Rising Energy Demand

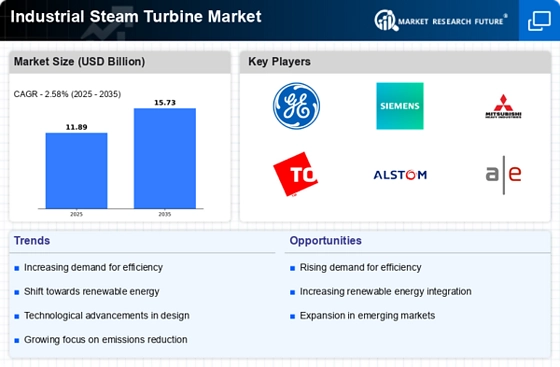

The increasing The Industrial Steam Turbine Industry. As economies expand and industrial activities intensify, the need for efficient energy generation becomes paramount. According to recent data, energy consumption is projected to rise by approximately 30% by 2040. This surge necessitates the deployment of advanced steam turbines, which are known for their efficiency and reliability. Industries such as power generation, oil and gas, and manufacturing are particularly reliant on steam turbines to meet their energy needs. Consequently, the Industrial Steam Turbine Market is likely to experience substantial growth as companies seek to enhance their energy production capabilities to align with this rising demand.

Technological Innovations

Technological innovations are reshaping the Industrial Steam Turbine Market, leading to enhanced efficiency and performance. Advances in materials science, control systems, and turbine design have resulted in the development of high-efficiency steam turbines that can operate at higher temperatures and pressures. These innovations not only improve energy conversion rates but also reduce operational costs for industries. For instance, the introduction of digital twin technology allows for real-time monitoring and predictive maintenance, thereby optimizing turbine performance. As industries increasingly adopt these cutting-edge technologies, the Industrial Steam Turbine Market is poised for growth, driven by the demand for more efficient and reliable energy solutions.

Investment in Renewable Energy

Investment in renewable energy sources is significantly influencing the Industrial Steam Turbine Market. As nations strive to reduce carbon emissions and transition to cleaner energy, there is a marked increase in the deployment of renewable energy technologies. Steam turbines play a crucial role in converting biomass, geothermal, and solar thermal energy into electricity. Recent statistics indicate that investments in renewable energy projects have surged, with a notable increase in capacity additions. This trend suggests that the Industrial Steam Turbine Market will benefit from the growing integration of steam turbines in renewable energy systems, thereby enhancing their market presence and driving innovation.

Industrial Growth and Urbanization

The rapid pace of industrial growth and urbanization is a significant driver for the Industrial Steam Turbine Market. As urban areas expand and industrial sectors evolve, the demand for reliable and efficient energy sources intensifies. Industries such as manufacturing, chemicals, and food processing are expanding their operations, necessitating the use of steam turbines for energy generation. Recent projections indicate that urbanization will lead to a substantial increase in energy consumption, further propelling the need for steam turbines. This trend suggests that the Industrial Steam Turbine Market will continue to thrive as industries seek to meet the energy demands of a growing urban population.

Government Initiatives and Policies

Government initiatives and policies aimed at promoting energy efficiency and sustainability are pivotal for the Industrial Steam Turbine Market. Many governments are implementing regulations that encourage the adoption of cleaner technologies, including steam turbines. Incentives such as tax breaks, grants, and subsidies for energy-efficient projects are becoming commonplace. These policies not only stimulate investment in new steam turbine installations but also encourage retrofitting existing systems. As a result, the Industrial Steam Turbine Market is likely to see increased activity as companies respond to these favorable regulatory environments, enhancing their operational efficiencies and reducing their carbon footprints.

.png)