Rise of Functional Foods

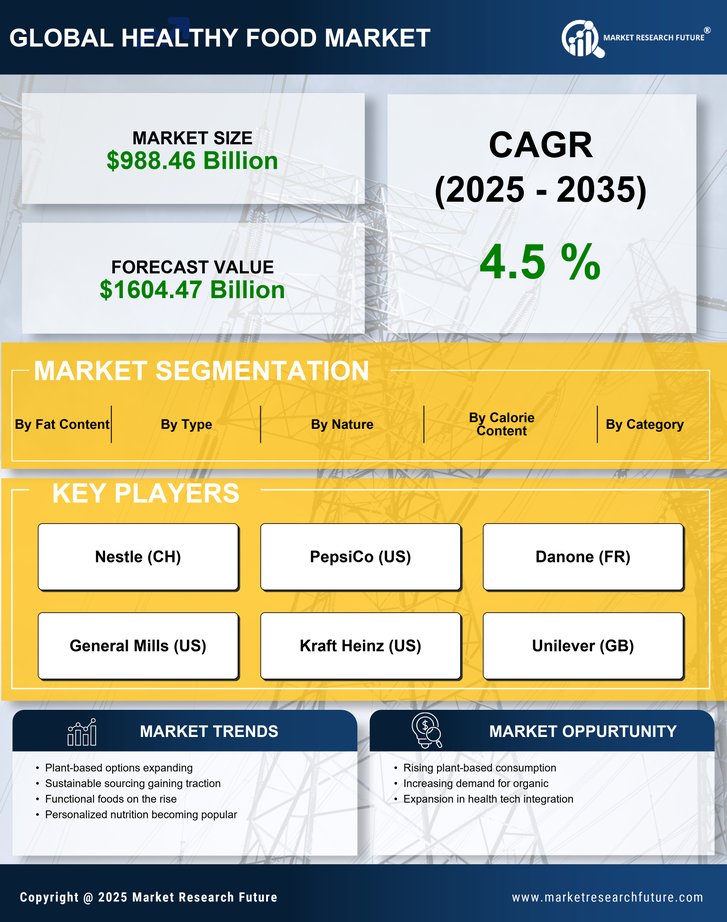

The Healthy Food Market Industry is witnessing a significant rise in the popularity of functional foods, which are designed to provide health benefits beyond basic nutrition. These products often contain added ingredients such as probiotics, vitamins, and minerals that promote specific health outcomes. The market for functional foods is projected to grow at a robust pace, driven by increasing consumer interest in preventive health measures. As individuals seek to enhance their overall well-being through diet, the demand for foods that support immunity, digestive health, and mental wellness is likely to expand. This trend indicates a shift in consumer preferences, positioning the Healthy Food Market Industry at the forefront of health-oriented food innovation.

Increased Health Awareness

The Healthy Food Market Industry is experiencing a notable surge in consumer health consciousness. Individuals are increasingly prioritizing their well-being, leading to a heightened demand for nutritious food options. This trend is reflected in the growing sales of organic and natural products, which have seen a compound annual growth rate of approximately 10% over the past few years. As consumers become more informed about the health implications of their dietary choices, they are gravitating towards foods that are perceived as healthier. This shift is not merely a passing trend; it appears to be a fundamental change in consumer behavior, suggesting that the Healthy Food Market Industry will continue to expand as health awareness becomes more ingrained in societal norms.

Changing Demographics and Lifestyles

Demographic shifts and evolving lifestyles are significantly influencing the Healthy Food Market Industry. As populations age and urbanization continues, there is a growing demand for convenient, healthy food options that cater to busy lifestyles. Younger consumers, in particular, are seeking quick yet nutritious meals that fit their on-the-go habits. This trend is reflected in the increasing popularity of ready-to-eat meals and snack options that prioritize health without compromising convenience. Additionally, the rise of single-person households is driving demand for smaller portion sizes and innovative packaging solutions. These demographic changes suggest that the Healthy Food Market Industry must adapt to meet the diverse needs of consumers, ensuring that healthy options are accessible and appealing.

Sustainability and Ethical Consumption

Sustainability has emerged as a pivotal driver within the Healthy Food Market Industry. Consumers are increasingly concerned about the environmental impact of their food choices, leading to a preference for sustainably sourced and ethically produced products. This trend is evidenced by the rise in demand for plant-based foods, which are often associated with lower carbon footprints. Reports indicate that the market for sustainable food products is projected to grow significantly, with consumers willing to pay a premium for items that align with their values. As awareness of climate change and environmental degradation intensifies, the Healthy Food Market Industry is likely to see a continued shift towards sustainable practices, influencing product development and marketing strategies.

Technological Advancements in Food Production

Technological innovation is reshaping the landscape of the Healthy Food Market Industry. Advances in food processing, preservation, and packaging technologies are enabling manufacturers to create healthier products that retain nutritional value while extending shelf life. For instance, the adoption of smart farming techniques and precision agriculture is enhancing the quality and yield of healthy food crops. Furthermore, the integration of artificial intelligence in supply chain management is optimizing distribution, ensuring that fresh products reach consumers more efficiently. These technological advancements not only improve product quality but also cater to the growing consumer demand for transparency and traceability in food sourcing, thereby bolstering the Healthy Food Market Industry.