Increased Healthcare Expenditure

Japan's healthcare expenditure has been on the rise, which is positively impacting the ultrasound gastroscopes sector. The government has been investing heavily in healthcare infrastructure and technology to improve patient care and outcomes. In 2025, healthcare spending is projected to account for around 10% of the country's GDP, reflecting a commitment to enhancing medical services. This increase in funding allows hospitals and clinics to upgrade their medical equipment, including ultrasound gastroscopes, thereby improving diagnostic capabilities. As healthcare facilities modernize, the demand for advanced ultrasound gastroscopes is likely to grow, further propelling the market forward.

Supportive Regulatory Environment

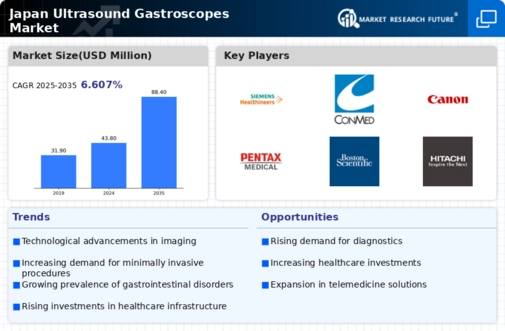

The regulatory environment in Japan is becoming increasingly supportive of innovations in the ultrasound gastroscopes sector. The Pharmaceuticals and Medical Devices Agency (PMDA) has streamlined the approval process for new medical devices, encouraging manufacturers to introduce advanced ultrasound technologies. This regulatory support is crucial for fostering innovation and ensuring that healthcare providers have access to the latest diagnostic tools. As a result, the ultrasound gastroscopes market is likely to benefit from a steady influx of new products and technologies, enhancing competition and improving patient care. The favorable regulatory landscape is expected to contribute to a projected market growth of around 6% annually over the next few years.

Technological Innovations in Imaging

Technological advancements in imaging techniques are significantly influencing the ultrasound gastroscopes sector in Japan. Innovations such as high-definition imaging, real-time visualization, and enhanced image processing capabilities are making ultrasound gastroscopes more effective and user-friendly. These improvements not only enhance diagnostic accuracy but also expand the range of applications for these devices. For instance, the integration of artificial intelligence in imaging analysis is expected to streamline workflows and improve patient outcomes. The market for advanced imaging technologies is anticipated to reach approximately $500 million by 2026, indicating a robust growth trajectory that will likely benefit the ultrasound gastroscopes market as well.

Rising Demand for Minimally Invasive Procedures

The ultrasound gastroscopes market in Japan is experiencing a notable increase in demand for minimally invasive procedures. This trend is largely driven by the growing awareness among patients and healthcare providers regarding the benefits of such techniques, including reduced recovery times and lower risk of complications. As a result, hospitals and clinics are increasingly adopting ultrasound gastroscopes, which facilitate these procedures. According to recent data, the market for minimally invasive surgical instruments is projected to grow at a CAGR of approximately 8% over the next five years. This shift towards less invasive options is likely to bolster the ultrasound gastroscopes sector, as these devices are integral to performing various diagnostic and therapeutic procedures with minimal patient discomfort.

Growing Prevalence of Gastrointestinal Disorders

The rising prevalence of gastrointestinal disorders in Japan is a critical driver for the ultrasound gastroscopes sector. Conditions such as gastritis, ulcers, and cancers of the digestive tract are becoming increasingly common, necessitating effective diagnostic tools. Recent statistics indicate that approximately 30% of the Japanese population experiences some form of gastrointestinal issue, leading to a heightened demand for diagnostic procedures. Ultrasound gastroscopes are particularly valuable in this context, as they provide non-invasive options for diagnosis and treatment. This growing health concern is expected to sustain the ultrasound gastroscopes market's growth as healthcare providers seek efficient solutions for managing these disorders.

Leave a Comment