Increased Focus on Patient-Centric Care

The Home Health Software Market is witnessing a shift towards patient-centric care, which emphasizes the importance of tailoring healthcare services to meet individual patient needs. This trend is driven by a growing recognition of the value of personalized care in improving health outcomes. Home health software solutions are increasingly being designed to support this approach, offering features that enable healthcare providers to customize care plans and engage patients in their treatment processes. As healthcare organizations strive to enhance patient satisfaction and outcomes, the demand for innovative home health software solutions is expected to rise, further propelling the growth of the Home Health Software Market.

Technological Advancements in Healthcare

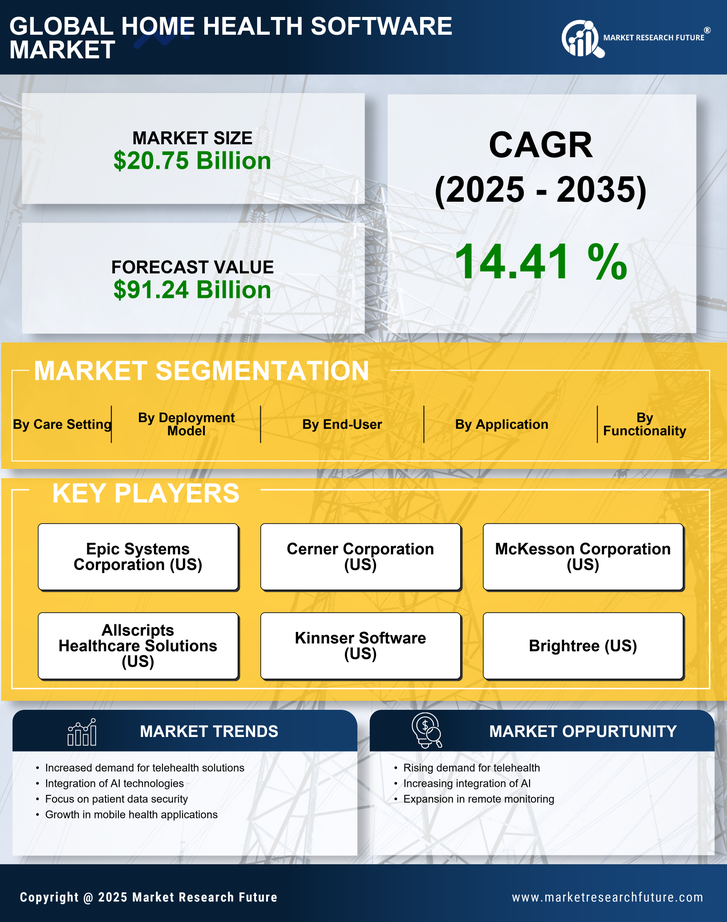

Technological advancements are playing a pivotal role in shaping the Home Health Software Market. Innovations such as mobile health applications, wearable devices, and remote monitoring tools are transforming how healthcare is delivered at home. These technologies enable healthcare providers to monitor patients' health in real-time, ensuring timely interventions and reducing hospital readmissions. The integration of these advanced technologies into home health software solutions is expected to enhance patient engagement and satisfaction. Furthermore, the global market for telehealth is anticipated to reach USD 459.8 billion by 2030, indicating a robust growth trajectory that will likely benefit the Home Health Software Market as providers increasingly adopt these solutions.

Cost Efficiency and Resource Optimization

Cost efficiency and resource optimization are critical factors influencing the Home Health Software Market. Healthcare providers are under constant pressure to reduce operational costs while maintaining high-quality care. Home health software solutions offer tools that streamline administrative tasks, improve scheduling, and enhance communication among care teams. By optimizing resource allocation and minimizing waste, these solutions can lead to significant cost savings for healthcare organizations. As the emphasis on financial sustainability continues to grow, the adoption of home health software is likely to increase, driving the expansion of the Home Health Software Market.

Rising Demand for Home Healthcare Services

The Home Health Software Market is experiencing a notable surge in demand for home healthcare services. This trend is largely driven by an aging population that requires ongoing medical care and assistance. According to recent statistics, the number of individuals aged 65 and older is projected to reach 1.5 billion by 2050, which indicates a substantial increase in the need for home health services. As a result, healthcare providers are increasingly adopting home health software solutions to streamline operations, enhance patient care, and improve overall service delivery. This growing demand is likely to propel the Home Health Software Market forward, as organizations seek to meet the needs of this expanding demographic.

Regulatory Support for Home Health Services

Regulatory support is emerging as a significant driver for the Home Health Software Market. Governments and regulatory bodies are increasingly recognizing the importance of home healthcare services, leading to the establishment of favorable policies and reimbursement models. For instance, initiatives aimed at promoting home health services can enhance access to care and improve patient outcomes. This regulatory backing encourages healthcare organizations to invest in home health software solutions that comply with new standards and facilitate efficient service delivery. As a result, the Home Health Software Market is likely to witness accelerated growth, as providers align their operations with evolving regulatory frameworks.