Evolving Regulatory Landscape

Japan's regulatory environment is evolving, with new laws and guidelines being introduced to enhance data protection and cybersecurity. The managed detection-response market is likely to see increased demand as organizations strive to comply with these regulations. For instance, the Personal Information Protection Act (PIPA) has been updated to impose stricter requirements on data handling and breach notifications. As a result, companies are turning to managed detection-response services to ensure compliance and avoid potential penalties. The managed detection-response market is thus becoming a critical partner for organizations navigating this complex regulatory landscape, providing the necessary tools and expertise to meet compliance requirements effectively.

Increasing Cybersecurity Awareness

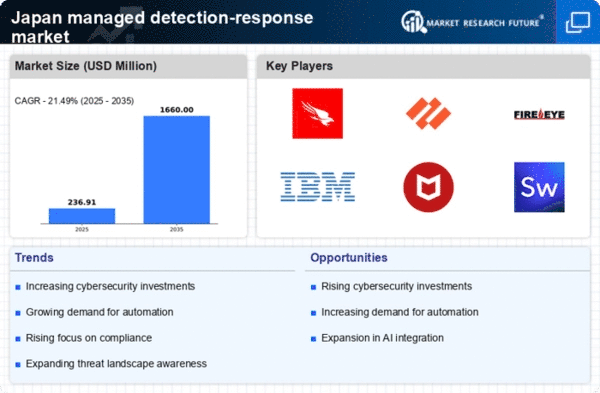

The managed detection-response market in Japan is experiencing growth due to heightened awareness of cybersecurity threats among organizations. As businesses recognize the potential financial and reputational damage from cyber incidents, they are increasingly investing in managed detection-response services. In 2025, it is estimated that the cybersecurity market in Japan will reach approximately $20 billion, with a significant portion allocated to managed detection-response solutions. This trend indicates a shift in organizational priorities, where proactive threat detection and response capabilities are becoming essential components of cybersecurity strategies. The managed detection-response market is thus positioned to benefit from this growing emphasis on security, as companies seek to mitigate risks and enhance their overall security posture.

Integration of AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning technologies into cybersecurity solutions is transforming the managed detection-response market in Japan. These technologies enhance threat detection capabilities by analyzing vast amounts of data in real-time, allowing for quicker identification of potential threats. As organizations increasingly adopt AI-driven solutions, the managed detection-response market is likely to expand, with a projected growth rate of around 15% annually. This technological advancement not only improves the efficiency of threat response but also reduces the burden on security teams, enabling them to focus on more strategic initiatives. Consequently, the demand for managed detection-response services that leverage AI and machine learning is expected to rise significantly.

Rising Demand for Cloud Security Solutions

The shift towards cloud computing in Japan is driving the demand for managed detection-response services tailored for cloud environments. As more organizations migrate their operations to the cloud, they face unique security challenges that require specialized solutions. The managed detection-response market is responding to this trend by offering services that protect cloud-based assets and data. In 2025, the cloud security market in Japan is projected to reach $5 billion, with a substantial portion dedicated to managed detection-response services. This growth reflects the increasing recognition of the need for robust security measures in cloud environments, as organizations seek to safeguard their digital assets against evolving threats.

Shortage of Skilled Cybersecurity Professionals

The managed detection-response market in Japan is also influenced by the ongoing shortage of skilled cybersecurity professionals. As cyber threats become more sophisticated, organizations are struggling to find qualified personnel to manage their security operations effectively. This skills gap is prompting many companies to outsource their cybersecurity needs to managed detection-response providers. The managed detection-response market is thus positioned to fill this void, offering expertise and resources that organizations may lack internally. By leveraging external services, companies can enhance their security posture without the need for extensive in-house training and recruitment, making managed detection-response services an attractive option in the current labor market.

Leave a Comment