Government Initiatives and Funding

Government support plays a pivotal role in the growth of the genetic testing market. Various initiatives aimed at enhancing healthcare infrastructure and funding for genetic research are being implemented. The Indian government has allocated substantial resources to promote genetic testing, particularly in rural areas where access to healthcare is limited. This funding is likely to facilitate the establishment of more testing facilities and increase public awareness about the benefits of genetic testing. As a result, the genetic testing market is anticipated to experience a surge in demand, driven by improved accessibility and affordability of testing services.

Advancements in Genetic Technologies

Technological innovations in genetic testing methodologies are significantly influencing the genetic testing market. The introduction of next-generation sequencing (NGS) and CRISPR technology has revolutionized the accuracy and efficiency of genetic tests. These advancements allow for comprehensive genomic analysis, which is essential for personalized medicine. In India, the cost of genetic testing has decreased by nearly 30% due to these technological improvements, making it more accessible to the general population. As laboratories adopt these cutting-edge technologies, the genetic testing market is expected to expand, catering to a broader demographic and enhancing diagnostic capabilities.

Rising Prevalence of Genetic Disorders

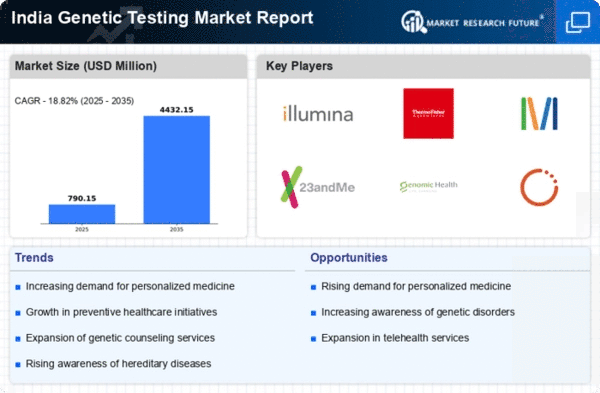

The increasing incidence of genetic disorders in India is a crucial driver for the genetic testing market. With an estimated 6-8 million people affected by genetic conditions, the demand for early diagnosis and intervention is growing. Genetic testing enables healthcare providers to identify hereditary diseases, allowing for timely treatment and management. This trend is further supported by the Indian government's initiatives to promote genetic research and healthcare accessibility. As awareness of genetic disorders rises, more individuals seek testing, thereby expanding the market. The genetic testing market is expected to grow at a CAGR of approximately 15% over the next five years, reflecting the urgent need for effective diagnostic solutions.

Growing Interest in Preventive Healthcare

The shift towards preventive healthcare is becoming increasingly prominent in India, driving the genetic testing market. Individuals are becoming more proactive about their health, seeking genetic tests to assess their risk for various diseases. This trend is supported by a growing body of evidence linking genetic predispositions to health outcomes. As more people recognize the value of preventive measures, the demand for genetic testing is likely to rise. The market is projected to see a growth rate of around 12% annually as consumers prioritize health management and disease prevention through genetic insights.

Increased Collaboration Between Healthcare Providers and Genetic Testing Companies

Collaborative efforts between healthcare providers and genetic testing companies are fostering growth in the genetic testing market. Partnerships are being formed to integrate genetic testing into routine healthcare practices, enhancing patient care. These collaborations facilitate the sharing of knowledge and resources, leading to improved testing services and patient outcomes. As healthcare professionals become more familiar with genetic testing, they are more likely to recommend these services to patients. This trend is expected to drive market growth, as the integration of genetic testing into standard healthcare practices becomes more prevalent.