Increasing Demand for Asset Tracking

The real time-location-system market is experiencing a surge in demand for asset tracking solutions across various sectors in India. Industries such as manufacturing, healthcare, and logistics are increasingly adopting these systems to enhance operational efficiency. According to recent estimates, the asset tracking segment is projected to grow at a CAGR of approximately 20% over the next five years. This growth is driven by the need for real-time visibility of assets, which helps in reducing losses and improving inventory management. As organizations seek to optimize their supply chains, the integration of real time-location systems becomes crucial. The ability to monitor assets in real-time not only enhances productivity but also contributes to cost savings, making it a vital component of the real time-location-system market in India.

Rising Adoption in Healthcare Sector

The healthcare sector in India is increasingly recognizing the value of real time-location systems for improving patient care and operational efficiency. Hospitals and healthcare facilities are implementing these systems to track medical equipment, manage patient flow, and ensure timely delivery of services. The real time-location-system market is projected to witness a growth rate of around 15% in this sector over the next few years. By utilizing location-based technologies, healthcare providers can enhance patient safety and streamline operations, ultimately leading to better health outcomes. The integration of real time-location systems in healthcare not only addresses logistical challenges but also supports compliance with regulatory standards, thereby reinforcing its importance in the market.

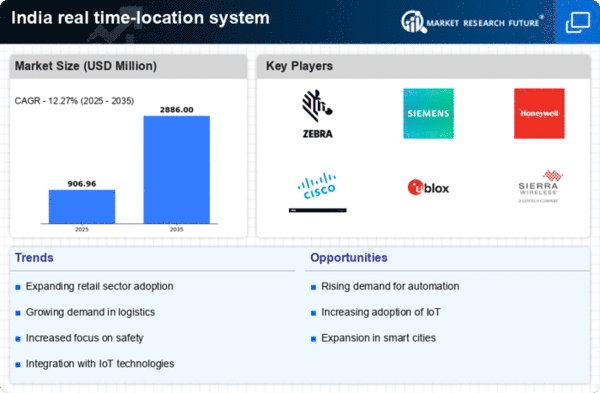

Expansion of Smart Cities Initiatives

The push for smart cities in India is significantly influencing the real time-location-system market. With the government's commitment to developing urban infrastructure, there is a growing need for advanced technologies that facilitate efficient city management. Real time-location systems play a pivotal role in traffic management, public safety, and resource allocation. As cities become more interconnected, the demand for location-based services is expected to rise. Reports indicate that investments in smart city projects could reach $30 billion by 2025, creating a favorable environment for the adoption of real time-location systems. This trend not only enhances urban living but also positions the real time-location-system market as a key player in the smart city ecosystem.

Growing Focus on Supply Chain Optimization

The emphasis on supply chain optimization is becoming a significant driver for the real time-location-system market in India. Companies are increasingly recognizing the importance of real-time data in managing their supply chains effectively. By implementing real time-location systems, organizations can gain insights into inventory levels, shipment statuses, and overall supply chain performance. This capability is particularly vital in sectors such as retail and manufacturing, where efficiency directly impacts profitability. The market is expected to grow as businesses strive to reduce operational costs and improve service levels. With the potential to enhance decision-making processes, real time-location systems are likely to play a crucial role in the future of supply chain management in India.

Technological Advancements in RTLS Solutions

Technological advancements are driving innovation within the real time-location-system market in India. The development of more sophisticated sensors, improved data analytics, and enhanced connectivity options are enabling businesses to leverage real time-location systems more effectively. For instance, the introduction of ultra-wideband (UWB) technology is enhancing the accuracy of location tracking, which is crucial for applications in various industries. As companies seek to adopt cutting-edge solutions, the market is likely to see a shift towards more integrated and user-friendly systems. This trend suggests that the real time-location-system market will continue to evolve, offering enhanced functionalities that cater to the diverse needs of Indian businesses.