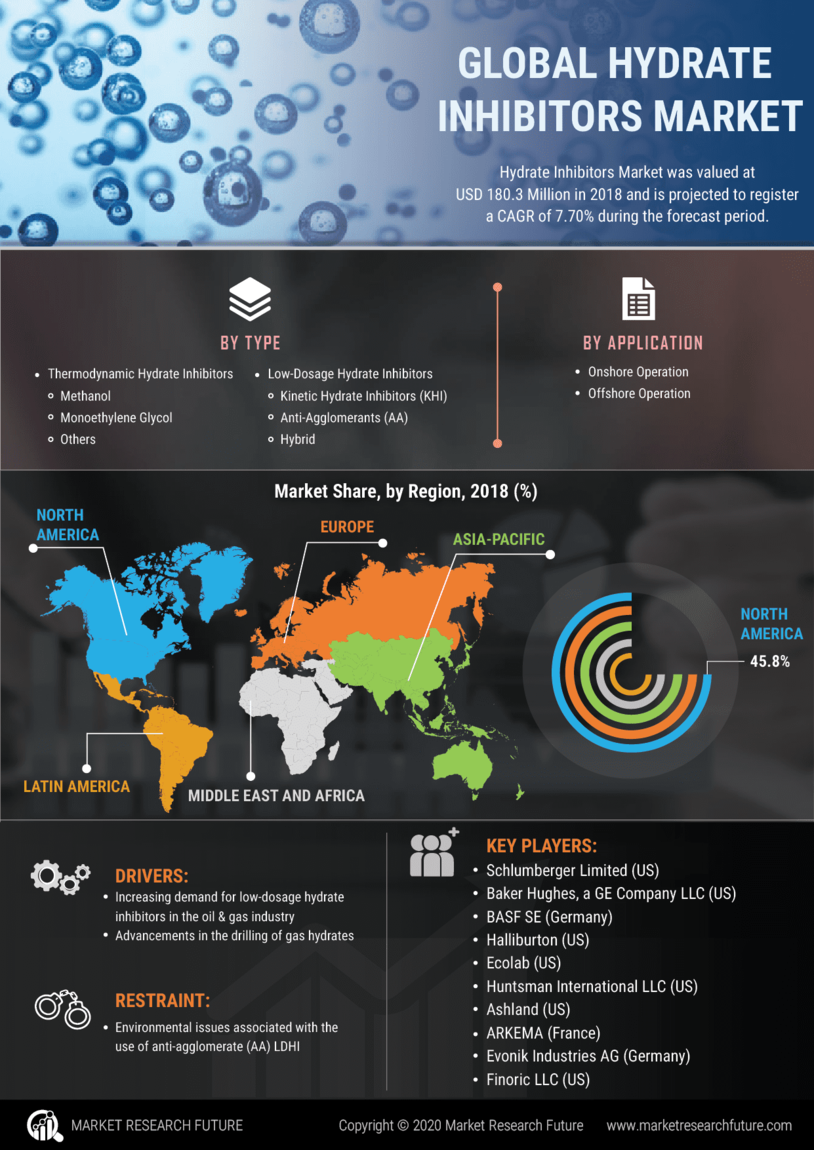

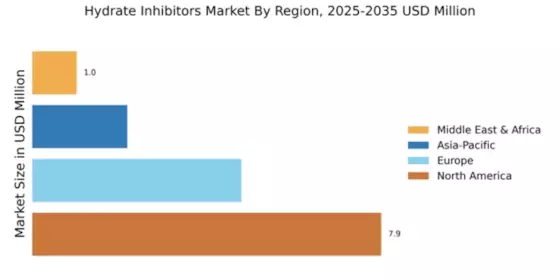

North America : Market Leader in Hydrate Inhibitors

North America is poised to maintain its leadership in the hydrate inhibitors market, holding a significant share of 7.86 in 2024. The region's growth is driven by increasing offshore oil and gas exploration activities, stringent regulations promoting safety, and technological advancements in hydrate management. The demand for effective hydrate inhibitors is further fueled by the need for enhanced production efficiency and reduced operational costs.

The United States stands out as the leading country in this sector, with major players like Halliburton Company, Schlumberger Limited, and Baker Hughes Company driving innovation and competition. The presence of key companies such as BASF SE and Ecolab Inc. enhances the competitive landscape, ensuring a robust supply chain and advanced product offerings. This dynamic environment positions North America as a critical hub for hydrate inhibitor solutions.

Europe : Emerging Market with Growth Potential

Europe's hydrate inhibitors market is on a growth trajectory, with a market size of 4.71. The region benefits from increasing investments in renewable energy and stringent environmental regulations that necessitate the use of effective hydrate management solutions. The demand for hydrate inhibitors is also driven by the need to optimize production in aging oil fields and enhance safety measures in offshore operations.

Leading countries such as the UK, Germany, and Norway are at the forefront of this market, supported by key players like Clariant AG and BASF SE. The competitive landscape is characterized by a mix of established companies and innovative startups, fostering a dynamic environment for product development. The European market is expected to see continued growth as companies adapt to regulatory changes and technological advancements.

Asia-Pacific : Emerging Powerhouse in Hydrate Solutions

The Asia-Pacific region is emerging as a significant player in the hydrate inhibitors market, with a market size of 2.14. The growth is primarily driven by increasing offshore exploration activities and the rising demand for energy in countries like China and India. Regulatory frameworks promoting safety and environmental sustainability are also contributing to the demand for effective hydrate management solutions in the region.

Countries such as China, Australia, and India are leading the charge, with a growing presence of key players like Halliburton Company and Schlumberger Limited. The competitive landscape is evolving, with both local and international companies vying for market share. As the region continues to invest in energy infrastructure, the demand for hydrate inhibitors is expected to rise significantly, positioning Asia-Pacific as a vital market for future growth.

Middle East and Africa : Resource-Rich Frontier for Hydrate Inhibitors

The Middle East and Africa region, with a market size of 1.0, is recognized as a resource-rich frontier for hydrate inhibitors. The growth in this region is driven by the increasing exploration and production activities in oil-rich countries, alongside the need for effective hydrate management solutions to ensure operational efficiency. Regulatory initiatives aimed at enhancing safety and environmental standards are also catalyzing market growth.

Countries like Saudi Arabia, UAE, and Nigeria are leading the market, supported by key players such as Baker Hughes Company and Ecolab Inc. The competitive landscape is characterized by a mix of established firms and emerging players, fostering innovation and collaboration. As the region continues to develop its energy sector, the demand for hydrate inhibitors is expected to grow, making it a key area for investment and development.