Market Analysis

In-depth Analysis of Hormonal Implants Market Industry Landscape

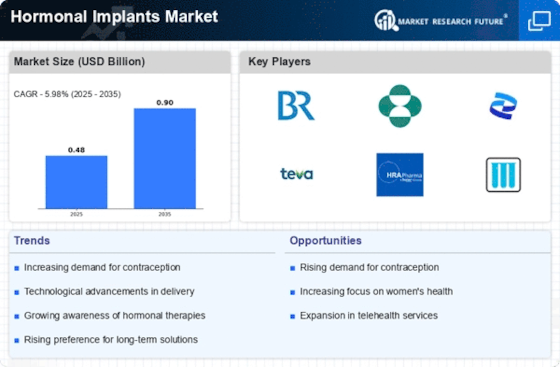

The hormonal implants market addresses a critical fragment inside the healthcare business, offering long-acting and reversible preventative options, hormone replacement therapy, and other clinical applications. Market elements in this area are formed by variables, for example, developing prophylactic inclinations, progressions in embed innovation, and the expanding extent of hormonal treatments. The rise of long-acting reversible contraception (LARC) methods, including hormonal implants, impacts market elements. The comfort and viability of hormonal implants, which can give preventative security to quite a long while, add to their occurrence in family planning. Market elements are essentially affected by persistent progressions in hormonal embed innovation. Developments in embed plan, materials, and medication conveyance frameworks upgrade adequacy, decrease aftereffects, and further develop the general client experience, driving market growth. An elevated spotlight on ladies' health and strengthening impacts market elements. Hormonal implants, furnishing ladies with more noteworthy command over family planning and hormonal guideline, line up with more extensive healthcare patterns stressing individualized and patient-driven care. Awareness and training drives about preventative options and hormonal treatments influence market elements. As data about the advantages, comfort, and dependability of hormonal implants becomes more open, buyers are better educated, affecting their decisions and demand for these items. The expanding extent of hormonal implants past contraception to incorporate hormone replacement therapy (HRT) for menopausal side effects impacts market elements. Hormonal implants offer a sustained and controlled influx of hormones, tending to the requirements of people going through HRT, impacting market growth. Economic circumstances, including healthcare spending and moderateness, influence market elements. The economic practicality of hormonal implants as a smart, long-term preventative choice impacts reception rates and market patterns, especially in areas with shifting economic circumstances.

Leave a Comment