Rising Construction Activities

The ongoing expansion of the construction sector in Italy appears to be a primary driver for the ceramic tiles market. With a projected growth rate of approximately 4.5% annually, the demand for ceramic tiles is likely to increase as new residential and commercial projects emerge. This growth is fueled by urbanization trends and government initiatives aimed at boosting infrastructure development. As more buildings are constructed, the need for durable and aesthetically pleasing flooring solutions becomes paramount. Consequently, the ceramic tiles market is positioned to benefit from this surge in construction activities, as builders and architects increasingly opt for ceramic tiles due to their versatility and design options.

Consumer Preference for Aesthetics

In Italy, consumer preferences are shifting towards aesthetically appealing interior designs, which significantly influences the ceramic tiles market. The Italian market is renowned for its rich design heritage, and consumers are increasingly seeking tiles that not only serve functional purposes but also enhance the visual appeal of their spaces. This trend is reflected in the growing demand for patterned and textured tiles, which are expected to capture a larger market share. As a result, manufacturers in the ceramic tiles market are innovating to meet these aesthetic demands, potentially leading to a 6% increase in sales over the next few years as consumers prioritize style alongside functionality.

Government Regulations and Standards

Government regulations and standards regarding building materials are influencing the ceramic tiles market in Italy. Stricter regulations aimed at improving energy efficiency and reducing environmental impact are prompting builders and manufacturers to adapt their practices. Compliance with these regulations often necessitates the use of high-quality ceramic tiles that meet specific performance criteria. As a result, the ceramic tiles market is expected to experience growth, with an estimated increase of 4% as stakeholders prioritize compliance and quality in their projects. This regulatory environment encourages innovation and drives demand for superior ceramic tile products.

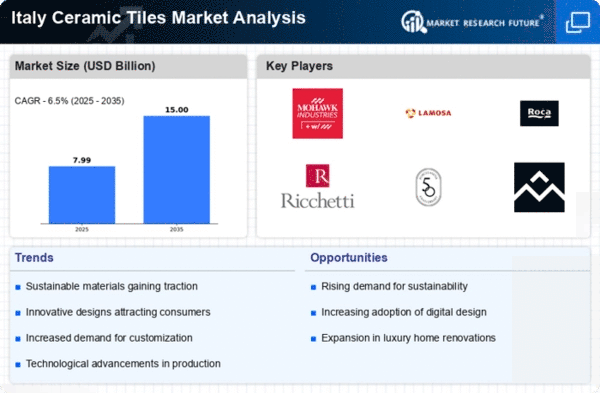

Technological Innovations in Production

Technological advancements in the production processes of ceramic tiles are likely to play a crucial role in shaping the market landscape in Italy. Innovations such as digital printing and advanced glazing techniques enable manufacturers to produce high-quality tiles with intricate designs and improved durability. These advancements not only enhance the aesthetic appeal of ceramic tiles but also reduce production costs, making them more accessible to a broader audience. As a result, the ceramic tiles market may witness a surge in demand, with an estimated growth of 5% in the next year as consumers become more aware of the benefits of technologically advanced products.

Sustainability and Eco-Friendly Products

The increasing emphasis on sustainability and eco-friendly products is becoming a significant driver for the ceramic tiles market in Italy. Consumers are becoming more environmentally conscious, leading to a rising demand for tiles made from recycled materials and those that have a lower environmental impact during production. This shift is prompting manufacturers to innovate and develop sustainable product lines, which could potentially capture a larger share of the market. The ceramic tiles market is likely to see a growth of around 7% as eco-friendly options become more mainstream, aligning with the broader trend of sustainable living.