Cost Containment Initiatives

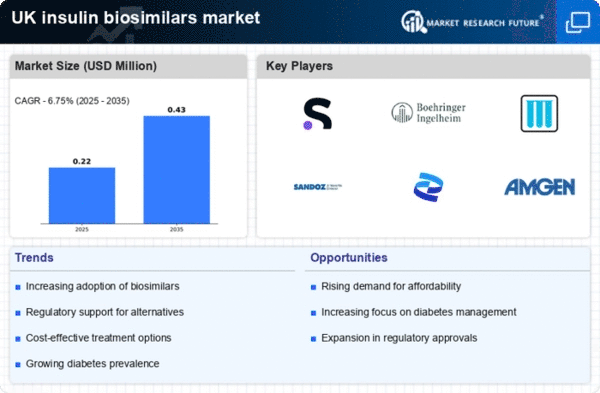

In the UK, healthcare systems are under constant pressure to contain costs while ensuring access to essential medications. The insulin biosimilars market is poised to thrive as healthcare providers and payers increasingly adopt cost containment strategies. The National Health Service (NHS) has been actively promoting the use of biosimilars to reduce expenditure on diabetes treatments. By 2025, it is estimated that the NHS could save up to £300 million annually through the adoption of biosimilars. This financial incentive encourages healthcare professionals to prescribe biosimilars over more expensive reference products, thereby driving market growth. As the NHS continues to implement policies that favour the use of biosimilars, the insulin biosimilars market is likely to expand, providing patients with more affordable treatment options.

Supportive Regulatory Framework

The regulatory environment in the UK plays a pivotal role in shaping the insulin biosimilars market. The Medicines and Healthcare products Regulatory Agency (MHRA) has established a clear pathway for the approval of biosimilars, which fosters innovation and competition. This supportive framework encourages pharmaceutical companies to invest in the development of biosimilars, knowing that they can navigate the approval process efficiently. Moreover, the MHRA's commitment to ensuring the safety and efficacy of biosimilars instills confidence among healthcare providers and patients alike. As more biosimilars gain regulatory approval, the market is expected to expand, providing a wider array of treatment options for individuals with diabetes.

Increasing Prevalence of Diabetes

The rising incidence of diabetes in the UK is a crucial driver for the insulin biosimilars market. According to recent statistics, approximately 4.9 million people in the UK are diagnosed with diabetes, a figure that is projected to increase significantly in the coming years. This growing patient population necessitates a greater supply of insulin products, including biosimilars, which are often more affordable than their reference biologics. The insulin biosimilars market is likely to benefit from this trend, as healthcare providers seek cost-effective solutions to manage diabetes effectively. Furthermore, the increasing awareness of diabetes management and the importance of insulin therapy among patients and healthcare professionals may further stimulate demand for biosimilars, thereby enhancing market growth.

Growing Patient Awareness and Education

Patient awareness regarding the availability and benefits of biosimilars is a vital driver for the insulin biosimilars market. As educational initiatives by healthcare organisations and advocacy groups increase, patients are becoming more informed about their treatment options. This heightened awareness is crucial, as it empowers patients to engage in discussions with their healthcare providers about the potential advantages of biosimilars, including cost savings and accessibility. Surveys indicate that a significant % of patients express a willingness to switch to biosimilars if adequately informed. Consequently, as patient education efforts continue to expand, the insulin biosimilars market is likely to experience increased demand, as more patients opt for these alternatives.

Technological Advancements in Biologics

The insulin biosimilars market is significantly influenced by advancements in biotechnology and manufacturing processes. Innovations in biopharmaceutical production, such as improved cell culture techniques and purification methods, have enhanced the efficiency and quality of biosimilar products. These technological improvements not only reduce production costs but also ensure that biosimilars meet stringent regulatory standards. As a result, the market is witnessing an influx of high-quality biosimilars that can compete effectively with reference products. Furthermore, the development of more sophisticated analytical methods for characterising biosimilars is likely to bolster confidence among healthcare providers and patients, thereby promoting their adoption in diabetes management.