Rising E-commerce and Delivery Services

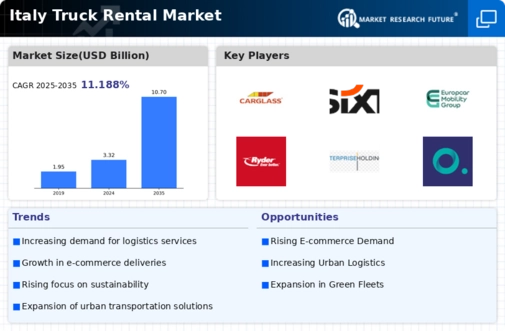

The surge in e-commerce activities in Italy is a significant driver for the truck rental market. As online shopping continues to gain traction, businesses are increasingly relying on efficient delivery services to meet consumer expectations. This trend necessitates the use of rental trucks for last-mile delivery solutions, particularly in urban areas where logistics can be challenging. In 2025, e-commerce sales in Italy are expected to reach €40 billion, indicating a robust market for delivery services. Consequently, the truck rental market is likely to benefit from this growth, as companies seek to optimize their logistics operations and reduce costs associated with owning a fleet. The flexibility offered by rental services aligns well with the dynamic nature of e-commerce.

Environmental Regulations and Compliance

The truck rental market in Italy is increasingly shaped by stringent environmental regulations aimed at reducing carbon emissions and promoting sustainability. The Italian government has implemented various policies to encourage the use of low-emission vehicles and alternative fuels. As a result, rental companies are adapting their fleets to comply with these regulations, which may involve investing in electric or hybrid trucks. By 2025, it is anticipated that the market share of low-emission vehicles in the truck rental sector could reach 25%. This shift not only aligns with regulatory requirements but also meets the growing consumer demand for environmentally friendly transportation options, thereby enhancing the appeal of truck rental services.

Economic Growth and Infrastructure Development

The truck rental market in Italy appears to be positively influenced by the ongoing economic growth and infrastructure development initiatives. As the Italian economy expands, there is an increasing demand for logistics and transportation services. The government has invested heavily in infrastructure projects, including road improvements and the expansion of logistics hubs. This investment is likely to enhance the efficiency of transportation networks, thereby increasing the demand for truck rentals. In 2025, the logistics sector is projected to grow by approximately 4.5%, which could further stimulate the truck rental market. The growth in e-commerce and retail sectors also contributes to this demand, as businesses require flexible transportation solutions to meet customer needs.

Technological Advancements in Fleet Management

Technological advancements in fleet management systems are transforming the truck rental market in Italy. The integration of telematics, GPS tracking, and data analytics allows rental companies to optimize their operations, improve vehicle utilization, and enhance customer service. These technologies enable real-time monitoring of vehicle performance and maintenance needs, which can lead to reduced downtime and operational costs. As of 2025, it is estimated that around 30% of rental companies in Italy will adopt advanced fleet management technologies, which could significantly improve their competitive edge. This trend not only benefits rental companies but also enhances the overall efficiency of the logistics sector, thereby driving demand for truck rentals.

Urbanization and Changing Consumer Preferences

Urbanization in Italy is a critical factor influencing the truck rental market. As more people move to urban areas, the demand for efficient transportation solutions increases. Urban logistics challenges, such as traffic congestion and limited parking, necessitate flexible rental options for businesses. Additionally, changing consumer preferences towards convenience and speed in delivery services further drive the need for truck rentals. In 2025, urban areas are expected to account for over 70% of the total logistics demand in Italy. This trend suggests that rental companies must adapt their offerings to cater to the unique needs of urban consumers, potentially leading to innovative rental solutions that address these challenges.

Leave a Comment