Rising Energy Demand

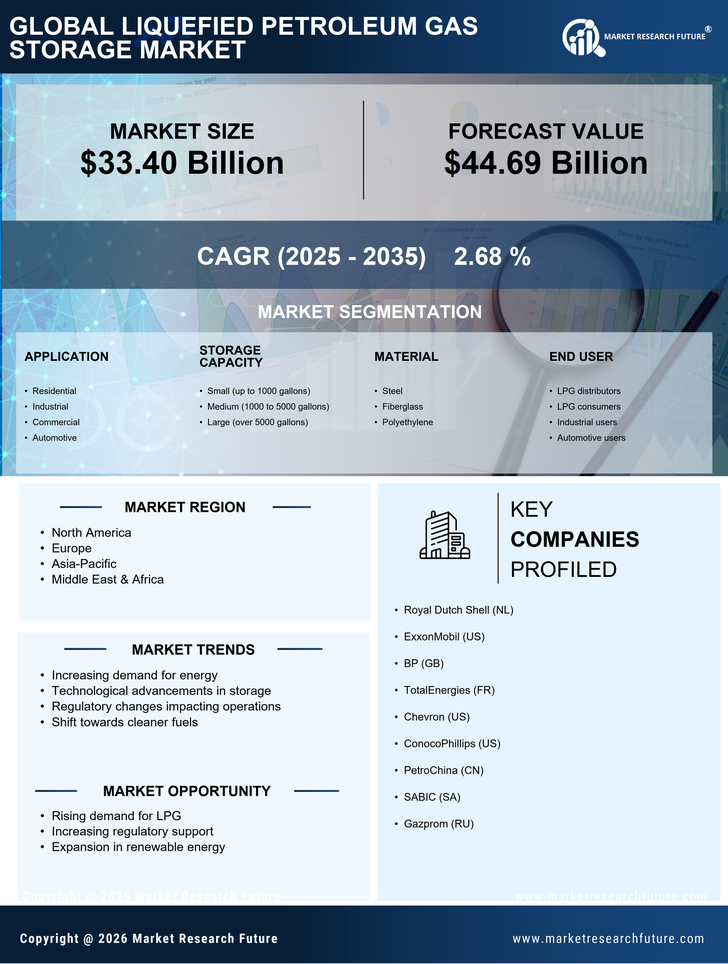

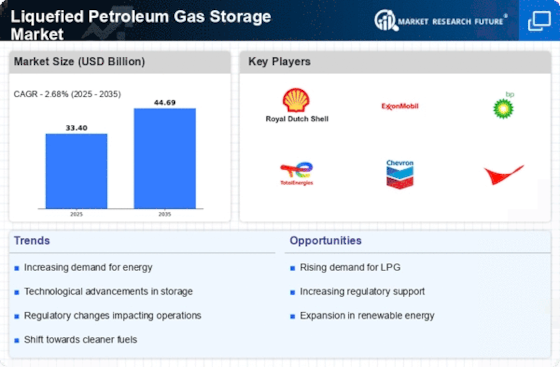

The Liquefied Petroleum Gas Storage Market is significantly influenced by the rising energy demand across various sectors. As economies continue to grow, the need for reliable and efficient energy sources becomes paramount. Liquefied petroleum gas (LPG) is increasingly recognized for its versatility and efficiency, making it a preferred choice for both industrial and residential applications. According to recent data, the demand for LPG is projected to grow at a compound annual growth rate of approximately 4% over the next few years. This increasing demand necessitates the expansion of storage facilities to ensure a steady supply, thereby driving growth in the Liquefied Petroleum Gas Storage Market.

Regulatory Support for Cleaner Fuels

The Liquefied Petroleum Gas Storage Market benefits from regulatory support aimed at promoting cleaner fuels. Governments worldwide are implementing policies that encourage the use of LPG as a transitional fuel towards a more sustainable energy future. These regulations often include incentives for the construction of new storage facilities and the retrofitting of existing ones to accommodate LPG. For example, certain regions have introduced tax breaks and subsidies for companies investing in LPG infrastructure. This regulatory environment not only fosters growth in the Liquefied Petroleum Gas Storage Market but also aligns with global efforts to reduce carbon emissions and combat climate change.

Increased Investment in Infrastructure

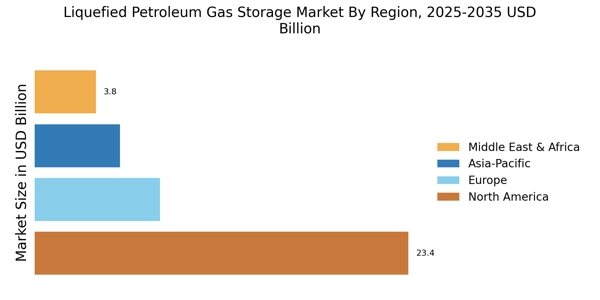

The Liquefied Petroleum Gas Storage Market is witnessing increased investment in infrastructure development. As countries strive to enhance their energy security, investments in storage facilities are becoming a priority. This trend is particularly evident in emerging markets, where the need for reliable energy sources is critical for economic development. Recent reports indicate that investments in LPG infrastructure are expected to reach several billion dollars over the next decade. Such investments are likely to lead to the construction of new storage terminals and the expansion of existing ones, thereby bolstering the Liquefied Petroleum Gas Storage Market and ensuring a stable supply of LPG.

Shift Towards Decentralized Energy Systems

The Liquefied Petroleum Gas Storage Market is adapting to a shift towards decentralized energy systems. As consumers increasingly seek energy independence, the demand for localized storage solutions is rising. This trend is particularly pronounced in rural and remote areas, where access to centralized energy sources may be limited. Liquefied petroleum gas offers a practical solution for these regions, allowing for on-site storage and usage. The growing popularity of off-grid systems is likely to drive the demand for LPG storage solutions, thereby contributing to the expansion of the Liquefied Petroleum Gas Storage Market. This shift not only enhances energy accessibility but also promotes the use of cleaner fuels.

Technological Innovations in Storage Systems

The Liquefied Petroleum Gas Storage Market is experiencing a surge in technological innovations that enhance storage efficiency and safety. Advanced materials and designs are being developed to improve the integrity of storage tanks, thereby reducing the risk of leaks and accidents. For instance, the introduction of smart monitoring systems allows for real-time tracking of gas levels and pressure, which can prevent overfilling and ensure optimal operational conditions. Furthermore, the integration of automation in storage facilities is streamlining operations, leading to cost reductions and improved safety protocols. As these technologies become more prevalent, they are likely to attract investments, thereby expanding the Liquefied Petroleum Gas Storage Market.