Increasing Dental Procedures

The dental suture market in Italy is experiencing growth due to the rising number of dental procedures performed annually. Factors such as an aging population and increased awareness of oral health are driving this trend. According to recent statistics, the number of dental visits has increased by approximately 15% over the past five years. This surge in dental procedures necessitates the use of sutures for various surgical interventions, thereby boosting demand in the dental suture market. Additionally, the growing prevalence of dental diseases, including periodontal issues, further contributes to the need for effective suturing solutions. As dental professionals seek reliable and high-quality sutures, the market is likely to expand, reflecting the increasing importance of surgical precision in dental care.

Rising Aesthetic Dentistry Trends

The dental suture market is also benefiting from the growing trend towards aesthetic dentistry in Italy. As more patients seek cosmetic dental procedures, such as veneers and gum contouring, the demand for sutures that facilitate these treatments is on the rise. Aesthetic procedures often require precise suturing to ensure optimal results and patient satisfaction. The market for aesthetic dentistry has expanded significantly, with estimates suggesting a growth rate of around 10% annually. This trend not only increases the volume of procedures but also elevates the standards for suturing materials used in these applications. As dental practitioners prioritize aesthetics alongside functionality, the dental suture market is likely to see a shift towards innovative and aesthetically pleasing suture options.

Growth of Dental Implant Procedures

The dental suture market is significantly influenced by the rising popularity of dental implant procedures in Italy. With advancements in implant technology and materials, more patients are opting for implants as a solution for missing teeth. Reports indicate that the dental implant market has grown by over 20% in the last few years, leading to a corresponding increase in the demand for sutures used during the surgical placement of these implants. The need for effective wound closure in implant surgeries underscores the importance of high-quality sutures, which are essential for ensuring optimal healing and reducing complications. Consequently, the dental suture market is poised for growth as dental professionals increasingly rely on specialized suturing products to support these procedures.

Regulatory Support for Dental Products

Regulatory support for dental products in Italy is a significant driver for the dental suture market. The Italian government has implemented various initiatives to streamline the approval process for new dental products, including sutures. This regulatory environment encourages innovation and the introduction of new suturing materials that meet the evolving needs of dental professionals. As a result, the market is witnessing an influx of advanced sutures that offer enhanced performance and safety features. The positive regulatory landscape not only fosters competition among manufacturers but also ensures that dental practitioners have access to a diverse range of high-quality sutures. This support is likely to sustain the growth of the dental suture market as new products continue to emerge.

Technological Innovations in Dental Sutures

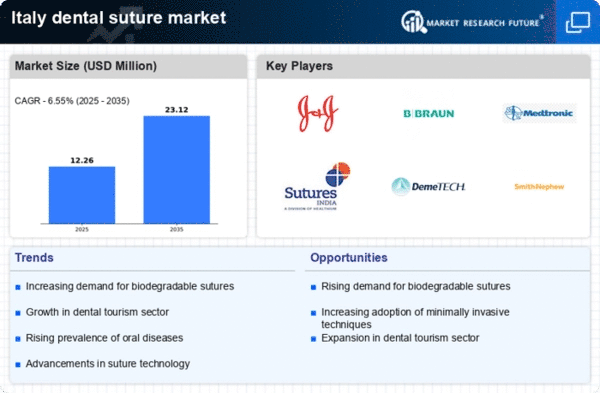

Technological advancements in the development of dental sutures are playing a crucial role in shaping the market landscape in Italy. Innovations such as the introduction of smart sutures, which can monitor healing processes, are gaining traction among dental professionals. These advancements enhance the effectiveness of sutures, leading to improved patient outcomes and satisfaction. The dental suture market is expected to witness a compound annual growth rate (CAGR) of approximately 8% over the next few years, driven by these technological innovations. As dental practitioners become more aware of the benefits of advanced suturing materials, the demand for high-tech solutions is likely to increase, further propelling the market forward.

Leave a Comment