Increased Focus on Energy Efficiency

The Interposer and Fan-Out WLP Market is witnessing an increased focus on energy efficiency, driven by both regulatory pressures and consumer preferences. As energy consumption becomes a critical concern, manufacturers are exploring packaging solutions that minimize power loss and enhance overall efficiency. The adoption of fan-out wafer-level packaging is particularly appealing due to its ability to reduce the size and weight of semiconductor devices while improving thermal performance. This trend is expected to propel the market forward, as energy-efficient solutions are increasingly prioritized in the design and manufacturing of electronic components. Furthermore, the integration of energy-efficient technologies in the Interposer and Fan-Out WLP Market aligns with global sustainability goals, potentially attracting investments and partnerships aimed at developing greener technologies.

Rising Demand for Consumer Electronics

The Interposer and Fan-Out WLP Market is significantly influenced by the rising demand for consumer electronics, particularly smartphones, tablets, and wearable devices. As consumers increasingly seek more advanced features and functionalities, manufacturers are compelled to adopt innovative packaging solutions that can accommodate these requirements. The market for consumer electronics is expected to reach a valuation of over 1 trillion dollars by 2026, which directly correlates with the growth of the Interposer and Fan-Out WLP Market. This trend is further amplified by the shift towards 5G technology, which necessitates more compact and efficient semiconductor packaging. Consequently, the demand for fan-out wafer-level packaging is likely to increase, as it offers superior performance and miniaturization capabilities, making it an attractive option for electronics manufacturers.

Strategic Collaborations and Partnerships

The Interposer and Fan-Out WLP Market is increasingly characterized by strategic collaborations and partnerships among key players. These alliances are often formed to leverage complementary strengths, share technological advancements, and enhance market competitiveness. For instance, collaborations between semiconductor manufacturers and packaging companies can lead to the development of cutting-edge packaging solutions that meet the evolving needs of the industry. Such partnerships are likely to accelerate innovation and reduce time-to-market for new products. Moreover, as the demand for advanced packaging solutions continues to rise, these strategic alliances may play a crucial role in shaping the future landscape of the Interposer and Fan-Out WLP Market, enabling companies to respond effectively to market dynamics and consumer demands.

Emerging Applications in Automotive Electronics

The Interposer and Fan-Out WLP Market is expanding into emerging applications within the automotive sector, particularly with the rise of electric vehicles and advanced driver-assistance systems. As automotive manufacturers seek to enhance vehicle performance and safety, the demand for high-performance semiconductor packaging solutions is escalating. The automotive electronics market is projected to grow significantly, with estimates suggesting it could reach over 300 billion dollars by 2027. This growth is likely to drive the adoption of interposer and fan-out packaging technologies, which offer the necessary reliability and performance for critical automotive applications. Additionally, the integration of these advanced packaging solutions is expected to facilitate the development of innovative features such as autonomous driving and connected vehicle technologies, further propelling the Interposer and Fan-Out WLP Market.

Technological Innovations in Semiconductor Packaging

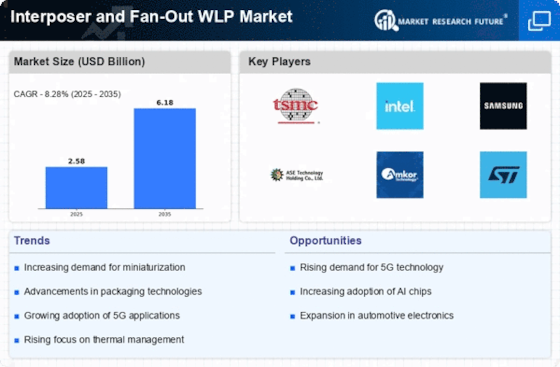

The Interposer and Fan-Out WLP Market is experiencing a surge in technological innovations that enhance semiconductor packaging solutions. These advancements include the development of advanced materials and processes that improve thermal management and electrical performance. For instance, the introduction of high-density interconnects allows for more efficient signal transmission, which is crucial for high-performance applications. As a result, the market is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is driven by the increasing complexity of semiconductor devices, which necessitates more sophisticated packaging solutions. Furthermore, the integration of 3D packaging technologies is likely to redefine the landscape of the Interposer and Fan-Out WLP Market, enabling manufacturers to meet the demands of next-generation electronics.

.png)