The enterprise video market in India is currently characterized by a dynamic competitive landscape, driven by rapid technological advancements and an increasing demand for digital communication solutions. Major players such as Microsoft (US), Cisco (US), and Zoom (US) are strategically positioning themselves to capitalize on this growth. Microsoft (US) focuses on integrating its video solutions with its broader suite of productivity tools, enhancing user experience and collaboration. Cisco (US), on the other hand, emphasizes security and scalability in its offerings, catering to enterprises with stringent compliance requirements. Zoom (US) continues to innovate its platform, expanding features that enhance user engagement and interactivity, thereby solidifying its market presence. Collectively, these strategies contribute to a competitive environment that is increasingly centered around innovation and user-centric solutions.

In terms of business tactics, companies are increasingly localizing their operations to better serve the Indian market. This includes optimizing supply chains and establishing regional partnerships to enhance service delivery. The market structure appears moderately fragmented, with several key players vying for dominance. However, the influence of major companies is substantial, as they set industry standards and drive technological advancements that smaller players often follow.

In September 2025, Microsoft (US) announced the launch of a new AI-driven feature within its Teams platform, aimed at enhancing virtual collaboration. This strategic move not only reinforces Microsoft’s commitment to innovation but also positions it as a leader in integrating AI into enterprise video solutions. The introduction of such features is likely to attract more enterprises seeking advanced collaboration tools, thereby expanding Microsoft’s market share.

In October 2025, Cisco (US) unveiled a new security framework designed specifically for its Webex platform, addressing growing concerns over data privacy in video communications. This initiative underscores Cisco’s focus on security, which is increasingly becoming a critical factor for enterprises when selecting video solutions. By prioritizing security, Cisco may enhance its appeal to organizations that require robust compliance measures, potentially increasing its customer base.

In August 2025, Zoom (US) expanded its partnership with various educational institutions to provide tailored video solutions for remote learning. This strategic alliance not only broadens Zoom’s market reach but also demonstrates its adaptability to different sectors. By catering to the educational sector, Zoom is likely to strengthen its brand loyalty and establish long-term relationships with institutions, which could lead to sustained revenue growth.

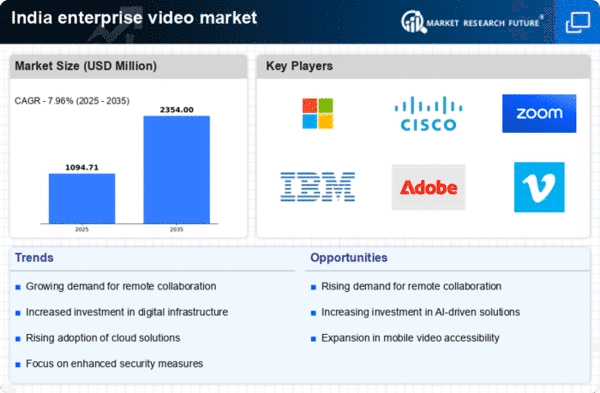

As of November 2025, the enterprise video market is witnessing trends such as digitalization, AI integration, and a growing emphasis on sustainability. Strategic alliances are increasingly shaping the competitive landscape, allowing companies to leverage each other's strengths. Looking ahead, competitive differentiation is expected to evolve, with a shift from price-based competition to a focus on innovation, technology, and supply chain reliability. This transition may redefine how companies position themselves in the market, emphasizing the importance of delivering unique value propositions to customers.

Leave a Comment