Cost Containment Initiatives

Cost containment initiatives implemented by healthcare systems are a crucial driver for the Herceptin Biosimilar Market. As healthcare expenditures rise, payers and providers are increasingly seeking ways to reduce costs while maintaining quality care. Biosimilars, including those that mimic Herceptin, offer a viable solution by providing similar therapeutic benefits at a lower price point. Reports indicate that biosimilars can reduce treatment costs by up to 30% compared to their reference biologics. This financial incentive encourages healthcare providers to adopt biosimilars, thereby expanding their market presence. Additionally, government policies promoting the use of biosimilars further bolster this trend, as they aim to enhance patient access to essential medications. Consequently, the Herceptin Biosimilar Market is likely to thrive as cost containment becomes a priority for healthcare stakeholders.

Advancements in Biotechnology

Technological advancements in biotechnology are significantly influencing the Herceptin Biosimilar Market. Innovations in biomanufacturing processes and analytical techniques have enhanced the ability to develop high-quality biosimilars that closely mimic the reference product. These advancements not only improve the efficacy and safety profiles of biosimilars but also streamline the production process, potentially reducing costs. As a result, the market is witnessing an influx of new entrants aiming to capitalize on the growing demand for biosimilars. Furthermore, the increasing investment in research and development by pharmaceutical companies indicates a robust pipeline of biosimilar products. This trend suggests that the Herceptin Biosimilar Market will continue to expand, driven by the continuous evolution of biotechnological capabilities.

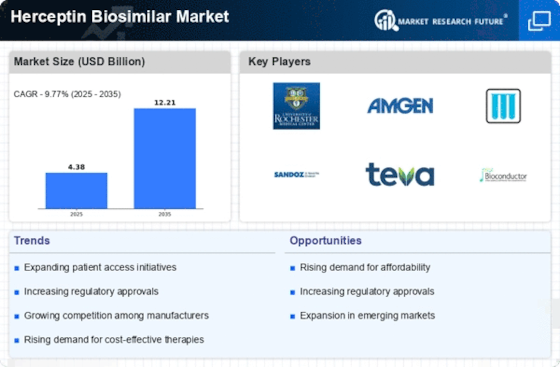

Regulatory Framework Enhancements

Enhancements in the regulatory framework surrounding biosimilars are fostering growth in the Herceptin Biosimilar Market. Regulatory agencies are increasingly streamlining the approval processes for biosimilars, which facilitates quicker market entry for these products. This shift is particularly evident in regions where regulatory bodies have established clear guidelines for the development and approval of biosimilars, thereby reducing uncertainty for manufacturers. The expedited approval pathways not only encourage innovation but also enhance competition within the market. As a result, the availability of Herceptin biosimilars is expected to increase, providing patients with more treatment options. This regulatory support is crucial for the sustainability of the Herceptin Biosimilar Market, as it aligns with the broader goal of improving patient access to affordable therapies.

Patient-Centric Treatment Approaches

The shift towards patient-centric treatment approaches is significantly impacting the Herceptin Biosimilar Market. As healthcare evolves, there is a growing emphasis on personalized medicine, which tailors treatment plans to individual patient needs. This trend is particularly relevant in oncology, where the effectiveness of therapies can vary based on genetic and molecular factors. Biosimilars, including those that replicate Herceptin, are increasingly recognized for their potential to provide effective treatment options that align with patient preferences and financial considerations. The focus on patient outcomes and satisfaction is driving healthcare providers to consider biosimilars as viable alternatives to reference biologics. Consequently, the Herceptin Biosimilar Market is likely to benefit from this paradigm shift, as more patients and providers embrace the advantages of biosimilar therapies.

Increasing Incidence of Breast Cancer

The rising incidence of breast cancer is a pivotal driver for the Herceptin Biosimilar Market. As breast cancer remains one of the most prevalent cancers worldwide, the demand for effective treatment options continues to escalate. According to recent statistics, breast cancer accounts for approximately 25% of all cancer cases in women. This alarming trend necessitates the availability of affordable biosimilar alternatives to Herceptin, which is a monoclonal antibody used in targeted therapy. The increasing patient population seeking treatment creates a substantial market opportunity for biosimilars, as healthcare systems strive to manage costs while ensuring access to essential therapies. Consequently, the Herceptin Biosimilar Market is poised for growth as stakeholders recognize the need for cost-effective solutions to address the rising burden of breast cancer.