Shift Towards Circular Economy Models

The transition towards circular economy models is significantly impacting the Industrial Solid Waste Management Market. This paradigm shift emphasizes the importance of resource recovery and waste minimization, encouraging industries to rethink their waste management strategies. Companies are increasingly adopting practices that prioritize recycling and reusing materials, which not only reduces waste but also conserves resources. Reports indicate that businesses implementing circular economy principles can achieve cost savings of up to 30% through improved resource efficiency. As more organizations recognize the economic and environmental benefits of circularity, the demand for comprehensive waste management solutions is expected to rise. This trend is likely to foster collaboration among stakeholders, including manufacturers, waste management firms, and policymakers, to create a more sustainable industrial ecosystem.

Economic Incentives for Waste Reduction

Economic incentives are emerging as a crucial driver in the Industrial Solid Waste Management Market. Governments and local authorities are increasingly offering financial incentives to encourage businesses to adopt waste reduction and recycling practices. These incentives may include tax breaks, grants, or subsidies for companies that implement sustainable waste management solutions. For instance, some regions have introduced pay-as-you-throw schemes, which charge businesses based on the amount of waste they generate, thereby motivating them to minimize waste production. Such economic measures not only promote responsible waste management but also stimulate innovation in waste processing technologies. As industries respond to these financial incentives, the demand for effective waste management solutions is likely to grow, further propelling the Industrial Solid Waste Management Market.

Growing Awareness of Environmental Impact

There is a growing awareness of the environmental impact associated with industrial solid waste, which is driving changes in the Industrial Solid Waste Management Market. Stakeholders, including consumers, investors, and regulatory bodies, are increasingly demanding transparency and accountability from companies regarding their waste management practices. This heightened scrutiny is prompting industries to adopt more sustainable waste management solutions. Surveys indicate that a significant percentage of consumers are willing to pay a premium for products from companies that demonstrate a commitment to environmental stewardship. Consequently, businesses are investing in waste reduction initiatives and sustainable practices to meet these expectations. This shift not only enhances corporate reputation but also positions companies favorably in a competitive market, thereby contributing to the growth of the Industrial Solid Waste Management Market.

Technological Advancements in Waste Processing

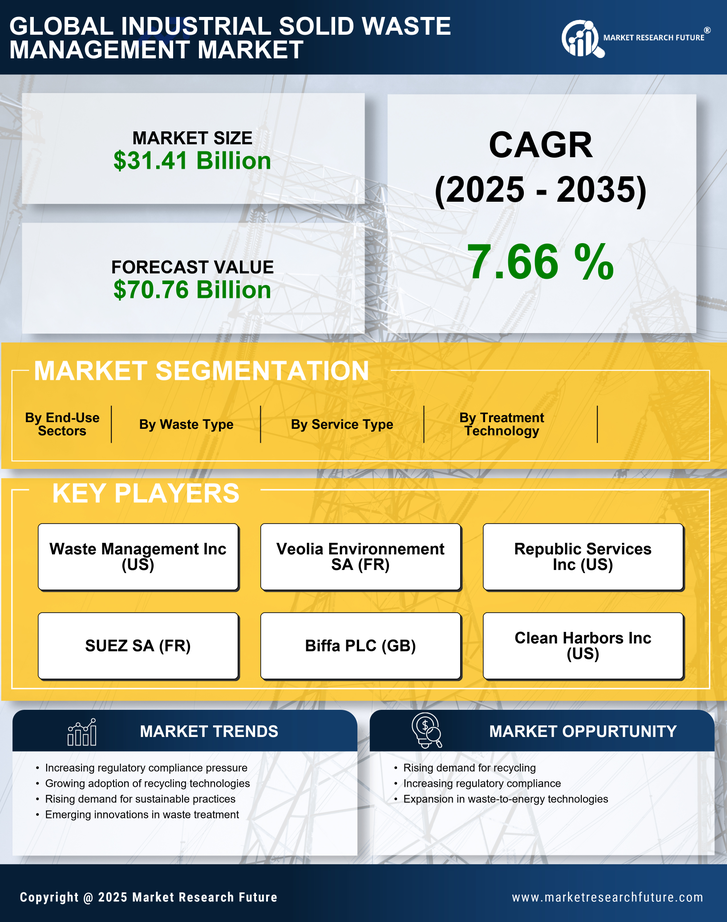

Technological innovations are playing a pivotal role in shaping the Industrial Solid Waste Management Market. Advanced waste processing technologies, such as automated sorting systems and waste-to-energy conversion, are enhancing efficiency and reducing operational costs. For example, the adoption of artificial intelligence in waste sorting has improved accuracy and speed, leading to higher recovery rates of recyclable materials. The market for waste-to-energy technologies is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 8% in the coming years. These advancements not only streamline waste management processes but also contribute to the reduction of landfill usage, thereby addressing environmental concerns. As industries increasingly recognize the benefits of these technologies, the demand for innovative waste management solutions is likely to escalate, further propelling the Industrial Solid Waste Management Market.

Regulatory Compliance and Sustainability Initiatives

The Industrial Solid Waste Management Market is increasingly influenced by stringent regulatory frameworks aimed at promoting sustainability. Governments are implementing laws that mandate waste reduction, recycling, and proper disposal methods. This regulatory pressure compels industries to adopt more efficient waste management practices. For instance, the implementation of the Waste Framework Directive in various regions has led to a notable increase in recycling rates, with some areas reporting up to 50% of waste being recycled. As industries strive to comply with these regulations, investments in waste management technologies and services are expected to rise, thereby driving growth in the Industrial Solid Waste Management Market. Furthermore, companies that proactively engage in sustainable practices may enhance their brand reputation, attracting environmentally conscious consumers and investors.