Rise of Mobile Solutions

The rise of mobile solutions represents a significant driver within the Hospitality Point of Sale Software Market. With the increasing prevalence of smartphones and tablets, many hospitality businesses are adopting mobile POS systems to enhance service delivery. These mobile solutions allow staff to take orders and process payments directly at the table, reducing wait times and improving customer satisfaction. According to recent estimates, mobile POS systems are expected to account for over 30% of the total POS market share by 2026. This shift towards mobility not only facilitates faster transactions but also provides valuable data collection opportunities, enabling businesses to analyze customer behavior and preferences more effectively. As a result, the demand for mobile-enabled POS solutions continues to rise, reflecting a broader trend towards convenience and efficiency in the hospitality sector.

Integration of Advanced Technologies

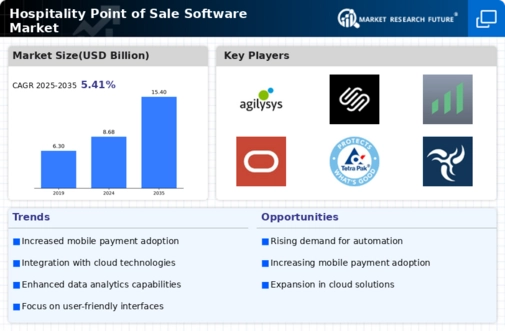

The integration of advanced technologies is a pivotal driver in the Hospitality Point of Sale Software Market. As establishments increasingly adopt artificial intelligence, machine learning, and cloud computing, the efficiency and functionality of POS systems are enhanced. For instance, AI-driven analytics can provide insights into customer preferences, enabling personalized service. The market for hospitality POS software is projected to grow at a compound annual growth rate of approximately 10% over the next five years, driven by these technological advancements. Furthermore, the ability to integrate with other systems, such as inventory management and customer relationship management, is becoming essential. This interconnectedness not only streamlines operations but also improves the overall customer experience, making it a critical factor for businesses aiming to remain competitive.

Focus on Data Security and Compliance

A heightened focus on data security and compliance is increasingly shaping the Hospitality Point of Sale Software Market. As cyber threats become more sophisticated, hospitality businesses are prioritizing the protection of sensitive customer information. Compliance with regulations such as the Payment Card Industry Data Security Standard (PCI DSS) is essential for maintaining customer trust and avoiding potential penalties. The market is witnessing a surge in demand for POS systems that incorporate robust security features, including encryption and tokenization. It is estimated that the global market for security-focused POS solutions will grow by approximately 15% annually over the next few years. This emphasis on security not only safeguards customer data but also enhances the overall reputation of hospitality businesses, making it a crucial driver in the competitive landscape.

Growing Demand for Contactless Payments

The growing demand for contactless payments is a notable driver in the Hospitality Point of Sale Software Market. As consumers increasingly prefer the convenience and speed of contactless transactions, hospitality businesses are adapting their POS systems to accommodate this trend. The adoption of Near Field Communication (NFC) technology allows customers to make payments using their smartphones or contactless cards, streamlining the checkout process. Recent data indicates that contactless payment transactions are expected to surpass 50% of all card transactions by 2026. This shift not only enhances customer satisfaction but also reduces the risk of cash handling, which can be a significant concern for businesses. Consequently, the integration of contactless payment options into POS systems is becoming a standard expectation, driving growth in the hospitality POS software market.

Emphasis on Customer Experience Enhancement

An emphasis on customer experience enhancement is a critical driver in the Hospitality Point of Sale Software Market. As competition intensifies, hospitality businesses are increasingly recognizing the importance of delivering exceptional customer experiences. POS systems that offer features such as loyalty programs, personalized promotions, and real-time feedback mechanisms are becoming essential tools for engaging customers. Research suggests that businesses that prioritize customer experience can achieve revenue growth rates of up to 5-10% higher than their competitors. By leveraging data analytics, hospitality establishments can tailor their offerings to meet the specific needs and preferences of their clientele. This focus on enhancing customer interactions not only fosters loyalty but also drives repeat business, making it a vital consideration for the ongoing evolution of POS software in the hospitality sector.