The virtual engineering market is currently characterized by a dynamic competitive landscape, driven by rapid technological advancements and an increasing demand for innovative solutions across various sectors. Key players such as Siemens (US), Autodesk (US), and ANSYS (US) are strategically positioning themselves to leverage these growth opportunities. Siemens (US) focuses on digital transformation and smart infrastructure, while Autodesk (US) emphasizes cloud-based solutions and design automation. ANSYS (US) is heavily invested in simulation software, which is critical for product development in engineering. Collectively, these strategies not only enhance their operational capabilities but also intensify competition, as companies strive to differentiate themselves through innovation and customer-centric solutions.

In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance efficiency and responsiveness. The competitive structure of the market appears moderately fragmented, with several key players exerting influence over various segments. This fragmentation allows for niche players to emerge, yet the collective strength of major companies like Siemens (US) and Autodesk (US) shapes market dynamics significantly, as they set benchmarks for technology and service delivery.

In November 2025, Siemens (US) announced a strategic partnership with a leading AI firm to enhance its digital twin technology, which is expected to revolutionize predictive maintenance in manufacturing. This move underscores Siemens' commitment to integrating AI into its offerings, potentially providing clients with unprecedented insights into operational efficiencies. Such advancements may not only solidify Siemens' market position but also compel competitors to accelerate their own AI initiatives.

In October 2025, Autodesk (US) launched a new suite of tools aimed at improving collaboration in remote engineering projects. This initiative reflects a growing trend towards remote work solutions, which have become essential in the current business environment. By enhancing collaborative capabilities, Autodesk (US) is likely to attract a broader customer base, particularly among firms seeking to streamline their engineering processes in a hybrid work setting.

In September 2025, ANSYS (US) expanded its cloud-based simulation offerings through the acquisition of a smaller tech firm specializing in machine learning algorithms. This acquisition is strategically significant as it allows ANSYS (US) to enhance its simulation capabilities, making them more accessible and efficient for users. The integration of machine learning into simulation processes could lead to faster product development cycles, thereby providing ANSYS (US) with a competitive edge in the market.

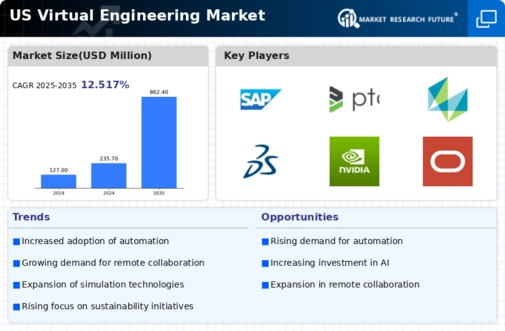

As of December 2025, the virtual engineering market is witnessing trends that emphasize digitalization, sustainability, and AI integration. Strategic alliances are increasingly shaping the competitive landscape, as companies recognize the value of collaboration in driving innovation. The shift from price-based competition to a focus on technological advancement and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to innovate and adapt to evolving market demands.

Leave a Comment