Market Analysis

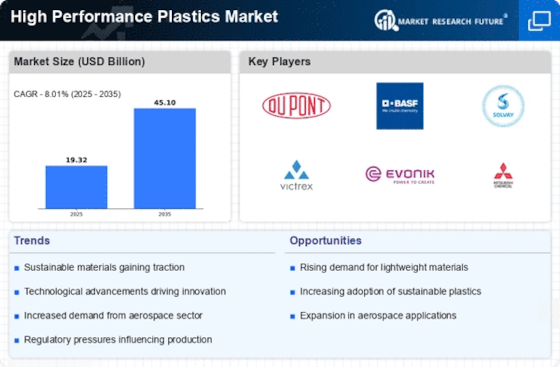

High Performance Plastics Market (Global, 2024)

Introduction

The High Performance Polymers Market is set to play a pivotal role in the industries, as the demand for the materials which can withstand extreme conditions and retain their performance properties. High performance polymers are being used in various industries, such as aviation, automobile, and electronics, where the requirement for lightweight and resistance to heat and chemicals is high. The continuous shift towards sustainable and efficient manufacturing is driving the market growth for high performance polymers. The industries are looking for the advanced materials to enhance the performance of their products and at the same time reduce the environmental impact. The innovation in the product design and functionality is driving the development of new high performance polymer formulations, which are able to meet the specific requirements of diverse applications. The high performance polymers market is dynamic and offers both challenges and opportunities to the market participants.

PESTLE Analysis

- Political

- High-performance plastics are influenced by many political factors in 2024, such as the government's policy on taxation and trade. The European Union's Green Deal, which aims to reduce carbon dioxide emissions by at least 55 per cent by 2030, has a major effect on the plastics industry. Also, the United States has set aside $1.2 billion for research into advanced materials, including high-performance plastics, as part of its plan to invest in infrastructure. This is expected to boost innovation and production in this field.

- Economic

- The economic environment for high-performance plastics in 2024 is characterized by the fluctuating cost of raw materials and the globalization of the supply chain. In 2024 the average price of crude oil, which is the main raw material for most plastics, is expected to be around seventy-five dollars per barrel, which directly affects the cost of production. The unemployment rate in the manufacturing sector is expected to be around 4.2%, indicating a stable labor market that will support the production capacity and the availability of labor in the high-performance plastics industry.

- Social

- In 2024, the prevailing social trends show a growing preference for sustainable and earth-friendly materials. According to a survey, about 70 per cent of consumers are willing to pay more for products made of sustainable materials, which has increased the demand for high-performance plastics that meet these criteria. Moreover, an increased awareness of the environment has given rise to educational programs. Over 1,000 universities around the world now offer courses in sustainable materials and engineering.

- Technological

- The market for high-performance plastics in 2024 is rapidly changing. Additive manufacturing methods such as 3D printing have been adopted by more than a quarter of the industry to manufacture complex plastic parts. In addition, research and development expenditures have risen to over $500 million, bringing innovations in polymer chemistry and processing. This has increased the performance and applications of high-performance plastics.

- Legal

- In 2024, the legal framework affecting the high-performance plastics market will include stricter regulations on the use of plastics and the management of waste. The EPA in the United States has recently introduced new reporting requirements for the use of certain chemicals in plastics, which will have a considerable impact on the costs of compliance. Also, the European Union's REACH regulation requires the registration of over 30,000 chemicals used in plastics, which will increase the risk of litigation and liability for manufacturers who do not comply with the regulations.

- Environmental

- In 2024, the environment becomes a growing concern for the high-performance plastics market. In a global move towards sustainable development, bioplastics are developed, and now constitute an estimated 15 per cent of the total market. And by 2024, the percentage of plastics that are recycled reaches 20 per cent, a result of both technological developments and a rise in the number of consumers taking part in the collection of plastics. Furthermore, companies are putting pressure on themselves to reduce their carbon footprint. Many have committed themselves to zero emissions by 2030, which has consequences for the way they produce and the materials they use.

Porter's Five Forces

- Threat of New Entrants

- High-performance plastics are subject to a moderate degree of competition because of the need for a large investment in production facilities and technology. New entrants can nevertheless find opportunities in niche markets or with new products. But the established brand loyalty and customer relationships of the existing companies are a barrier to new entrants.

- Bargaining Power of Suppliers

- The bargaining power of the suppliers in the high-performance plastics market is relatively low. There are many suppliers of raw materials, which leads to a highly competitive situation. Also, the possibility of buying from different suppliers is available to many companies in this market, which further reduces the power of suppliers. This dynamic situation enables the manufacturers to bargain for favorable terms and prices.

- Bargaining Power of Buyers

- High-Performance Plastics: High-Performance Plastics: High-Performance Plastics: High-Performance Polymers: High-Performance Polymers: High-Performance Polymers: High-Performance Polymers: Polyurethane, Polystyrene, PEEK, PEEK-Glass, PTFE, PTFE, PTFE, Polyurea, Polystyrene, Polystyrene, Polyimide, Polyurea, polystyrene, polyurea, polyurea, PTPET. The automobile and aircraft industries, as major purchasers, can, by their scale of purchase, obtain the lowest prices. The increasing demand for specialized products gives the buyer greater power in negotiations.

- Threat of Substitutes

- The threat of substitutes in the high-performance plastics market is moderate. The high-performance plastics have a unique set of properties that makes them superior to other materials, such as metals and ceramics. In the future, however, new materials could threaten the market, if they offer similar properties at lower prices.

- Competitive Rivalry

- The competition in the high-performance plastics market is fierce, and there are many players fighting for market share. To differentiate themselves, companies are constantly improving and innovating their products. The competition is further intensified by the presence of large companies with strong brand names and extensive distribution networks. There is also a lot of competition in terms of price, as companies try to win and retain customers.

SWOT Analysis

Strengths

- High durability and resistance to extreme temperatures and chemicals.

- Growing demand in aerospace, automotive, and medical sectors.

- Innovative manufacturing processes enhancing product performance.

Weaknesses

- High production costs compared to traditional plastics.

- Limited recycling options for certain high-performance plastics.

- Dependency on volatile raw material prices.

Opportunities

- Expansion into emerging markets with increasing industrialization.

- Development of bio-based high-performance plastics.

- Technological advancements leading to new applications and products.

Threats

- Intense competition from alternative materials and substitutes.

- Regulatory challenges regarding environmental impact and sustainability.

- Economic downturns affecting industrial demand.

Summary

High-Performance Plastics Market 2024 is characterized by its strengths of high strength, high demand in several industries, and high production costs and limited recyclability. Opportunities for growth lie in emerging markets and new materials, while competition and government regulations may have a significant impact on market dynamics. Strategically, the focus on sustainable development and technological development is key to achieving opportunities and reducing risks.

Leave a Comment