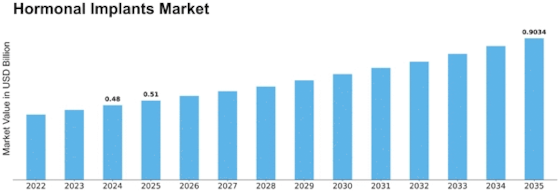

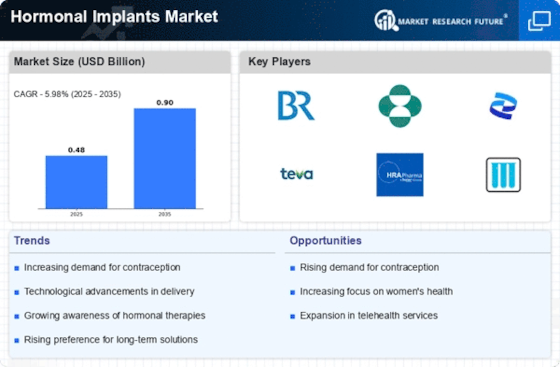

Hormonal Implants Size

Hormonal Implants Market Growth Projections and Opportunities

The hormonal implants market is affected by the rising commonness of hormonal problems like hormonal imbalance nature, menopausal side effects, and hormonal contraceptives. As the occurrence of these conditions rises worldwide, there is an equal expansion in the demand for hormonal implants as compelling and long-enduring helpful options. The market is driven by the expanding uses of hormonal implants in contraception. Long-acting reversible contraceptives (LARCs), including hormonal implants, offer a helpful and profoundly compelling conception prevention choice, impacting market elements and meeting the developing inclinations of women looking for dependable contraception. The pattern towards long-acting treatments in healthcare impacts the hormonal implants market. Patients and healthcare suppliers progressively favor treatment options that proposition prolonged viability and diminish the requirement for incessant interventions, adding to the demand for hormonal implants. The rising support of ladies in the labor force impacts the demand for advantageous and solid prophylactic options. Hormonal implants, offering long-enduring contraception without the requirement for daily consideration, line up with the necessities of working ladies, impacting market growth. Changing segment patterns, including deferred family planning and a maturing populace, influence the hormonal implants market. More experienced people looking for hormonal treatments for menopausal side effects and deferred family planning add to the expanding segment reach of hormonal embed applications. The globalization of healthcare and further developed admittance to healthcare administrations influence the hormonal implants market. Expanded availability of hormonal embed options in different districts tends to the healthcare needs of a more extensive population, adding to market development.

Leave a Comment