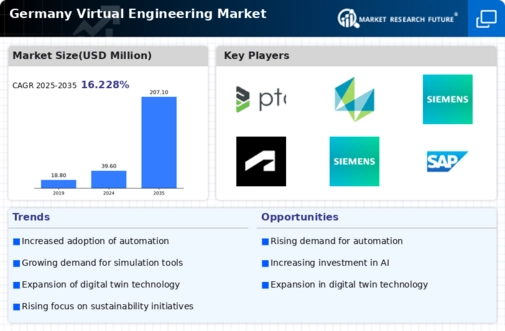

The virtual engineering market in Germany is characterized by a dynamic competitive landscape, driven by rapid technological advancements and increasing demand for digital solutions across various industries. Key players such as Siemens AG (DE), SAP SE (DE), and Dassault Systemes SE (FR) are at the forefront, each adopting distinct strategies to enhance their market positioning. Siemens AG (DE) focuses on innovation through its digital twin technology, which allows for real-time simulations and optimizations in engineering processes. Meanwhile, SAP SE (DE) emphasizes partnerships with cloud service providers to bolster its enterprise resource planning (ERP) solutions, thereby enhancing integration capabilities for clients. Dassault Systemes SE (FR) is leveraging its 3D modeling software to facilitate collaborative engineering, which is increasingly vital in a globalized market. Collectively, these strategies contribute to a competitive environment that is both collaborative and competitive, as companies seek to differentiate themselves through technological prowess and customer-centric solutions.

In terms of business tactics, companies are increasingly localizing their operations to better serve the German market, optimizing supply chains to enhance efficiency and responsiveness. The competitive structure of the market appears moderately fragmented, with several key players holding substantial market shares while also facing competition from emerging firms. This fragmentation allows for a diverse range of solutions, catering to various customer needs and preferences, which in turn fosters innovation and drives market growth.

In November 2025, Siemens AG (DE) announced a strategic partnership with a leading AI firm to integrate advanced machine learning algorithms into its engineering software. This move is likely to enhance predictive maintenance capabilities, thereby reducing downtime and operational costs for clients. The integration of AI into engineering processes signifies a pivotal shift towards more intelligent and automated solutions, positioning Siemens AG (DE) as a leader in the digital transformation of engineering.

In October 2025, SAP SE (DE) launched a new cloud-based platform aimed at streamlining engineering workflows for manufacturing clients. This platform is designed to facilitate real-time data sharing and collaboration among teams, which is crucial for enhancing productivity and reducing time-to-market. The introduction of this platform underscores SAP SE's commitment to digitalization and its strategic focus on providing comprehensive solutions that address the evolving needs of the engineering sector.

In September 2025, Dassault Systemes SE (FR) expanded its 3DEXPERIENCE platform to include enhanced simulation capabilities tailored for the automotive industry. This expansion is significant as it allows automotive engineers to conduct more accurate simulations, thereby improving design efficiency and reducing development costs. By focusing on industry-specific solutions, Dassault Systemes SE (FR) is likely to strengthen its competitive edge and attract a broader client base.

As of December 2025, the competitive trends in the virtual engineering market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances among key players are shaping the landscape, fostering innovation and collaborative development. The shift from price-based competition to a focus on technological innovation and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to deliver cutting-edge solutions that meet the complex demands of the market.

Leave a Comment