Growing Aging Population

The increasing aging population in India is a pivotal driver for the viscosupplementation market. As individuals age, they often experience joint-related issues, particularly osteoarthritis, which necessitates effective treatment options. According to recent estimates, approximately 15% of the Indian population is aged 60 and above, a demographic that is likely to expand in the coming years. This demographic shift is expected to elevate the demand for viscosupplementation therapies, as they provide a non-invasive alternative to surgical interventions. The viscosupplementation market is poised to benefit from this trend, as older adults seek to maintain mobility and quality of life. Furthermore, the growing awareness of joint health among this age group may lead to increased consultations with healthcare professionals, further driving market growth.

Rising Disposable Incomes

The increase in disposable incomes among the Indian population is a significant driver for the viscosupplementation market. As economic conditions improve, more individuals are willing to invest in their health and well-being. This trend is particularly evident in urban areas, where rising incomes enable consumers to seek advanced medical treatments, including viscosupplementation. The willingness to spend on healthcare services is likely to enhance the market's growth, as patients prioritize effective solutions for joint pain and mobility issues. Additionally, the availability of various financing options and health insurance plans may further facilitate access to viscosupplementation treatments. As disposable incomes continue to rise, the market is expected to expand, catering to a broader demographic seeking quality healthcare solutions.

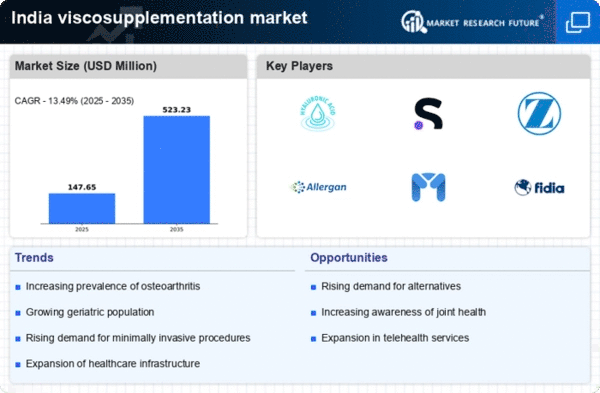

Rising Incidence of Osteoarthritis

The prevalence of osteoarthritis in India is on the rise, significantly impacting the viscosupplementation market. Studies indicate that around 28% of the Indian population suffers from some form of arthritis, with osteoarthritis being the most common. This condition often leads to pain and reduced mobility, prompting patients to seek effective treatment options. Viscosupplementation, which involves the injection of hyaluronic acid into the joints, has emerged as a viable solution for alleviating symptoms associated with osteoarthritis. The increasing incidence of this condition is likely to drive demand for viscosupplementation products, as patients and healthcare providers look for alternatives to traditional pain management strategies. As awareness of the benefits of viscosupplementation grows, the market is expected to expand, catering to the needs of a larger patient population.

Increased Focus on Preventive Healthcare

The shift towards preventive healthcare in India is influencing the viscosupplementation market. As individuals become more health-conscious, there is a growing emphasis on early intervention and management of joint health. Preventive measures, including the use of viscosupplementation, are gaining traction among healthcare providers and patients alike. This trend is supported by initiatives aimed at educating the public about the importance of maintaining joint health and the potential benefits of viscosupplementation. As awareness increases, more patients may seek out these treatments as a proactive approach to managing joint issues. The market is likely to see growth as healthcare professionals advocate for viscosupplementation as a preventive measure, potentially reducing the need for more invasive procedures in the future.

Advancements in Healthcare Infrastructure

The ongoing improvements in healthcare infrastructure across India are contributing to the growth of the viscosupplementation market. With the government and private sectors investing in modern healthcare facilities, access to advanced treatment options is becoming more widespread. Enhanced healthcare infrastructure facilitates the availability of viscosupplementation therapies in urban and rural areas alike. As hospitals and clinics adopt new technologies and treatment modalities, the adoption of viscosupplementation is likely to increase. Furthermore, the establishment of specialized orthopedic centers is expected to provide patients with targeted care, thereby promoting the use of viscosupplementation as a preferred treatment option. This trend indicates a positive outlook for the market, as improved healthcare access may lead to higher patient engagement and treatment uptake.

Leave a Comment