Cost Containment Pressures

In Japan, the healthcare system faces significant cost containment pressures, which are influencing the insulin biosimilars market. The government has implemented various measures to control healthcare expenditures, including price reductions for pharmaceuticals. This environment creates a favorable landscape for biosimilars, which are generally priced lower than their reference biologics. The insulin biosimilars market is likely to see increased adoption as healthcare providers and payers prioritize cost-effective treatment options. With the potential for biosimilars to reduce overall healthcare costs, stakeholders may be more inclined to support their integration into treatment protocols. As a result, the insulin biosimilars market could experience accelerated growth driven by the need for sustainable healthcare solutions in Japan.

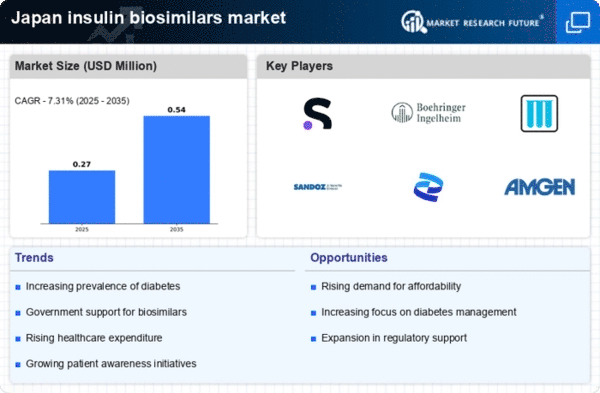

Increasing Prevalence of Diabetes

The rising incidence of diabetes in Japan is a critical driver for the insulin biosimilars market. As of recent data, approximately 7.4 million individuals in Japan are diagnosed with diabetes, a figure that is projected to increase. This growing patient population necessitates the availability of affordable insulin options, thereby propelling the demand for biosimilars. The insulin biosimilars market is likely to benefit from this trend, as healthcare providers seek cost-effective alternatives to traditional insulin therapies. Furthermore, the increasing prevalence of diabetes-related complications underscores the need for effective management solutions, which may further stimulate the market. As the healthcare system in Japan continues to adapt to this rising burden, the insulin biosimilars market is positioned to play a pivotal role in addressing the needs of patients and healthcare providers alike.

Regulatory Framework Enhancements

The regulatory framework in Japan is evolving to support the development and approval of biosimilars, which is a key driver for the insulin biosimilars market. Recent initiatives by the Pharmaceuticals and Medical Devices Agency (PMDA) aim to streamline the approval process for biosimilars, thereby encouraging innovation and competition. This supportive regulatory environment may lead to an increase in the number of biosimilars entering the market, providing patients with more treatment options. The insulin biosimilars market is likely to experience growth as a result of these regulatory enhancements, which could foster a more dynamic marketplace. As the approval process becomes more efficient, stakeholders may be more willing to invest in the development of new biosimilars, further expanding the market.

Rising Patient Awareness and Education

Patient awareness and education regarding biosimilars are on the rise in Japan, which is positively influencing the insulin biosimilars market. As healthcare providers increasingly educate patients about the benefits and safety of biosimilars, acceptance is likely to grow. This shift in perception may lead to higher demand for biosimilars as patients seek affordable alternatives to traditional insulin therapies. The insulin biosimilars market could see a notable increase in uptake as patients become more informed about their treatment options. Furthermore, initiatives aimed at enhancing patient education may contribute to a more favorable environment for biosimilars, ultimately supporting market growth. As awareness continues to expand, the insulin biosimilars market may find itself in a stronger position to meet the needs of patients and healthcare providers.

Advancements in Biologics Manufacturing

Technological advancements in biologics manufacturing are significantly impacting the insulin biosimilars market. Innovations in production processes, such as improved cell culture techniques and purification methods, have enhanced the efficiency and quality of biosimilars. These advancements may lead to a reduction in production costs, making biosimilars more accessible to patients. The insulin biosimilars market stands to benefit from these developments, as manufacturers can produce high-quality products at competitive prices. Additionally, the ability to scale production effectively may support the growing demand for biosimilars in Japan. As the market evolves, these manufacturing advancements could play a crucial role in shaping the future landscape of the insulin biosimilars market.