Rising Investment in Research and Development

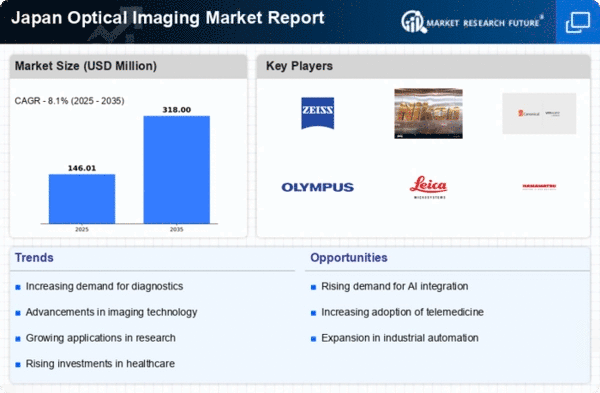

The The optical imaging market. in Japan is experiencing a surge in investment directed towards research and development. This trend is primarily driven by the need for innovative imaging solutions across various sectors, including healthcare and industrial applications. In 2025, the Japanese government allocated approximately $1.5 billion to support R&D initiatives in advanced imaging technologies. This funding is expected to enhance the capabilities of optical imaging systems, leading to improved resolution and accuracy. Furthermore, collaboration between academic institutions and private companies is likely to foster the development of cutting-edge imaging modalities. As a result, the optical imaging market is poised for substantial growth, with projections indicating a compound annual growth rate (CAGR) of around 8% over the next five years. This investment climate is crucial for maintaining Japan's competitive edge in The optical imaging market.

Growing Demand for Miniaturized Imaging Systems

The The optical imaging market. is witnessing a growing demand for miniaturized imaging systems in Japan. As technology advances, there is an increasing need for compact and portable imaging solutions that can be utilized in various applications, including telemedicine and point-of-care diagnostics. In 2025, the miniaturized optical imaging systems segment is expected to account for approximately 25% of the overall market share, reflecting a shift towards more accessible imaging technologies. This trend is driven by the need for convenience and efficiency in healthcare delivery, particularly in remote areas. Furthermore, advancements in micro-optics and sensor technologies are enabling the development of smaller, yet highly effective imaging systems. As a result, the optical imaging market is likely to see a proliferation of innovative products that cater to the evolving needs of healthcare providers and patients alike.

Regulatory Support for Optical Imaging Innovations

The The optical imaging market. in Japan is benefiting from regulatory support aimed at fostering innovation and ensuring safety in imaging technologies. The Japanese government has implemented policies that encourage the development and commercialization of advanced optical imaging systems. In 2025, it is anticipated that new regulatory frameworks will streamline the approval process for innovative imaging devices, thereby accelerating their entry into the market. This supportive environment is likely to attract investments and stimulate research initiatives within the optical imaging market. Additionally, collaboration between regulatory bodies and industry stakeholders is expected to enhance the overall quality and safety of imaging products. As a result, the optical imaging market is positioned for growth, with an emphasis on developing cutting-edge technologies that meet stringent regulatory standards.

Increasing Adoption of Optical Imaging in Diagnostics

The The optical imaging market. is witnessing a notable increase in the adoption of imaging technologies for diagnostic purposes in Japan. Healthcare providers are increasingly utilizing optical imaging techniques, such as optical coherence tomography (OCT) and fluorescence imaging, to enhance diagnostic accuracy and patient outcomes. In 2025, it is estimated that the market for optical imaging in diagnostics will reach approximately $600 million, reflecting a growth rate of 10% compared to the previous year. This growth is attributed to the rising prevalence of chronic diseases and the demand for non-invasive diagnostic methods. Additionally, advancements in imaging technologies are enabling earlier detection of diseases, which is crucial for effective treatment. Consequently, the optical imaging market is becoming an integral part of the healthcare landscape in Japan, driving further innovation and investment in this sector.

Expansion of Optical Imaging in Industrial Applications

The The optical imaging market. is experiencing significant expansion within industrial applications in Japan. Industries such as manufacturing, automotive, and electronics are increasingly adopting optical imaging technologies for quality control, inspection, and automation processes. In 2025, the market for optical imaging in industrial applications is projected to reach $400 million, with a CAGR of 7% over the next five years. This growth is driven by the need for precision and efficiency in production processes, as well as the demand for real-time monitoring solutions. Optical imaging systems are being integrated into production lines to enhance product quality and reduce waste. As industries continue to embrace automation and smart manufacturing practices, the optical imaging market is likely to play a pivotal role in driving operational excellence and innovation.

Leave a Comment