Market Trends

Introduction

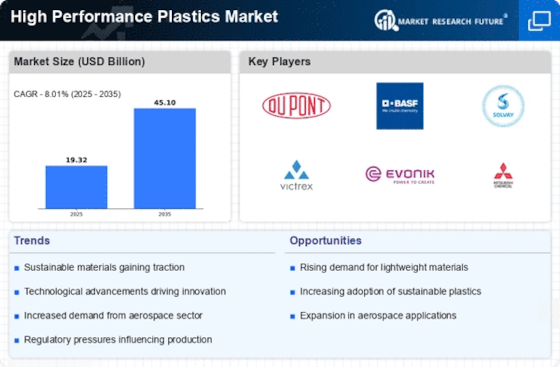

As we enter 2024, the high-performance plastics market is expected to see a significant evolution, mainly due to the confluence of macroeconomic factors such as rapid technological changes, tightening regulations, and changing consumer preferences. In addition, innovations in material science will allow the development of high-performance plastics that meet the requirements of a wide range of applications, from automobiles to electronics. In parallel, the growing regulatory pressure on the environment and on the sustainability of products will compel manufacturers to adopt eco-friendly practices and materials. Moreover, changing consumer habits, based on the need for greater performance and longer-lasting products, are reshaping the product ranges in this market. These trends are crucial for the actors in the high-performance plastics industry to understand. They not only influence their positioning, but also guide strategic investments and innovation paths in the high-performance plastics industry.

Top Trends

-

Sustainability Initiatives

The Green Deal of the European Union is a green economy initiative, and the aim is to replace all current plastics with green ones. Companies like BASF are investing in bio-based polymers, which are expected to reduce the carbon footprint by a great deal. This will also mean a demand for high-performance plastics that meet the strictest environmental standards. In the face of ever tightening regulations, businesses have to keep up or risk losing access to the market. In the future, this may well mean a greater emphasis on biodegradability and greater efficiency in the collection and treatment of waste. -

Advanced Manufacturing Techniques

The use of additive manufacturing or 3D printing is revolutionizing the manufacture of high-performance plastics. DuPont is exploiting this technology to make complex components that cannot be made by traditional methods. This trend is expected to lead to increased personalization of products and a reduction in waste in the manufacturing process. As manufacturing becomes more efficient, operating costs may fall, leading to a wider market. The next generation of technology will further integrate artificial intelligence and automation into production lines. -

Increased Demand in Aerospace and Automotive

High-performance polymers are increasingly being used in the aeronautical and automobile industries in order to reduce weight and thus improve fuel efficiency. For example, Toray Industries has developed a series of lightweight, high-strength composite materials that improve the performance of automobiles. The trend is to comply with increasingly stringent emissions regulations. As these industries evolve, the demand for such new materials will increase, thereby increasing R&D investment. The result will be greater safety and longer product life. -

Growth in Electronics Applications

High-performance plastics are indispensable to the electronics industry, because of their good electrical and thermal insulating properties. Companies like 3M develop advanced materials for use in semiconductors and printed circuit boards. The increasing miniaturization of these devices is expected to lead to an increase in demand for high-performance plastics. And as technology continues to develop, we may see innovations that increase the performance and reduce the cost of these plastics. And there is also the prospect of combining these materials with smart materials to make them more responsive. -

Regulatory Compliance and Safety Standards

The high-performance plastics market is influenced by stricter regulations on the safety and the environment of the materials used. For example, the Food and Drug Administration of the United States has recently issued new guidelines for food-grade polymers, which has prompted companies such as SABIC to develop new, safer materials. These regulations are essential for access to the market and for consumers’ trust. As these regulations develop, the companies must increase their R&D efforts. There may be a trend towards more transparent regulations and better testing procedures. -

Emergence of Smart Plastics

The development of smart plastics that react to the environment is gaining ground in various industries. For example, companies such as LG Chem are developing smart plastics that change their properties according to the environment, such as temperature and pressure. This is a trend that is mainly driven by the need for more flexible and diversified materials in the fields of health care and packaging. This trend is expected to spread as the technology develops, and it will bring about greater efficiencies and cost savings. It will also have a positive impact on the environment. -

Focus on Lightweighting Solutions

Lightweighting is a major trend in industries such as the automobile and aeronautical industries, where a reduction in weight can lead to significant savings in fuel. This has given rise to a great deal of research into the development of lightweight materials, and the most important of these is composites. The need to improve energy efficiency and reduce emissions is the driving force behind this development. As industries increasingly turn their attention to the issue of sustainable development, the demand for lightweight, high-performance plastics is expected to grow. In future, the trend may well be towards further improvement in the strength-to-weight ratio. -

Integration of Circular Economy Principles

The circular economy is influencing the high-performance plastics market. The main focus is on the re-use and re-cycling of materials. For example, Eastman has developed a process to convert high-quality plastics into raw materials for new high-performance plastics. It is driven by the trend for sustainable products and practices and by the demands of the regulators. Companies may benefit from lower raw material costs and greater customer loyalty as the circular economy takes hold. There is a trend towards closed-loop systems in production. -

Technological Advancements in Material Properties

The development of new plastics with higher properties is a result of research into material science. Solvay has developed new formulations which meet the requirements of the most demanding industrial applications. This trend is essential to meet the ever-changing requirements of sectors such as aeronautics and health care. The technical progress of the company may also bring about improvements in operating efficiency, which may lead to a reduction in costs. Progress may be aimed at the creation of materials with multiple properties. -

Collaborative Innovation and Partnerships

A strong collaboration between industry, research institutes and governments is driving the development of high-performance plastics. For example, Teijin has formed a close alliance with automobile manufacturers to develop advanced composite materials. This trend is essential to the sharing of knowledge and resources that will help speed up the development of new products. Competition is becoming more intense. In the future, this trend towards closer cooperation may become more common. There may be a greater tendency to establish innovation centres and to fund joint ventures.

Conclusion: Navigating High Performance Plastics Dynamics

The High Performance Plastics Market in 2024 will be characterized by intense competition and significant fragmentation. Both established and new players will compete to win market share. The regional trend is a growing demand in Asia-Pacific and North America, which is driving the strategies of the vendors. The established companies are using their supply chains and customer loyalty to win over the mass market, while new entrants are focusing on innovation and sustainability to capture the niche markets. In order to succeed, vendors will need to integrate advanced features such as automation, artificial intelligence, and flexibility. The companies that make sustainable choices will be able to distinguish themselves from the competition. They will have to make long-term strategic investments in these areas.

Leave a Comment