Research Methodology on Hematology Diagnostics Market

Introduction

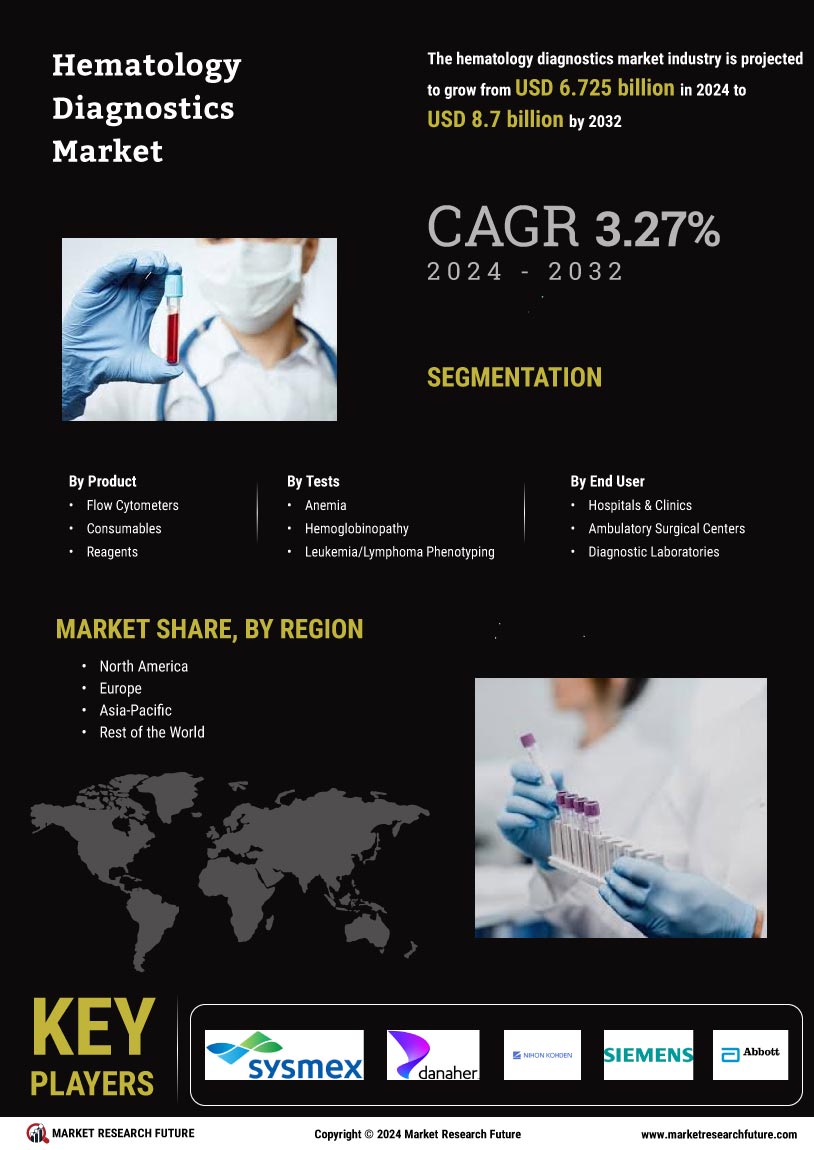

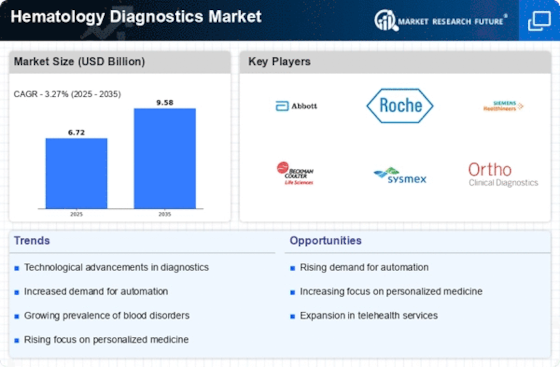

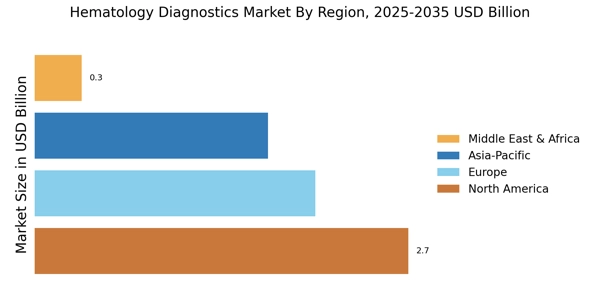

The global hematology diagnostics market is expected to witness substantial growth over the forecast period 2023 to 2030, owing to the increasing prevalence of infectious diseases and rising demand for automated hematology diagnostics methods. Hematology diagnostics comprises different tests and procedures for measuring and analyzing components of blood, such as red and white blood cells, platelets, and coagulation factors.

The report provides an in-depth analysis of this market and demonstrates the latest trends in the global hematology diagnostics market, as well as its application in various therapeutic and diagnostic applications. Additionally, the report also provides a brief overview of the market drivers, opportunities, and challenges related to the hematology diagnostics market.

Research approach and methodology

A detailed market research approach and methodology are employed to effectively understand the global hematology diagnostics market. This approach involves extensive primary and secondary research to gather data related to the global hematology diagnostics market. The primary research involves interviews and surveys with industry experts and other key stakeholders. As part of secondary research, published reports, journals, industry databases, and other online sources were studied.

Primary research

Our primary research is conducted to gain an in-depth understanding of the global hematology diagnostics market. The survey is conducted among different industry professionals such as doctors, market analysts, and senior industry personnel to gain insights into the current market scenario. Questionnaires were developed using open-ended and close-ended questionnaires which include questions related to factors such as market drivers, challenges, and industry trends.

Secondary Research

Extensive secondary research is carried out to understand the global hematology diagnostics market better. We sorted through a wide variety of sources such as annual reports, published papers, government reports, industry journals, and other online sources. The secondary research is also conducted to understand the competitive landscape of the market and to gain insight into the strategies adopted by the leading players in the market.

Data Collection

The data is collected from both primary and secondary sources. MRFR undertook comprehensive secondary research to understand the key trend in the market and to develop the base year estimations. Furthermore, MRFR also conducted a reverse engineering approach to authenticate the obtained data. After the data is collected, MRFR verified it against the various available sources including government statistics and industry reports.

Market Size Estimation

The market size is estimated with the help of top-down and bottom-up approaches. The bottom-up approach is adopted to estimate the market size by researching the independent market segments, while the top-down approach is used to analyze the entire market size from a global perspective. The top-down approach included an examination of the major trends and regulatory scenarios in the market.

Data Validation

The data is validated using both qualitative and quantitative methods. The quantitative validation technique included validation by market participants, utilizing their industry knowledge and understanding. Qualitative validation involves the validation of the collected data with key industry participants. The validation also helped to verify industry statistics obtained from primary and secondary research.

Data Synthesis

The collected data is sorted and analyzed using various data triangulation methods. This helped in deriving insights into the market. The data is synthesized through the use of software tools such as Microsoft Excel and Visual Basic.

Data Analysis

To gain an understanding of the global hematology diagnostics market, MRFR used both qualitative and quantitative analysis methods. The qualitative analysis method includes an in-depth analysis of the strategies adopted by the leading players in the market, while the quantitative analysis method is used to arrive at the market forecast. The data analysis is performed with the help of various tools such as Microsoft Excel and Visual Basic.

Conclusion

The report provides an in-depth analysis of the global hematology diagnostics market and its recent trends, application, drivers and opportunities. The report also provides a comprehensive analysis of the market size and key drivers. The report is based on a detailed research approach and methodology, which is conducted using both primary and secondary sources. Additionally, data triangulation and validation techniques were used to verify the accuracy of market information. We believe that the report provides a comprehensive understanding of the global hematology diagnostics market and its current trends.