Top Industry Leaders in the Honeycomb Packaging Market

Honeycomb packaging, with its lightweight yet robust structure, is rapidly making waves in the packaging industry. This eco-friendly alternative to traditional materials like plastic and corrugated cardboard is attracting brands across diverse sectors, from food and beverage to automotive and electronics. To thrive in this dynamic market, players are adopting a range of strategies and focusing on key factors to gain market share.

Honeycomb packaging, with its lightweight yet robust structure, is rapidly making waves in the packaging industry. This eco-friendly alternative to traditional materials like plastic and corrugated cardboard is attracting brands across diverse sectors, from food and beverage to automotive and electronics. To thrive in this dynamic market, players are adopting a range of strategies and focusing on key factors to gain market share.

Strategies Shaping the Honeycomb Packaging Arena:

1. Product Differentiation: Companies are constantly innovating to stand out. This includes developing honeycomb cores from alternative materials like recycled paper or bioplastics, offering customized designs for specific applications, and integrating features like temperature control or anti-microbial properties. Sonoco Products, for instance, recently launched its EcoCor® honeycomb panels made from 100% recycled paper, catering to the growing demand for sustainable packaging solutions.

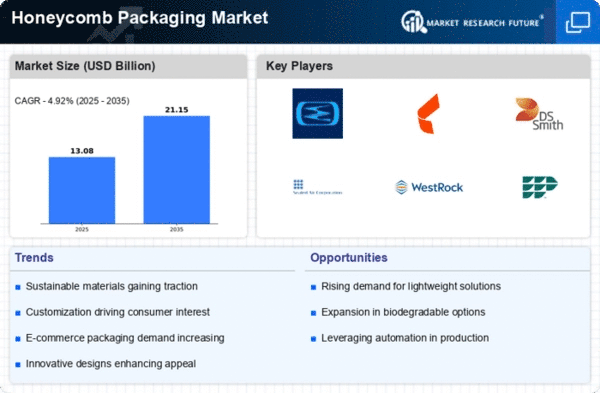

2. Geographical Expansion: With the global honeycomb packaging market expected to reach $5.2 billion by 2030, establishing a strong international presence is crucial. Leading players like Smurfit Kappa and WestRock Company are actively acquiring and partnering with regional players to expand their reach and cater to local needs. In September 2023, DS Smith acquired an American honeycomb core producer, expanding its footprint in the lucrative US market.

3. Vertical Integration: To gain greater control over production costs and quality, some players are integrating backward into core material production. Sealed Air, a major player, invested in a new paper honeycomb core production facility in 2023, aiming to improve efficiency and competitiveness.

4. Technology Adoption: Automation and digitalization are playing a key role in optimizing production processes and maximizing efficiency. Companies like ACH Foam Technologies are investing in automated cutting and assembly systems, while Lsquare Eco-Products leverages data analytics to optimize core designs and minimize material waste.

Factors Influencing Honeycomb Packaging Market Share:

1. Sustainability: The rising focus on eco-friendly packaging solutions is a major driver for honeycomb cores. Their lightweight nature translates to reduced fuel consumption during transportation, and their recyclability or biodegradability aligns with brands' sustainability goals. In October 2023, Huhtamaki Group announced its commitment to using 100% recyclable materials in its packaging by 2030, further boosting the demand for honeycomb solutions.

2. Performance: Honeycomb cores offer superior strength-to-weight ratio, excellent cushioning properties, and improved thermal insulation compared to traditional materials. This makes them ideal for protecting fragile goods during transport and storage. In August 2023, BASF introduced a new high-performance honeycomb core specifically designed for the demanding automotive industry.

3. Cost-Effectiveness: While upfront costs might be higher, honeycomb packaging can deliver long-term savings through reduced product damage, optimized logistics, and potential material cost reductions. As production volumes increase and technology advances, honeycomb cores are becoming increasingly cost-competitive.

Key Players

- ACH Foam Technologies (U.S)

- Smurfit Kappa Group Plc (Ireland)

- HUHTAMAKI GROUP (Mexico)

- DS Smith PIc (U.K)

- Packaging Corporation of America (U.S)

- Sonoco Products Company (U.S)

- BASF SE (Germany)

- square Eco-Products Pvt.Ltd. (India)

- Sealed Air Corporation (U.S)

- WestRock Company (U.S)

Recent Developments :

In May 2022, ALDO Naratama Tbk (ALDO) introduced a green product equivalent for Hexcel Wrap, Indonesia's first plastic bubble wrap. This product is intended to reduce the amount of plastic waste generated by e-commerce enterprises. Hexcel Wrap is a sustainable product and an alternative to bubble wrap in the shape of a honeycomb structure composed of recycled paper used as a protection option in packaging goods shipments, particularly for the e-commerce business.

In September 2021, Ajit Industries Private Limited (AIPL), one of India's top industrial tape makers, has introduced Self Adhesive Kraft Paper Tape and Honeycomb Paper. These environmentally friendly and sustainable packaging alternatives are being developed to eliminate plastic waste in secondary packaging. The company intends to employ these sustainable and biodegradable alternatives to replace non-biodegradable plastic used in secondary packaging.

In March 2022, Antalis Packaging created an easy-to-recycle honeycomb cell design that can be a viable alternative to timber shipping crates, providing greater protection for a corporation that required sustainable crates for the international shipment of big, fragile commodities. A custom-built shipping box constructed of PALLITE, a lightweight, paper-based material reinforced with a 25mm honeycomb cell design, is part of the solution.