Rising Incidence of Cancer

The increasing incidence of cancer in Italy is a primary driver for the positron emission-tomography-devices market. According to recent statistics, cancer cases have been on the rise, with estimates suggesting that approximately 3.5 million new cases are diagnosed annually. This trend necessitates advanced imaging technologies for accurate diagnosis and treatment planning. As healthcare providers seek to enhance patient outcomes, the demand for positron emission tomography devices is likely to grow. The ability of these devices to detect metabolic changes at an early stage makes them invaluable in oncology. Consequently, the positron emission-tomography-devices market is expected to expand as hospitals and clinics invest in state-of-the-art equipment to meet the needs of an aging population and the increasing burden of cancer.

Technological Innovations in Imaging

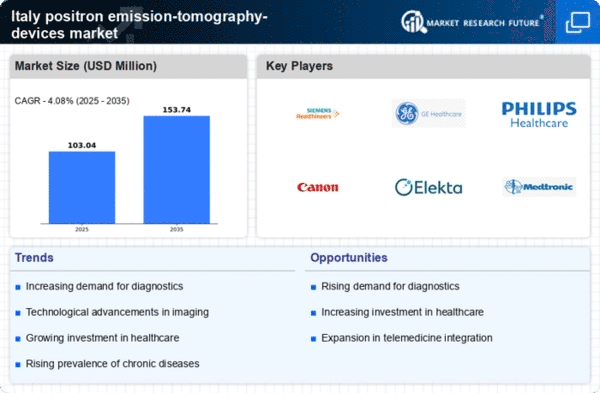

Technological innovations play a crucial role in shaping the positron emission-tomography-devices market. Recent advancements in imaging technology, such as improved detector systems and enhanced image reconstruction algorithms, have significantly increased the efficiency and accuracy of PET scans. These innovations not only enhance diagnostic capabilities but also reduce scan times, making the procedure more patient-friendly. In Italy, the integration of artificial intelligence in imaging analysis is emerging, potentially streamlining workflows and improving diagnostic precision. As healthcare facilities adopt these cutting-edge technologies, the positron emission-tomography-devices market is poised for growth, with an anticipated increase in market value projected to reach €500 million by 2027.

Aging Population and Chronic Diseases

The aging population in Italy is a critical factor influencing the positron emission-tomography-devices market. As the demographic shifts towards an older population, the prevalence of chronic diseases, including cancer and cardiovascular conditions, is expected to rise. Older adults often require more frequent diagnostic imaging to monitor their health, leading to increased demand for advanced imaging technologies. The positron emission-tomography-devices market is likely to see growth as healthcare providers adapt to the needs of this demographic. With projections indicating that by 2030, over 25% of the Italian population will be over 65 years old, the market is positioned for expansion as facilities invest in the necessary equipment to cater to this growing patient base.

Investment in Healthcare Infrastructure

Investment in healthcare infrastructure in Italy is a significant driver for the positron emission-tomography-devices market. The Italian government has been allocating substantial funds to modernize healthcare facilities and improve diagnostic capabilities. This includes the procurement of advanced imaging technologies, such as positron emission tomography devices, to enhance patient care. With an estimated €2 billion earmarked for healthcare upgrades over the next five years, hospitals and clinics are expected to expand their diagnostic services. This investment not only improves access to advanced imaging but also fosters competition among healthcare providers, further stimulating the positron emission-tomography-devices market.

Growing Awareness of Preventive Healthcare

There is a growing awareness of preventive healthcare among the Italian population, which is driving the positron emission-tomography-devices market. As individuals become more health-conscious, they are increasingly seeking early detection methods for various diseases, including cancer. This shift in mindset is prompting healthcare providers to offer advanced diagnostic services, including PET scans, as part of routine health check-ups. The Italian government has also been promoting preventive healthcare initiatives, which further supports the demand for advanced imaging technologies. Consequently, the positron emission-tomography-devices market is likely to benefit from this trend, as more patients opt for early screening and diagnostic services.

Leave a Comment