Market Analysis

In-depth Analysis of Lithographic Printing for Packaging Market Industry Landscape

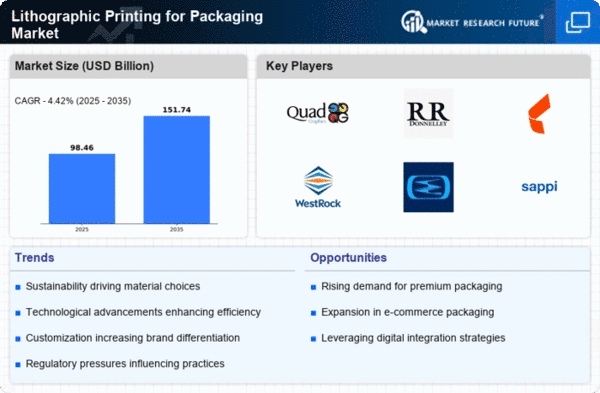

The Lithographic Printing for Packaging Market is experiencing dynamic changes driven by technological advancements, sustainability concerns, and shifting consumer preferences. Lithographic printing, a widely used method in the packaging industry, is known for its high-quality and versatile printing capabilities. One significant factor shaping the market dynamics is the continuous evolution of printing technology. The adoption of advanced lithographic printing presses, including computer-to-plate (CTP) systems, has enhanced efficiency, reduced setup times, and improved print quality. As packaging design complexity increases, lithographic printing remains a preferred choice due to its ability to reproduce intricate details and vibrant colors.

Sustainability considerations are increasingly influencing the market dynamics of lithographic printing for packaging. With growing awareness of environmental issues, there is a demand for eco-friendly printing solutions. In response, manufacturers are exploring waterless lithographic printing and environmentally friendly ink formulations. These initiatives align with the broader industry trend towards sustainable packaging, and companies incorporating eco-friendly practices into lithographic printing processes are gaining favor among environmentally conscious brands and consumers.

The competitive landscape plays a pivotal role in shaping market dynamics. Printing companies are investing in cutting-edge lithographic printing technologies to differentiate themselves and offer unique value propositions. The ability to provide high-quality, cost-effective printing solutions within shorter timelines is a key competitive advantage. Additionally, collaborations and partnerships between printing companies and packaging manufacturers contribute to the overall competitiveness of the lithographic printing for packaging market.

Moreover, market dynamics are influenced by the regulatory landscape governing packaging and printing materials. Governments and industry organizations establish standards related to ink formulations, material safety, and printing processes. Compliance with these regulations is crucial for lithographic printing companies to ensure the safety and suitability of their products for packaging applications. Adhering to these standards not only ensures regulatory compliance but also instills confidence in customers regarding the quality and safety of printed packaging.

Economic factors also contribute to the market dynamics of lithographic printing for packaging. Fluctuations in raw material prices, such as ink and printing plates, can impact production costs and, subsequently, pricing strategies. Economic conditions and market volatility influence the decision-making processes of both printing companies and their clients, shaping the overall market dynamics.

Consumer preferences and market trends play a pivotal role in driving the adoption of lithographic printing for packaging. The demand for personalized and aesthetically appealing packaging solutions is growing. Lithographic printing allows for the incorporation of various finishing techniques, such as embossing and foiling, enhancing the visual appeal of packaging. Brands looking to create a strong visual impact and convey a premium image often turn to lithographic printing for its ability to achieve sophisticated and eye-catching packaging designs.

Furthermore, advancements in digital printing technologies are impacting the market dynamics of lithographic printing for packaging. While lithography remains a dominant choice for large print runs and high-quality output, digital printing is gaining traction for short runs and customization. The integration of digital elements within lithographic printing workflows offers hybrid solutions, combining the benefits of both technologies to meet diverse customer requirements.

Global trends, such as the rise of e-commerce and the demand for sustainable packaging, are influencing the market dynamics of lithographic printing for packaging. As online retail continues to grow, packaging plays a crucial role in brand representation and consumer experience. Lithographic printing, with its ability to produce visually appealing and informative packaging, aligns with the branding needs of e-commerce businesses.

Leave a Comment