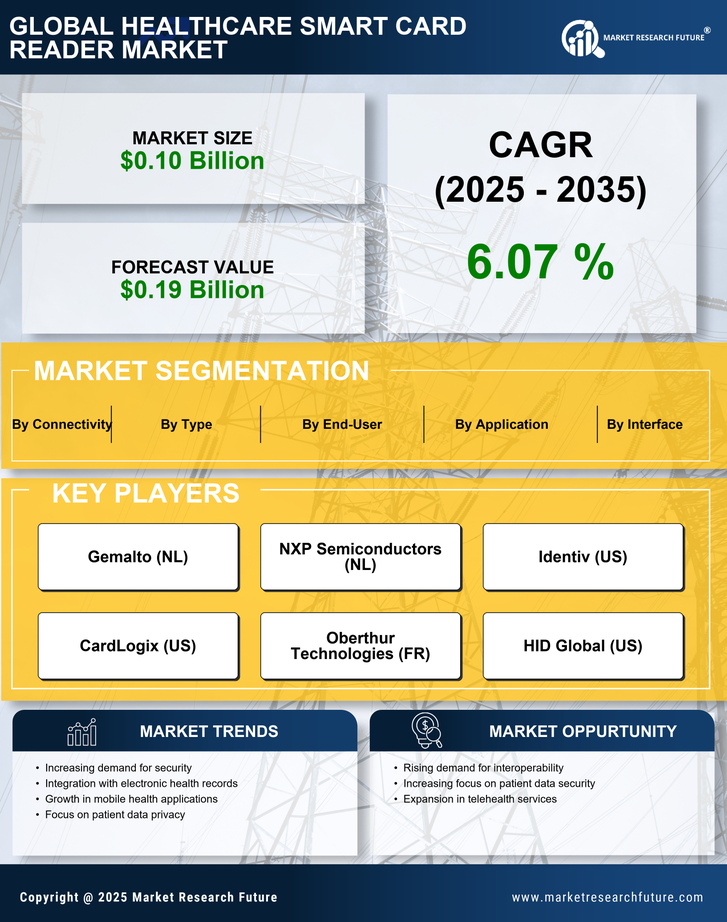

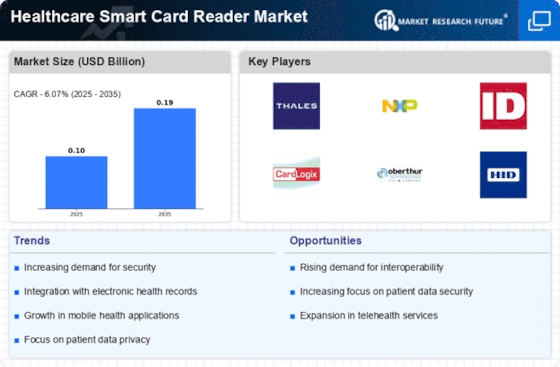

The Healthcare Smart Card Reader Market is currently characterized by a dynamic competitive landscape, driven by technological advancements and an increasing emphasis on secure patient data management. Key players such as Gemalto (NL), NXP Semiconductors (NL), and Identiv (US) are strategically positioned to leverage innovation and partnerships to enhance their market presence. Gemalto (NL) focuses on integrating advanced security features into their smart card solutions, while NXP Semiconductors (NL) emphasizes the development of contactless technology to streamline healthcare processes. Identiv (US) appears to be concentrating on expanding its product offerings through strategic collaborations, thereby enhancing its competitive edge. Collectively, these strategies indicate a trend towards a more integrated and secure healthcare ecosystem, where companies are not only competing on product features but also on the ability to provide comprehensive solutions that address the evolving needs of healthcare providers.

In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance efficiency and reduce costs. The market structure is moderately fragmented, with several players vying for market share, yet the influence of major companies remains substantial. This competitive environment fosters innovation, as companies strive to differentiate themselves through unique offerings and superior service delivery.

In August 2025, Gemalto (NL) announced a partnership with a leading healthcare provider to implement a new smart card system aimed at improving patient identification and data security. This strategic move is likely to enhance Gemalto's market position by showcasing its commitment to addressing critical healthcare challenges, particularly in the realm of data protection and patient safety. Such collaborations may also serve to establish Gemalto as a trusted partner in the healthcare sector, potentially leading to further opportunities for growth.

In September 2025, NXP Semiconductors (NL) launched a new line of contactless smart card readers designed specifically for healthcare applications. This innovation is significant as it aligns with the growing demand for efficient and secure patient interactions, suggesting that NXP is keen on capitalizing on the trend towards digitalization in healthcare. By focusing on contactless technology, NXP may enhance user experience while also addressing the need for hygienic solutions in clinical settings.

In July 2025, Identiv (US) expanded its product portfolio by introducing a new range of smart card readers that integrate biometric authentication features. This strategic initiative appears to be a response to the increasing demand for enhanced security measures in healthcare environments. By incorporating biometric technology, Identiv is likely positioning itself as a leader in secure access solutions, which could attract a broader customer base concerned with data integrity and patient confidentiality.

As of October 2025, the competitive trends in the Healthcare Smart Card Reader Market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances among key players are shaping the landscape, fostering innovation and collaboration. Looking ahead, it seems that competitive differentiation will evolve from traditional price-based competition to a focus on technological innovation, reliability in supply chains, and the ability to deliver comprehensive, secure solutions tailored to the unique needs of the healthcare sector.