Growing Awareness of Early Diagnosis

There is a notable increase in public awareness regarding the importance of early diagnosis in the UK, which serves as a catalyst for the positron emission-tomography-devices market. Campaigns promoting health screenings and early detection of diseases have gained traction, encouraging individuals to seek medical advice sooner. This shift in mindset is likely to drive demand for advanced imaging technologies, including PET scans, as patients and healthcare providers recognise their value in identifying conditions at earlier stages. The emphasis on preventive healthcare is expected to result in a higher utilisation rate of positron emission tomography devices, thereby expanding the market.

Technological Innovations in Imaging

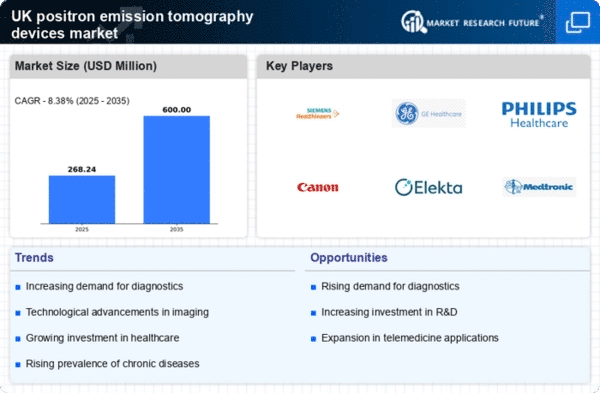

Technological innovations in imaging modalities are significantly influencing the positron emission-tomography-devices market. Advancements such as improved detector technologies, enhanced image resolution, and the integration of artificial intelligence in image analysis are transforming the landscape of medical imaging. These innovations not only increase the accuracy of diagnoses but also reduce the time required for imaging procedures. As healthcare providers in the UK adopt these cutting-edge technologies, the demand for modern positron emission tomography devices is likely to rise. The continuous evolution of imaging technology suggests a promising future for the market, as new features and capabilities are introduced.

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases in the UK is a primary driver for the positron emission-tomography-devices market. Conditions such as cancer, cardiovascular diseases, and neurological disorders necessitate advanced diagnostic tools for effective management. According to recent health statistics, cancer cases in the UK have risen, leading to a heightened demand for precise imaging techniques. PET scans are particularly valuable in oncology for detecting malignancies at early stages, thus improving treatment outcomes. The growing patient population requiring regular monitoring and diagnosis is likely to propel the market forward, as healthcare providers seek to invest in state-of-the-art imaging technologies to enhance patient care.

Investment in Healthcare Infrastructure

The UK government has been actively investing in healthcare infrastructure, which significantly impacts the positron emission-tomography-devices market. Initiatives aimed at modernising hospitals and healthcare facilities are likely to increase the availability of advanced diagnostic equipment. Recent budgets have allocated substantial funds for upgrading medical imaging technologies, including PET devices. This investment is expected to enhance diagnostic capabilities, leading to improved patient outcomes. Furthermore, the establishment of new healthcare facilities in underserved areas may create additional demand for positron emission tomography devices, as these facilities strive to provide comprehensive diagnostic services to their communities.

Collaboration Between Industry and Academia

Collaboration between industry and academic institutions is fostering innovation in the positron emission-tomography-devices market. Research partnerships are focusing on developing new imaging techniques and enhancing existing technologies. These collaborations often lead to breakthroughs that improve the efficacy and efficiency of PET scans. Furthermore, academic research can provide valuable insights into clinical applications, driving the adoption of these devices in various medical fields. As the UK continues to support such partnerships, the positron emission-tomography-devices market is likely to benefit from a steady influx of innovative solutions that address current healthcare challenges.

Leave a Comment