The high temperature-resistant wire market continues to grow due to major players investing heavily in R&D to expand their product offerings. Market participants also participate in several strategic initiatives to strengthen their footprint. The industry has seen significant development with the launch of new goods, agreements, mergers and acquisitions, higher investment, and collaboration with other companies. For the high-temperature-resistant wire industry to expand and prosper in a market that is becoming more competitive and expanding, it must offer reasonably priced products.

Manufacturing locally to save operational costs is one of the main business tactics manufacturers adopt in the worldwide high-temperature resistant wire industry to support clients and expand the market sector. The high-temperature-resistant wire industry has brought about some of the greatest medical advances in recent years.

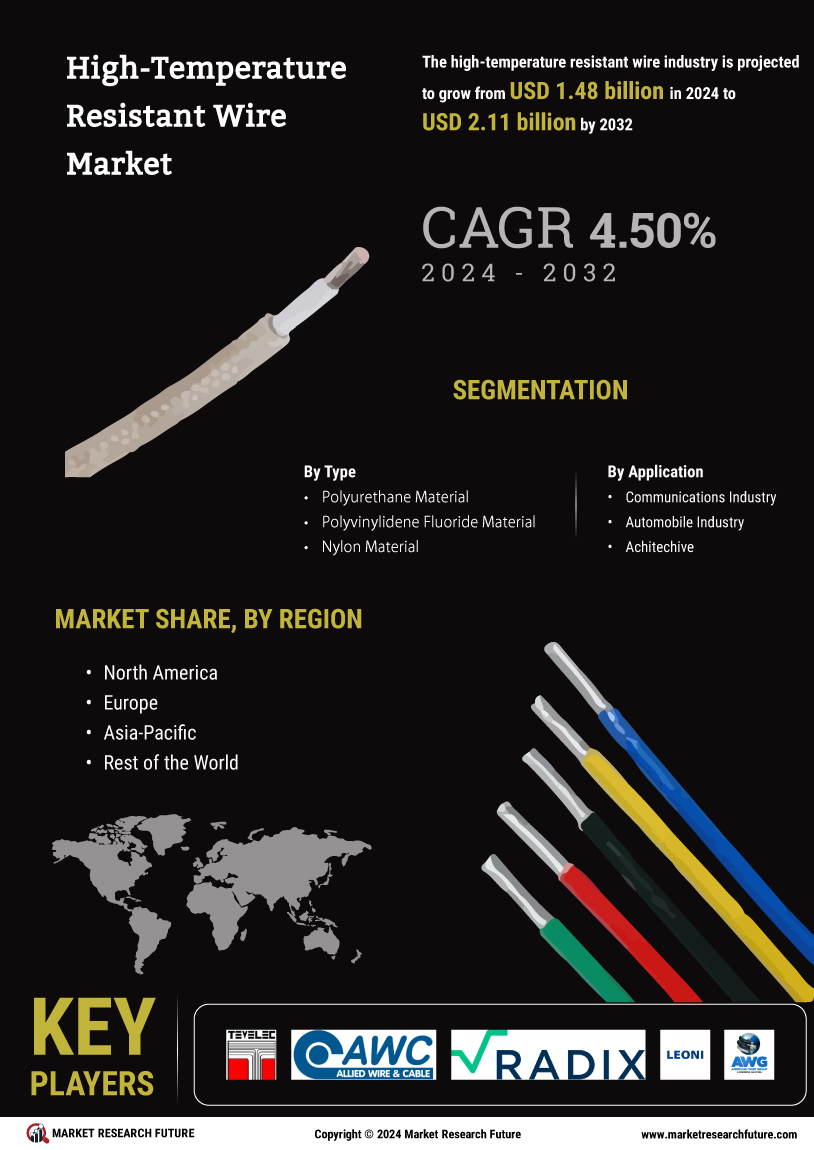

Major players in the high-temperature resistant wire market, including Tevelec Limited, Good Gi, Allied Wire and Cable, Radix, LEONI, American Wire Group, Dacon Systems, Totoku Electric, Anixter, SAB Cable, Cole Wire, LAPP, Reach Electrical, Heatsense, Polyexcel, New England Wire Technologies Corp, Zhejiang Wrlong High-Temperature Wire and Cable, and others, are attempting to increase market demand by investing in research and development operations.

Leoni AG develops, produces, and sells Cables and wiring systems. It provides wires and strands, optical fibers, standard and special cables, hybrid and optical cables, special vehicles, cable systems, cable harnesses, and related parts. Customers in the automotive, agricultural, telecommunications, medical technology, capital goods, energy and infrastructure, home appliances, and electrical appliances industries can purchase products, solutions, and services from it for energy and data management. Additionally, the company is focused on developing solutions related to electromobility and autonomous driving. Leoni AG announced in March 2023 that its new line of fire-resistant cables would be available in Europe.

The range is appropriate for many applications, such as railway and transportation systems, and is made to adhere to the most recent safety regulations.

The top manufacturer and supplier of wire and cable, hardware, equipment, and accessory solutions is American Wire Group (AWG). Their reputation has been built by providing outstanding customer service, producing products of the highest caliber, and making sure deliveries are made on schedule. Four regional distribution centers in Pennsylvania, California, Texas, and Florida have increased their reach to accommodate the rapidly growing demand in the utility and renewable energy markets. They keep a large stock of products used in the battery energy storage, solar, wind, power T&D, substation, and electric vehicle infrastructure markets.

AWG introduced its enlarged range of Kapton-insulated aeronautical wires in January 2022. These met the strict criteria of aerospace applications for chemical compatibility, abrasion resistance, and high-temperature tolerance and included MTW and ETFE-jacketed variants that the UL approved.

Leave a Comment