Research Methodology on LIDAR Marker

1. Introduction

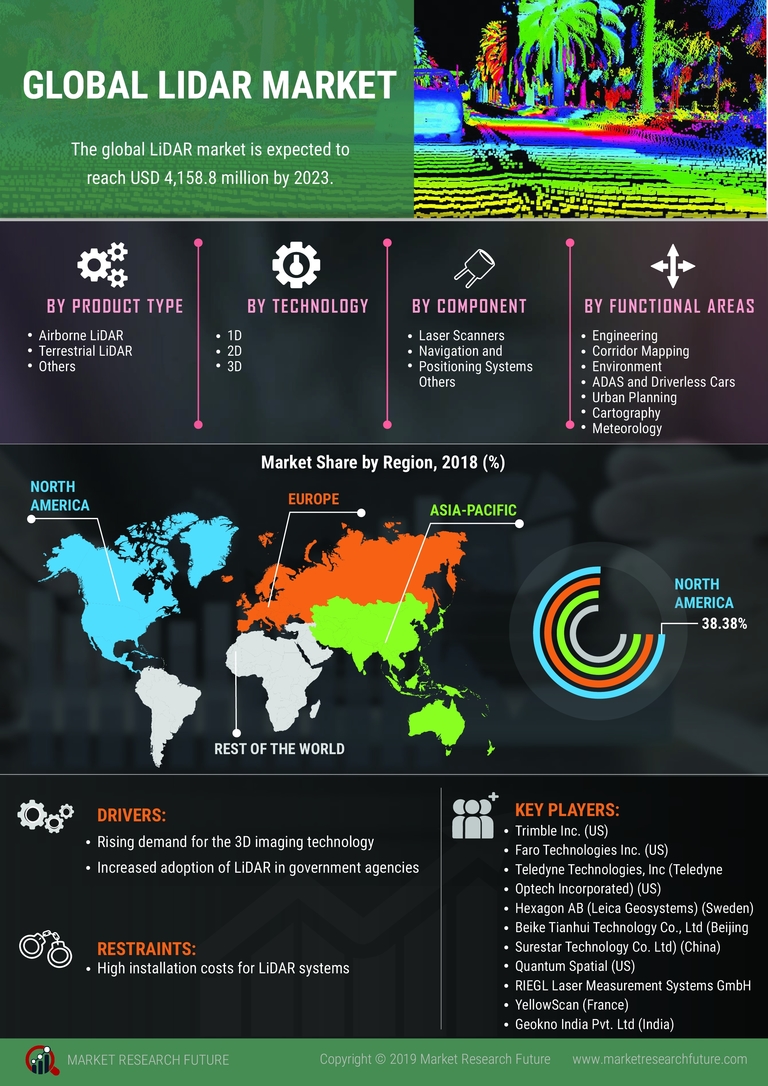

LIDAR (Light Detection and Ranging) is a remote sensing technology that measures the distance between the object and the detecting device by illuminating a laser light on the object and measuring its reflected light. It is typically used for assessing location-based parameters like height, depth and geographical features of an area. It is used in several applications including navigation, environmental monitoring and surveillance. Market Research Future recently published a research report titled ‘Global LIDAR Market Research Report – Forecast till 2030’ that focuses on analyzing and predicting the future market trends of the LIDAR technology. This research report also provides drivers and challenges for the LIDAR market and Porter’s Five Forces Analysis.

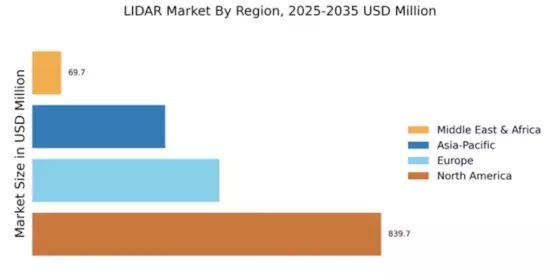

This research report assesses the present and future market conditions of the LIDAR market and its applications. It explores driver opportunities, challenges and strategies adopted by the market players and suggests strategies to gain a competitive advantage. The purpose of this research report is to help provide information on the current market size, growth potential and market dynamics of the LIDAR market.

2. Research Methodology

2.1. Research Design

This research report adopts a mixed-method research design. This involves collecting and analyzing both qualitative and quantitative data for the LIDAR market. Data collection methods may include primary and secondary research, literature review and interviews with industry experts.

2.2. Data Collection

For the purpose of this research report, secondary data need to be collected. Sources of secondary data include industry reports, trade magazines, statistical databases, market research reports and other published or unpublished sources. Primary data needs to be collected through conducting interviews with industry experts and collecting structured/ unstructured data from focus groups.

2.3. Data Analysis

Data analysis is done using methods such as statistical methods, econometric models and quantitative and qualitative data analysis techniques. Descriptive statistics are used to summarize data in the report.

2.4. Sampling

For the purpose of this research report, stratified and convenience sampling techniques are used to select the sample from the target population. Stratified sampling is used to divide the population into segments and a convenience sampling technique is used to select the sample from each stratified segment.

2.5. Modelling

For this research report, a market potential analysis model is used to evaluate the potential market growth and size of the market. PEST analysis is used to understand the external environment. Porter’s Five Forces model is used to assess market competitiveness.

3. Conclusion

This research report provides an in-depth analysis of the LIDAR market and its applications. The research methodology outlined above helps provide accurate and reliable insights into the current market size, growth potential and market dynamics, as well as recommend strategies for gaining competitive advantage.