Increased Focus on Preventive Healthcare

The shift towards preventive healthcare in Italy is significantly impacting the compression therapy market. As healthcare systems emphasize prevention over treatment, there is a growing recognition of the role of compression therapy in preventing venous disorders and related complications. This proactive approach is reflected in public health campaigns aimed at educating the population about the benefits of compression therapy. The market is expected to see a rise in demand for preventive compression products, with estimates suggesting a growth rate of 5% over the next few years. This trend indicates a broader acceptance of compression therapy as a vital component of preventive healthcare strategies.

Advancements in Product Design and Efficacy

Innovations in product design and technology are driving the compression therapy market forward in Italy. Manufacturers are increasingly focusing on developing advanced compression garments that offer improved comfort, breathability, and effectiveness. For instance, the introduction of smart textiles that monitor patient conditions in real-time is gaining traction. This trend is supported by a market analysis indicating that the demand for technologically advanced compression products is expected to grow by 8% annually. As healthcare professionals recognize the benefits of these innovations, the adoption of advanced compression therapy solutions is likely to increase, further propelling the market's expansion.

Rising Incidence of Chronic Venous Disorders

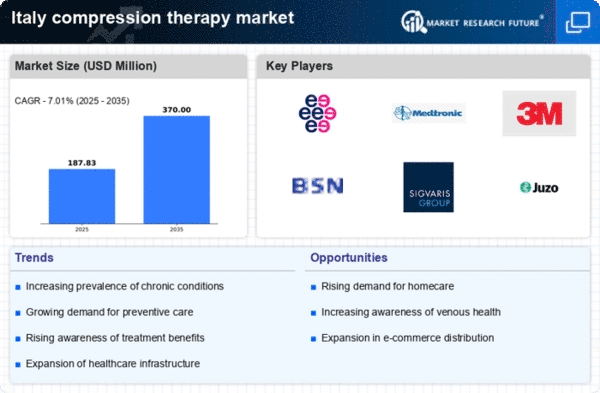

The increasing prevalence of chronic venous disorders in Italy is a notable driver for the compression therapy market. Conditions such as varicose veins and chronic venous insufficiency affect a significant portion of the population, with estimates suggesting that around 25% of adults may experience some form of venous disease. This growing patient demographic necessitates effective treatment options, thereby propelling the demand for compression therapy solutions. As healthcare providers seek to address these conditions, the compression therapy market is likely to expand, with a projected growth rate of approximately 6% annually over the next five years. The focus on improving patient outcomes through non-invasive therapies further underscores the importance of compression therapy in managing venous disorders.

Expansion of Distribution Channels and E-commerce

The expansion of distribution channels, particularly through e-commerce platforms, is reshaping the compression therapy market in Italy. With the increasing penetration of the internet and mobile technology, consumers are more inclined to purchase compression products online. This shift is supported by data indicating that online sales of medical supplies are projected to grow by 15% annually. The convenience of online shopping, coupled with the availability of a wider range of products, is likely to enhance market accessibility. As more consumers turn to e-commerce for their compression therapy needs, the market is expected to experience significant growth, driven by this evolving retail landscape.

Aging Population and Increased Healthcare Expenditure

Italy's aging population is a critical factor influencing the compression therapy market. With a significant portion of the population aged 65 and older, the demand for healthcare services, including compression therapy, is on the rise. Older adults are more susceptible to conditions requiring compression treatment, such as edema and venous insufficiency. Furthermore, the Italian government has been increasing healthcare expenditure, which is projected to reach €200 billion by 2026. This financial commitment is likely to enhance access to compression therapy products and services, thereby stimulating market growth. The intersection of an aging demographic and increased healthcare funding suggests a robust future for the compression therapy market in Italy.