Increasing Industrial Automation

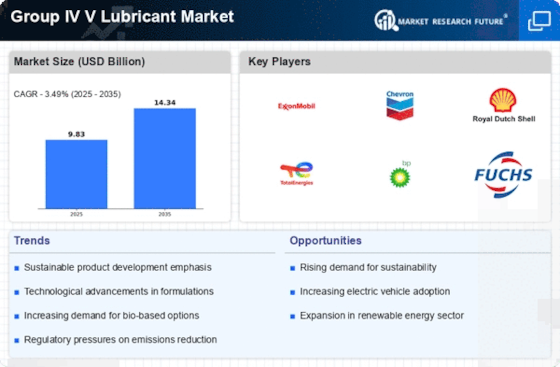

The Group IV V Lubricant Market is experiencing growth due to the increasing trend of industrial automation across various sectors. As industries adopt automated processes to enhance productivity and reduce operational costs, the demand for high-quality lubricants that can withstand the rigors of automated machinery is on the rise. Automated systems often require lubricants that provide superior protection against wear and tear, as well as enhanced thermal stability. The market for industrial lubricants is expected to grow at a steady pace, with projections indicating a growth rate of around 4% annually. This trend towards automation not only drives demand for Group IV V lubricants but also encourages manufacturers to innovate and develop products that meet the evolving needs of automated systems.

Growth in Electric Vehicle Market

The Group IV V Lubricant Market is poised to benefit from the rapid growth in the electric vehicle (EV) market. As the automotive industry shifts towards electrification, there is an increasing need for specialized lubricants that can meet the unique requirements of electric drivetrains. These lubricants must provide excellent thermal management and reduce friction to enhance the efficiency of electric motors. The EV market is projected to grow significantly, with estimates suggesting that electric vehicles could account for over 30% of total vehicle sales by 2030. This transition presents a substantial opportunity for the Group IV V Lubricant Market to develop and supply innovative lubricants tailored for electric vehicles, thereby capitalizing on this emerging trend.

Rising Demand for High-Performance Lubricants

The Group IV V Lubricant Market is experiencing a notable increase in demand for high-performance lubricants, driven by the need for enhanced efficiency and durability in various applications. Industries such as automotive, aerospace, and manufacturing are increasingly adopting these advanced lubricants to improve operational performance. According to recent data, the market for high-performance lubricants is projected to grow at a compound annual growth rate of approximately 5% over the next five years. This growth is attributed to the rising awareness of the benefits of using synthetic lubricants, which offer superior thermal stability and oxidation resistance compared to conventional options. As industries strive for greater efficiency and lower maintenance costs, the Group IV V Lubricant Market is likely to see sustained growth in demand for these specialized products.

Regulatory Compliance and Environmental Standards

The Group IV V Lubricant Market is significantly influenced by stringent regulatory compliance and environmental standards. Governments and regulatory bodies are increasingly implementing regulations aimed at reducing environmental impact, which has led to a shift towards more sustainable lubricant formulations. The introduction of regulations such as the European Union's REACH and the U.S. EPA's regulations on hazardous substances has prompted manufacturers to innovate and develop eco-friendly lubricants. This shift not only aligns with environmental goals but also meets the growing consumer demand for sustainable products. As a result, the market for Group IV V lubricants, which often meet these stringent standards, is expected to expand as companies seek to comply with regulations while maintaining product performance.

Technological Innovations in Lubricant Formulation

Technological innovations play a crucial role in shaping the Group IV V Lubricant Market. Advances in formulation technologies have led to the development of synthetic lubricants that offer superior performance characteristics, such as enhanced viscosity stability and improved wear protection. These innovations are particularly relevant in high-stress applications, where traditional lubricants may fail to perform adequately. The introduction of new additives and base oils has further enhanced the performance of Group IV V lubricants, making them suitable for a wider range of applications. As industries continue to seek out advanced solutions to improve efficiency and reduce downtime, the demand for technologically advanced lubricants is likely to rise, thereby driving growth in the Group IV V Lubricant Market.