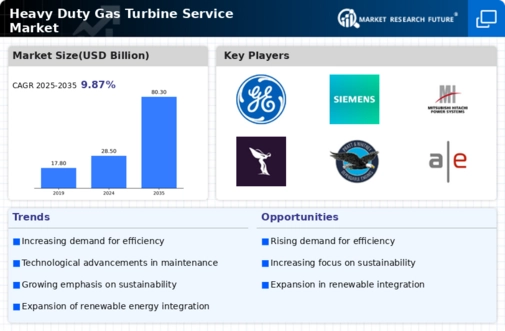

Increasing Demand for Energy Efficiency

The Heavy Duty Gas Turbine Service Market is experiencing a notable surge in demand for energy-efficient solutions. As industries strive to reduce operational costs and enhance productivity, the focus on energy efficiency becomes paramount. Heavy-duty gas turbines, known for their high efficiency and reliability, are increasingly favored in power generation and industrial applications. According to recent data, the efficiency of modern gas turbines can exceed 60%, which is significantly higher than older models. This trend is likely to drive investments in service and maintenance to ensure optimal performance, thereby propelling the Heavy Duty Gas Turbine Service Market forward.

Expansion of Renewable Energy Integration

The Heavy Duty Gas Turbine Service Market is poised for growth due to the increasing integration of renewable energy sources into the energy mix. As countries aim for a more sustainable energy future, gas turbines are often used as backup power sources to complement intermittent renewable energy generation. This hybrid approach necessitates regular maintenance and service to ensure reliability and efficiency. The market for heavy-duty gas turbine services is expected to expand as utilities and independent power producers invest in maintaining their gas turbine fleets to support renewable energy initiatives, thus enhancing the Heavy Duty Gas Turbine Service Market.

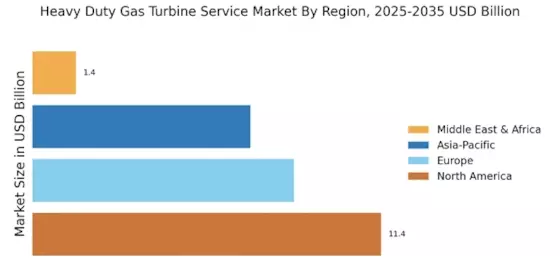

Rising Industrialization and Urbanization

The Heavy Duty Gas Turbine Service Market is significantly impacted by the rising trends of industrialization and urbanization. As economies develop, there is a corresponding increase in energy demand, particularly in emerging markets. Heavy-duty gas turbines are often deployed in industrial settings to meet this demand due to their ability to provide reliable and efficient power. The expansion of manufacturing and infrastructure projects necessitates regular maintenance and servicing of gas turbines to ensure uninterrupted operations. Consequently, this trend is expected to drive the Heavy Duty Gas Turbine Service Market as more industries seek to enhance their energy capabilities.

Technological Innovations in Turbine Design

The Heavy Duty Gas Turbine Service Market is benefiting from ongoing technological innovations in turbine design and performance. Advances in materials science and engineering have led to the development of more robust and efficient gas turbines. These innovations not only improve the operational efficiency of turbines but also extend their service life. As a result, service providers are increasingly required to adapt to these advancements, offering specialized maintenance and repair services tailored to new turbine technologies. This dynamic environment is likely to stimulate growth within the Heavy Duty Gas Turbine Service Market as operators seek to optimize their assets.

Regulatory Compliance and Emission Standards

The Heavy Duty Gas Turbine Service Market is significantly influenced by stringent regulatory compliance and evolving emission standards. Governments worldwide are implementing more rigorous environmental regulations aimed at reducing greenhouse gas emissions. This has led to a growing need for gas turbine services that can help operators meet these standards. For instance, the introduction of low-NOx combustion technologies has become essential for compliance. As a result, service providers are increasingly focusing on retrofitting and upgrading existing turbines to align with these regulations, thereby enhancing the overall market landscape for the Heavy Duty Gas Turbine Service Market.