Regulatory Compliance

The evolving regulatory landscape surrounding chemical safety and environmental protection is a crucial driver for the Hybrid Non-Isocyanate Polyurethanes Market. Governments and regulatory bodies are increasingly imposing stringent regulations on the use of hazardous substances, including traditional polyurethanes that contain isocyanates. This regulatory pressure is pushing manufacturers to seek alternatives that comply with safety standards while maintaining performance. The market for hybrid non-isocyanate polyurethanes is projected to grow as companies adapt to these regulations, with estimates indicating a potential increase in market size by 15% over the next few years. This shift not only enhances product safety but also opens new avenues for innovation in formulation and application.

Technological Innovations

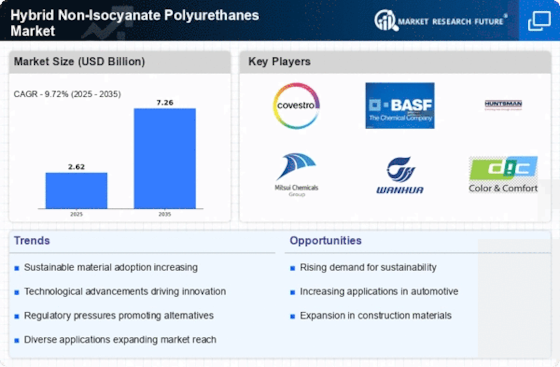

Technological advancements in the production and formulation of hybrid non-isocyanate polyurethanes are likely to propel the Hybrid Non-Isocyanate Polyurethanes Market forward. Innovations in polymer chemistry and processing techniques have enabled the development of products with superior performance characteristics, such as enhanced durability and flexibility. For instance, the integration of bio-based polyols has shown promising results in improving the mechanical properties of these materials. Market data suggests that the segment of hybrid non-isocyanate polyurethanes is expected to witness a compound annual growth rate of around 7% over the next five years, driven by these technological breakthroughs. As manufacturers continue to refine their processes, the potential for new applications in coatings, adhesives, and sealants expands significantly.

Sustainability Initiatives

The increasing emphasis on sustainability within various industries appears to be a primary driver for the Hybrid Non-Isocyanate Polyurethanes Market. As companies strive to reduce their environmental footprint, the demand for eco-friendly materials has surged. Hybrid non-isocyanate polyurethanes, which are derived from renewable resources and do not contain harmful isocyanates, align well with these sustainability goals. This shift is reflected in market data, indicating a projected growth rate of approximately 8% annually in the adoption of sustainable materials. Consequently, manufacturers are increasingly investing in research and development to enhance the properties of these polyurethanes, thereby expanding their applications across sectors such as automotive, construction, and consumer goods.

Consumer Awareness and Preferences

Consumer awareness regarding the environmental impact of products is shaping the Hybrid Non-Isocyanate Polyurethanes Market. As consumers become more informed about the benefits of sustainable materials, their preferences are shifting towards products that are eco-friendly and safe. This trend is particularly evident in the consumer goods sector, where brands are increasingly marketing their use of hybrid non-isocyanate polyurethanes as a selling point. Market data suggests that products labeled as sustainable can command a premium price, indicating a willingness among consumers to invest in environmentally responsible options. This growing consumer preference is likely to drive manufacturers to innovate and expand their offerings in the hybrid non-isocyanate polyurethanes market.

Growing Demand in End-Use Industries

The rising demand for hybrid non-isocyanate polyurethanes in various end-use industries is a significant driver for the Hybrid Non-Isocyanate Polyurethanes Market. Sectors such as automotive, construction, and furniture are increasingly adopting these materials due to their favorable properties, including resistance to abrasion and chemical exposure. For example, in the automotive industry, the need for lightweight and durable materials is driving the adoption of hybrid non-isocyanate polyurethanes in interior and exterior applications. Market analysis indicates that the automotive segment alone could account for over 30% of the total market share by 2026, reflecting the growing reliance on these innovative materials to meet industry demands.