innovations in Imaging Techniques

Technological innovations are playing a pivotal role in shaping the ultrasound gastroscopes market in Germany. Recent advancements in imaging techniques, such as enhanced resolution and real-time imaging capabilities, are making ultrasound gastroscopes more effective for both diagnosis and treatment. These innovations not only improve the accuracy of gastrointestinal examinations but also facilitate quicker decision-making in clinical settings. The integration of artificial intelligence and machine learning into ultrasound systems is further enhancing their functionality, potentially increasing their adoption rates among healthcare professionals. As these technologies continue to evolve, the ultrasound gastroscopes market is expected to benefit from increased investment in research and development, leading to more sophisticated and user-friendly devices.

Increased Investment in Healthcare Infrastructure

Investment in healthcare infrastructure in Germany is significantly impacting the ultrasound gastroscopes market. The government and private sector are channeling funds into upgrading medical facilities and acquiring advanced diagnostic equipment. This influx of capital is facilitating the adoption of ultrasound gastroscopes, as healthcare providers seek to enhance their diagnostic capabilities. Recent reports indicate that healthcare spending in Germany is projected to rise by approximately 5% annually, which is likely to include substantial investments in imaging technologies. As healthcare facilities modernize, the ultrasound gastroscopes market is expected to expand, driven by the need for state-of-the-art equipment that meets the demands of contemporary medical practice.

Aging Population and Increased Gastrointestinal Disorders

Germany's aging population is contributing significantly to the growth of the ultrasound gastroscopes market. As individuals age, they become more susceptible to various gastrointestinal disorders, including gastroesophageal reflux disease (GERD) and peptic ulcers. This demographic shift is prompting healthcare providers to seek effective diagnostic tools, such as ultrasound gastroscopes, to address these conditions. The prevalence of gastrointestinal disorders is expected to rise, with estimates suggesting that nearly 30% of the elderly population may experience such issues. Consequently, the ultrasound gastroscopes market is likely to expand as healthcare systems adapt to the increasing need for efficient diagnostic solutions tailored to an aging demographic.

Leave a Comment